2017 begins with plenty of economic data crammed into a short week. While most expected at least a touch of Dow 20K last week, it did not happen. The conversation quickly shifted to why the rally stalled out. In the coming week, the punditry will be asking:

Should we expect a weak start to 2017?

Last Week

Last week there was some soft economic news, but this week showed strength. There was little apparent market effect.

Theme Recap

In my last WTWA, two weeks ago, I predicted a shift from the Dow 20K obsession to developing a new list of market worries. That was a good guess, although as late as Wednesday some TV experts were debating whether 20K would be achieved by the end of the week. That represented another 55 points or so. Sheesh!

The Story in One Chart

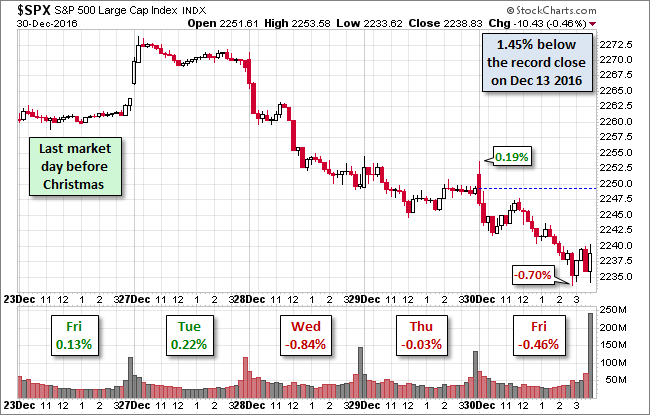

I always start my personal review of the week by looking at this great chart of the S&P 500 from Doug Short. He captures the trend for the week and the narrow range.

Doug has a special knack for pulling together all the relevant information. His charts save more than a thousand words! Read his entire post where he adds analysis grounded in data and several more charts providing long-term perspective.

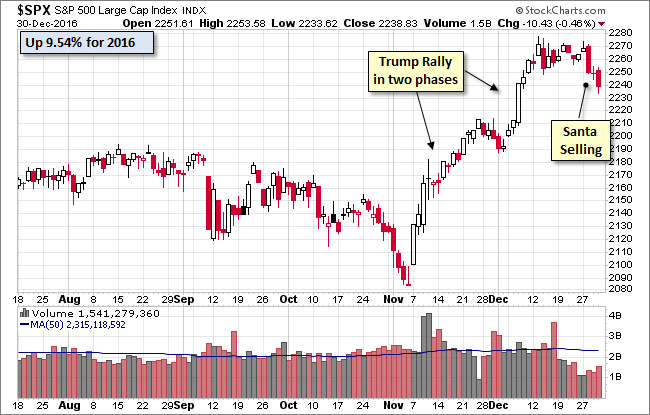

This additional choice captures the pre-election period, the Trump Rally, and last week’s selling.

The News

Each week I break down events into good and bad. Often there is an “ugly” and on rare occasion something very positive. My working definition of “good” has two components. The news must be market friendly and better than expectations. I avoid using my personal preferences in evaluating news – and you should, too!

This week’s news was quite good—almost all positive. I make objective calls, which means not stretching to achieve a false balance. If I missed something for the “bad” list, please feel free to suggest it in the comments.

The Good

- Rail traffic ended the year on a strong note. Steven Hansen at GEI reports the data, while also noting the year-over-year calendar effects. We will know a little more next week.

- Mortgage rates declined in the last week of the year.Calculated Risk notes that this modest improvement comes in the context of the worst five weeks in history in the post-election period.

- Earnings growth for Q4 is looking good. FactSet sees a second straight quarter of year-over-year increases, with strength in other metrics as well.

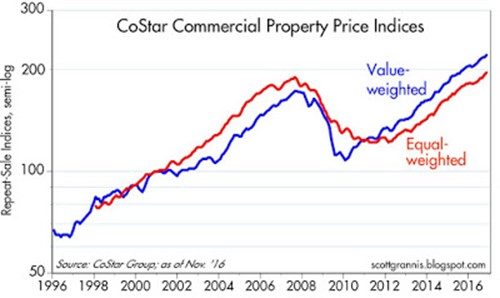

- Commercial real estate is booming. (Scott Grannis)

- Homebuilder sentiment reached an 11-year high. (MarketWatch).

- Initial jobless claims dipped to 265K, maintaining the recent low level.

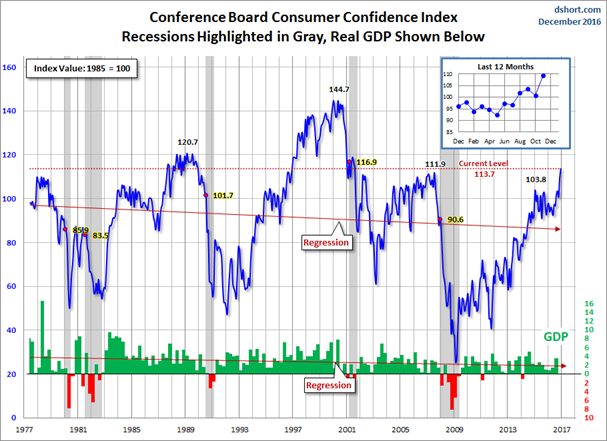

- Consumer confidence reached 113.7. Doug Short’s chart (via Jill Mislinski) puts this strong reading in perspective – best since before 9/11.

The Bad

- Pending home sales declined by 2.5%.

- Chicago Purchasing Index declined to 54.6 and missed expectations of 56. (GEI).

- China abandons the 6.5% growth target. Rupert Hargreaves (ValueWalk) analyzes a change which many already expected.

The Ugly

Russian malware found on a Vermont utility laptop. (Slate). The article notes that utilities in Western Ukraine were past targets and describes the possible consequences.

The Silver Bullet

I occasionally give the Silver Bullet award to someone who takes up an unpopular or thankless cause, doing the real work to demonstrate the facts. This week’s award goes to Robert Huebscher, founder and CEO of Advisor Perspectives, for his article, As Seen on TV: Financial Products You Should Avoid – Lear Capital.

His opening theme is excellent: Good financial products are bought, not sold.

He carefully avoids a discussion of the specific sales techniques, focusing on the facts of the offer. He writes:

But I caution anyone against buying precious metals from Lear Capital. It is not an SEC-registered investment advisor and its web site states that there is no fiduciary relationship between it and its customers.

And also…

For example, Lear will sell you a $10 circulated Liberty gold coin (1/2 ounce) for $753.00 (plus $24 shipping). I did a quick search on eBay and found a circulated Liberty coin selling for as low as $666 (with free shipping).

Buying silver is no different. Lear will sell you a pre-1921 circulated Morgan silver dollar for $30 (plus $10 shipping). On eBay, I quickly found one of these for $22.00 (plus $2.62 shipping).

Mr. Huebscher notes that other dealers are similar to Lear. I can confirm this, since I have checked out several such offers. I have seen many poor investments touted on TV and radio, but I cannot recall a single good one. It is just not that easy.

The Week Ahead

We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react. That is the purpose of considering possible themes for the week ahead. You can make your own predictions in the comments.

The Calendar

We have a big week for data and only four days of trading. It may start slowly, but expect seatbelts to be fastened before Friday’s employment report.

The “A” List

- Employment report (F). Still the most-watched number, with continuing strength expected.

- ISM Index (T). The first data for 2017 is expected to show continuing modest expansion.

- FOMC minutes (W). While we should not expect much from the report of a unanimous vote, pundits will find something.

- Auto sales (W). Has “peak auto” arrived?

- Initial claims (Th). The best concurrent indicator for employment trends. Not a part of this Friday’s report.

The “B” List

- ISM services (Th). Continuing rebound expected in the large service sector.

- ADP private employment (Th). Different methodology from the “official” report, but just as accurate.

- Trade balance (F). Important for GDP. Growing interest with possible changes in trade policy.

- Construction spending (T). November data for an important sector.

- Crude inventories (Th). Recently showing even more impact on oil prices. Rightly or wrongly, that spills over to stocks.

There is not much FedSpeak on the calendar, but Congress is returning to work on Tuesday.

Coming Week’s Theme

Last week attention started with more Dow 20K hype. This was true even though it is a rather meaningless round number in a flawed index. It shows the power of symbolism to attract attention. When the rally fizzled out, the story swiftly turned. Everyone questions rapid, short-term moves, so it is a natural for the punditry.

I expect this theme to carry over into 2017, despite an abundance of fresh news. Any sign of weakness will raise the questions:

Will 2017 have a weak start? Just like last year? And what will it mean?

Pundits were already hard at work last week:

- Trump rally mistaken, overdone, and a setup for selling.

- Regular “Santa” rally pulled forward, reversing normal seasonal effects.

- Selling for gains postponed in the hope of lower tax rates. Those waiting to sell strength are ready to move.

- Reflation trade was already starting; it would have happened anyway. The Trump story was merely a catalyst.

What should investors conclude from these sharply conflicting ideas? Your opinions are quite welcome! As usual, I’ll have a few ideas of my own in today’s “Final Thoughts”.

Quant Corner

We follow some regular great sources and the best insights from each week.

Risk Analysis

Whether you are a trader or an investor, you need to understand risk. Think first about your risk. Only then should you consider possible rewards. I monitor many quantitative reports and highlight the best methods in this weekly update.

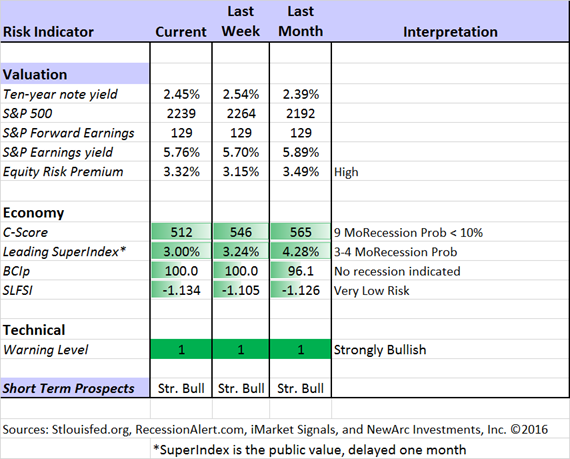

The Indicator Snapshot

Although dropping last week, the yield on the 10-year note has increased significantly since the election. This has lowered the risk premium a bit. I suspect much more to come. By this I mean that the relative attractiveness of stocks and bonds will continue to narrow.

The C-Score has also dropped, but is still well out of recession warning territory.

The Featured Sources:

Bob Dieli: The “C Score” which is a weekly estimate of his Enhanced Aggregate Spread (the most accurate real-time recession forecasting method over the last few decades). His subscribers get Monthly reports including both an economic overview of the economy and employment.

Holmes: Our cautious and clever watchdog, who sniffs out opportunity like a great detective, but emphasizes guarding assets.

Brian Gilmartin: Analysis of expected earnings for the overall market as well as coverage of many individual companies.

RecessionAlert: Many strong quantitative indicators for both economic and market analysis. While we feature his recession analysis, Dwaine also has several interesting approaches to asset allocation. Try out his new public Twitter Feed. His most recent research update suggests some “mixed signals” from labor markets.

Georg Vrba: The Business Cycle Indicator and much more.Check out his site for an array of interesting methods. Georg regularly analyzes Bob Dieli’s enhanced aggregate spread, considering when it might first give a recession signal. Georg thinks it is still a year away. It is interesting to watch this approach along with our weekly monitoring of the C-Score.

Doug Short: The World Markets Weekend Update (and much more). Jill Mislinski updates the ECRI coverage, noting that their public leading index is at the highest point since 2010. Surprisingly, the ECRI public statements remain bearish on the U.S. economy, the global economy, and stocks. It is as if they never recovered from the bad recession call in 2011. They have been out of step ever since.

Readers occasionally ask about the Risk Premium. Antonio Fatas has a slightly different method that I report every week, but an excellent discussion of the considerations.

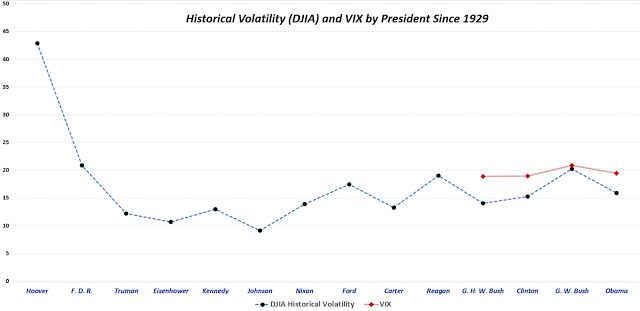

Many are concerned about higher stock volatility during the Trump Administration. Expert Bill Luby looks at the past fourteen Presidents, giving you a better idea about what to expect.

How to Use WTWA (especially important for new readers)

In this series, I share my preparation for the coming week. I write each post as if I were speaking directly to one of my clients. Most readers can just “listen in.” If you are unhappy with your current investment approach, we will be happy to talk with you. I start with a specific assessment of your personal situation. There is no rush. Each client is different, so I have six different programs ranging from very conservative bond ladders to very aggressive trading programs. A key question:

Are you preserving wealth, or like most of us, do you need to create more wealth?

My objective is to help all readers, so I provide several free resources. Just write to info at newarc dot com. We will send whatever you request. We never share your email address with others, and send only what you seek. (Like you, we hate spam!) Free reports include the following:

- Understanding Risk – what we all should know.

- Income investing – better yield than the standard dividend portfolio, and less risk.

- Holmes and friends – the top artificial intelligence techniques in action.

- Why it is a great time to own for Value Stocks – finding cheap stocks based on long-term earnings.

You can also check out my website for Tips for Individual Investors, and a discussion of the biggest market fears. (I welcome questions on this subject. What scares you now?)

Best Advice for the Week Ahead

The right move often depends on your time horizon. Are you a trader or an investor?

Insight for Traders

We consider both our models and the top sources we follow.

Felix and Holmes

We continue with a strongly bullish market forecast. Felix is fully invested. Oscar is fully invested in aggressive sectors. The more cautious Holmes also remains fully invested, but with continued profit-taking and position switching. The group meets weekly for a discussion they call the “Stock Exchange.” In each post I include a trading theme, ideas from each of our four technical experts, and some rebuttal from a fundamental analyst (usually me). There are plenty of investor ideas for the new year. Our discussion focused on how to find fresh trading ideas.

Top Trading Advice

Brett Steenbarger continues to provide almost daily insights for traders. Sometimes the ideas draw upon his expertise in psychology. Sometimes they emphasize his skills in training traders. Sometimes there are specific trading themes. If you are a trader who is not following his work, you are not doing as well as you should.

This week I especially liked the following (from his new indicator series):

- Tracking instantaneous supply and demand. A good teaching example is included.

- Why breadth matters.

Bridgewater is trying to replace hedge fund managers with artificial intelligence. Humans would retain ultimate authority. Since that is exactly what we are doing with our Stock Exchange group, I am glad that the models do not read. They would all want a raise or threaten to leave!

I look at many sources for good trading ideas, but I welcome suggestions from readers to broaden the list of candidates.

Insight for Investors

Investors have a longer time horizon. The best moves frequently involve taking advantage of trading volatility!

Best of the Week

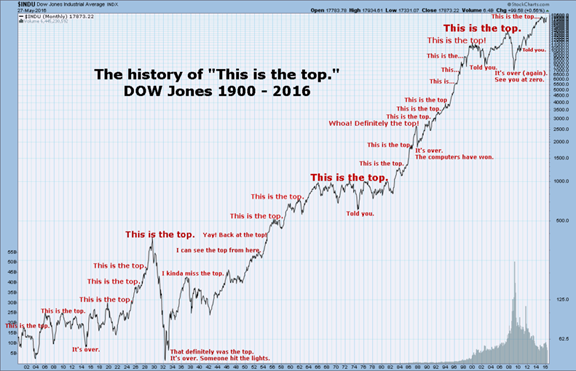

If I had to pick a single most important source for investors to read this week it would be this chart from @jackdamn (StockTwits) via Josh Brown. More words are not needed.

Stock Ideas

There are so many end-of-year ideas. I like to include some leads to research in WTWA, but I have a special challenge this week. You have many opportunities to read a range of sources and get lists of favorite stocks. I always review them and then do my own analysis. I hope you do as well.

I want to emphasize a few ideas that you might otherwise miss.

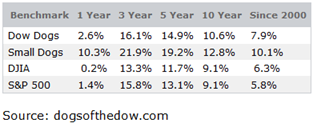

One method of playing for a long-term rebound is to take the “Dogs of the Dow.” Here is the past record, but see the site for the current rankings.

Lee Jackson at 24/7 Wall Street has several good columns with collections of picks. Here is one on biotech stocks. Check out the others for dividend choices, Trump stocks, financials and others.

Chuck Carnevale is back with an update on Flowers Foods (NYSE:FLO) including a deep dive into fundamentals and the settlement of the recent lawsuit.

Simply Safe Dividends takes a look at United Parcel Service Inc (NYSE:UPS) – boring but safe. I might consider this and write near-term calls against it in our Enhanced Yield program.

Our trading model, Holmes, has joined our other models in a weekly market discussion. Each one has a different “personality” and I get to be the human doing fundamental analysis. We have an enjoyable discussion every week, including four or five specific ideas that we are buying. This week Holmes likes Palo Alto Networks (Palo Alto Networks Inc (NYSE:PANW)). Check out the post for my own reaction, and more information about the trading models.

While we cannot verify the suitability of specific stocks for everyone who is a reader, the ideas have worked well so far. My hope is that it will be a good starting point for your own research. Holmes may exit a position at any time. If you want more information about the exits, just sign up via holmes at newarc dot com. You will get an email update whenever we sell an announced position.

Eddy Elfenbein announced his eagerly awaited buy list for 2017. Check out the post for the full list. You will definitely find some good ideas. Or you can also join in the whole list via Eddy’s new ETF (CWS). It is both convenient and inexpensive.

Personal Finance

Professional investors and traders have been making Abnormal Returns a daily stop for over ten years. If you are a serious investor managing your own account, this is a must-read. Even the more casual long-term investor should make time for a weekly trip on Wednesday. Tadas always has first-rate links for investors in his weekly special edition. There are always several great choices worth reading. My personal favorite this week is Ben Carlson’s advice on how to overcome a late start to retirement savings – a very common problem. The article has some good, practical advice.

Seeking Alpha Editor Gil Weinreich’s Financial Advisors’ Daily Digest has quickly become a must-read for financial professionals. Somewhat to my surprise, the topics also stimulate comments from active individual investors. It has added to the value of the posts for both groups. This week I especially liked the discussion of who might benefit from a financial advisor. You might also be interested in the discussion of whether you should be providing a questionnaire to your advisor, instead of the other way around.

Watch out for…

Giving up liquidity. David Merkel has another excellent warning for investors, explaining the hidden costs of tempting investments.

Final Thoughts

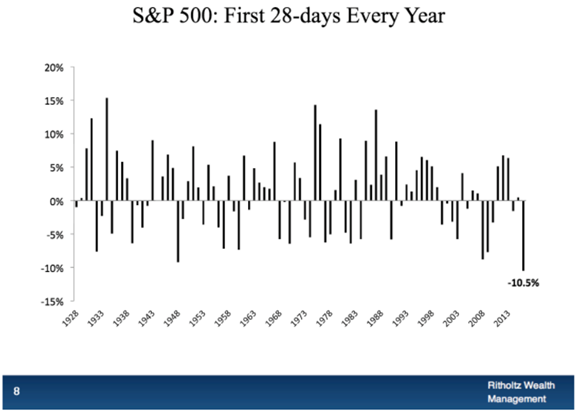

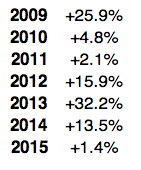

I do not know how the market will trade in the next week, and neither does anyone else. That will not stop everyone who can get quoted in a column or get on TV from offering an opinion. When you see these stories, you should keep in mind this first-rate post by Ben Carlson. With a combination of insight and humor, he hands out his Financial Market Awards for 2016. Keep these two charts in mind:

This frightened nearly everyone at the time, but here is what happened.

And this year the S&P was up 13.2%

My own conclusion is that the reflation trade (explanation here) was teed up and ready to go. I expect the late-year trends to continue, mostly because the reaction was small if you look at a long-term chart.

I will discuss the prospect for 2017 more in my annual preview, coming soon, but Mrs. OldProf informs me that I have done enough for tonight. She is requesting (more) champagne and my company.

Happy New Year to all my readers. I hope you have had a prosperous year, meeting your own specific goals.