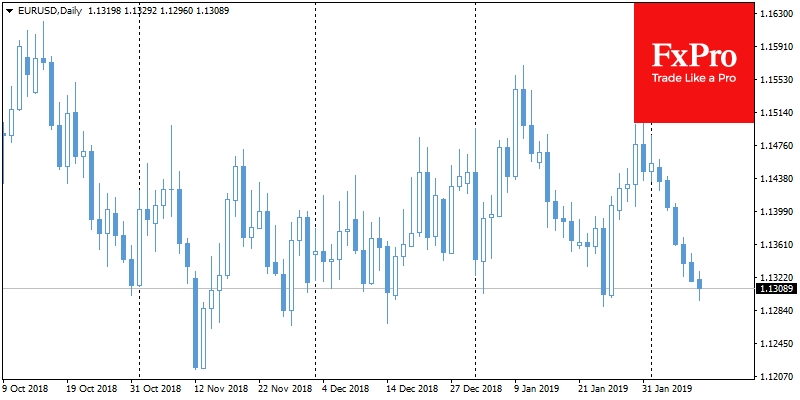

The USD demand came back at the start of trade in London: the EURUSD pair has dropped to the lowest level of the trading range since November returning to 1.1300. The USDX has reached new highs since December, demonstrating a healthy growth for eight consecutive trading session, making it the most extended rally of the US currency since the Presidential election at the end of 2016.

National stock markets were also experiencing a buzz as S&P500 futures grew on Friday and have continued to do so on Monday morning by adding 0.3%.

It’s important to remember that stocks and currencies very rarely move in the same direction and even more so is this movement consistent. So, a good idea would be to look closely for a catch. In our opinion, the higher risks at the moment lay with the stock market rather than the US currency.

As the USD demand is stronger in comparison with the European and Asian economies, which are exhibiting a considerable slowdown. Simply put the dollar is perceived as the least risky of the bunch. This is the exact opposite to the situation back at the end of 2016 when the USD growth was based on the tax reforms expectations.

The same goes for the stock market. US indices are growing due to strong earnings reports, but the Fed is softening its rhetoric, anticipating the end of the tax breaks’ effect. This might mean that at the moment American companies are living through their peak growth period. In addition, the worst December in the last 100 years has increased potential for the markets, which then supported the markets in January.

It’s also important to note that growth like this can’t be sustainable or long. At the moment it simply allows investors to ignore the imbalance of the situation of the overall global slow down and record-high levels of national debt. Investors don’t seem to have any long-term plans, living in the moment and only paying attention to the softer rhetoric of central banks and the short-term positive vibes of corporate news.

Alexander Kuptsikevich, the FxPro analyst