Three months ago, I served up a list of reasons for lowering one’s exposure to riskier assets. I discussed weakness in market internals where fewer and fewer corporate components of the Dow and S&P 500 had been propping up the popular U.S. benchmarks. I talked about the faster rate of deterioration in foreign stocks over domestic stocks via the Vanguard FTSE All-World (NYSE:VEU):S&P 500 SPDR Trust (NYSE:SPY) price ratio. Additionally, I highlighted exorbitant U.S. stock valuations, the Federal Reserve’s rate hike quagmire and the ominous risk aversion in credit spreads.

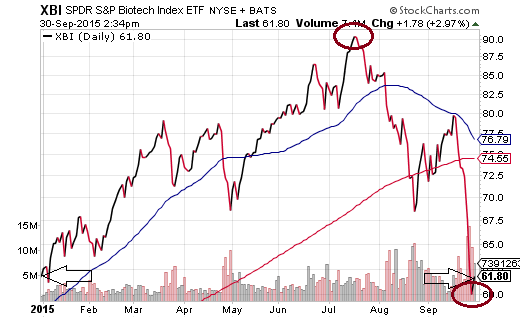

Three months later, a wide variety of risk assets are trading near 52-week lows or near year-to-date lows. Higher yielding bonds via PIMCO 0-5 Year High Yield Corporate (NYSE:HYS) as well as iShares iBoxx High Yield Bond (NYSE:HYG) are floundering in the basement. Energy via Equal Weight Energy (NYSE:RYE) has broken down below the S&P 500’s correction lows of August 24, suggesting that a bounce in oil and gas may be premature. Even former leadership in the beloved biotech sector via SPDR S&P Biotech Index (NYSE:XBI) reminds us that bearish drops of 33% can destroy wealth as quickly as it is accumulated.

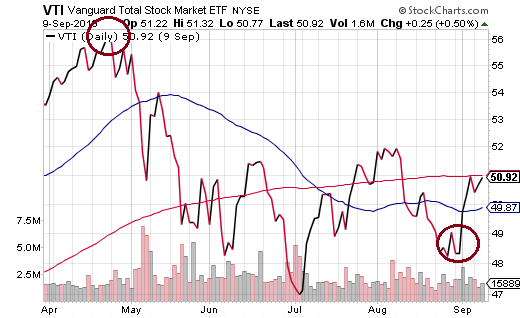

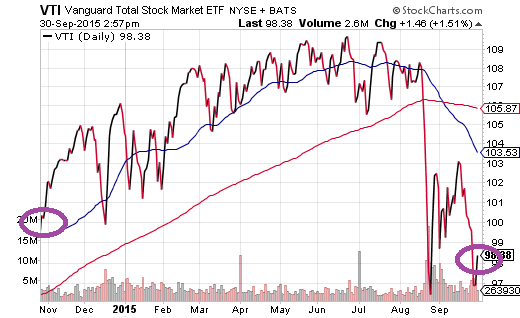

Is it true that, historically speaking, bull market rallies typically fend off 10%-19% pullbacks? Absolutely. Yet there is nothing typical about zero percent rate policy for roughly seven years. For that matter, there was nothing normal about the U.S. Federal Reserve’s quantitative easing experiment – an emergency endeavor where $3.75 trillion in electronic dollar credits were used to acquire government debt and mortgage-backed debt. And ever since its 3rd iteration came to an end eleven months ago, broad market index investments like Vanguard Total Stock Market (NYSE:VTI) have lost ground.

The same thing happened in 2010 during “QE1.” Once it ended, risk assets lost their mojo. Then in September of 2010, rumors swirled about the Fed engaging in a second round of quantitative easing (a.k.a. “QE2″). And then the bull rally was back in business.

As things currently stand, investments that are more likely to benefit from lower borrowing costs rather than higher ones have been winners. Utilities (Utilities Select Sector SPDR (NYSE:XLU)) and REITs (Vanguard REIT (NYSE:VNQ)) are up over the last three months; in contrast, industrials (Industrial Select Sector SPDR (NYSE:XLI)), financials (Financial Select Sector SPDR (NYSE:XLF)) and retail (SPDR S&P Retail (NYSE:XRT)) have been battered.

The demand for higher yielding stocks contradicts the idea that the Federal Reserve can demonstrate any genuine conviction when attempting to move the overnight lending rate higher. (Some seem to believe that the next significant move might even be to ease.)

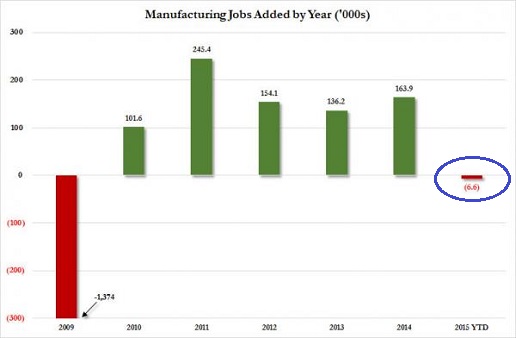

Relative strength for utilities and REITs in the stock world, as well as relative strength for investment grade debt in the bond universe, suggest that the Fed will barely bump overnight lending rates, if at all. Granted, the Federal Reserve would like to tell you the job growth is solid, even as chairwoman Yellen and her colleagues ignore the disappearance of high-paying manufacturing jobs on a daily basis. It has gotten so bad that, according to ADP, the manufacturing sector has experienced a net LOSS for 2015.

Is it any wonder that the extraordinary growth of part-time service workers alongside the loss of full-time manufacturing positions has contributed to significant declines in median household income? Should we ignore the reality that 19.5% of the 25-54 year-old, working-aged population are not participating in the labor force (a.k.a. unemployed) – a percentage that has increased every year from 16.5% in the Great Recession to 19.5% today? These are not “retirees” that we’re talking about here.

We are maintaining our lower-than-normal asset allocation for our moderate growth and income clients at Pacific Park Financial, Inc. During June-July, our equity exposure moved down from 65%-70% stock (e.g., growth, value, large, small, foreign, etc.), down to 50% (mostly large-cap domestic). Our income exposure moved down from 30%-35% (e.g., short, long, investment grade, high yield, etc.) down to 25% (almost exclusively investment grade).

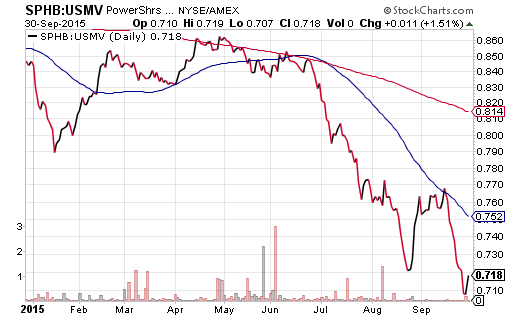

The 25% cash component that we’ve been holding? We would need to see a desire for greater risk through greater pursuit of high yield bonds at the expense of Treasuries. We would want to see a pursuit of capital gains over safety in a rising price ratio for PowerShares S&P 500 High Beta (NYSE:SPHB):iShares MSCI USA Minimum Volatility (NYSE:USMV). The fact that the SPHB:USMV price ratio is near its lows for the year tells me that it is still better to be safe than sorrowful.

Disclosure: ETF Expert is a web log (”blog”) that makes the world of ETFs easier to understand. Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc., and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at he ETF Expert website. ETF Expert content is created independently of any advertising relationship.