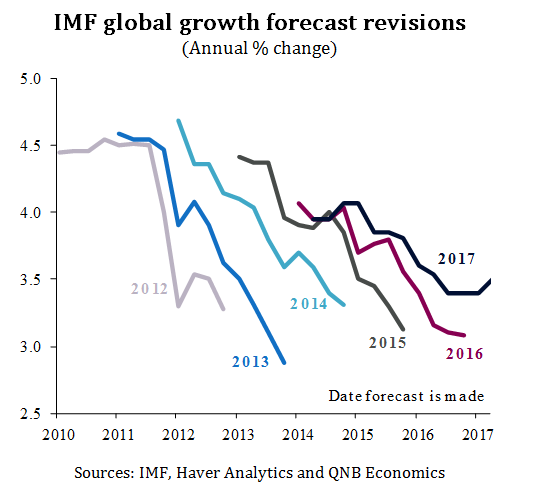

The International Monetary Fund (IMF) revised up its forecast for global growth for the first time for five years when it released its World Economic Outlook last week. The IMF now expects global growth to pick up from 3.1% in 2016 to 3.5% in 2017, compared with its previous forecast of 3.4% for 2017. A number of factors are expected to drive the acceleration in growth including a buoyant US economy, supportive government policies, an improvement in global sentiment, a recovery in commodity prices and an upturn in the inventory cycle. However, the IMF cautioned that a number of risks could upset the global recovery such as trade protectionism, geopolitics, rising debt and tighter-than-expected monetary policy.

Sources: IMF, Haver Analytics and QNB Economics

A number of factors are expected to drive up global growth. First, fiscal policy is expected to become more supportive of growth in 2017. The government response to the global financial crisis of 2008-09 and European sovereign debt crisis in 2011-12 was to implement more “austere” fiscal policy which dragged on growth right up to 2015. However, the IMF estimates that fiscal policy became mildly supportive of growth in 2016. The lagged effects of this change in stance and broadly neutral fiscal policy this year are likely to contribute to higher growth in 2017. In particular, China is providing considerable stimulus through public investment in infrastructure and real estate that has spillovers to the rest of the world.

Second, monetary policy in a number of economies is expected to remain highly accommodative. The European Central Bank continues with negative interest rates and quantitative easing, which is pushing credit growth higher, and the Bank of Japan has introduced a policy to target 10-year yields of zero. Although, monetary policy may be tightened in the US, the IMF expects that this will be more than offset by easing elsewhere.

Third, higher commodity prices are expected to contribute to global growth. The IMF expects oil prices to rise from an average of USD45 per barrel in 2016 to USD56 per barrel in 2017, similar to our forecasts. This will support global growth as higher revenue leads to a recovery in income and spending in commodity-exporting countries and as investment in the energy sector recovers, particularly in the US.

Fourth, the inventory cycle is likely to contribute to growth in 2017. In 2016, as growth proved slower than expected in a number of large economies, companies in the US and Europe pulled back on investment and drew on inventories to meet demand, which led to a drag of around 0.4 percentage points on GDP growth. However, since mid-2016, companies have started rebuilding inventories leading to higher investment, which is expected to continue in 2017 and should be an important contributor to growth in both the US and Europe.

Finally, consumer and business sentiment are also likely to be important contributors to higher global growth, particularly in the US. Forward looking indicators of business and consumer confidence have picked up globally since the middle of 2016. For example, US consumer confidence is the highest since the financial crisis and Germany’s business climate index is the highest since 2011. As global growth gathers momentum from easier policy, rising commodity prices and the upswing in the inventory cycle this leads to more confidence among businesses to invest and provides more income for consumption feeding back into confidence, business investment, consumer spending and growth.

Despite the positive prognosis, the IMF also cautions against a number of risks that could upset growth. Chief among these is the threat of rising protectionism as a result of new US trade policies and Brexit, which could limit global trade and growth. Second, political uncertainties abound with tensions rising in the Middle East and North Korea as well as potentially destabilising elections across Europe. Third, debt is rising globally as a share of GDP, which could lead to sharp deleveraging, particularly in China. Fourth, the Federal Reserve could hike US interest rates too quickly squelching the global recovery before it gets into full swing. In short, growth may be picking up in 2017, but the recovery could easily be short lived with a return to the slow global growth rates of the recent past not a distant possibility.