Per Briefing.com, here are the companies expected to report May 31 quarter end earnings next week. The two that I model and own for clients are FedEx (NYSE:FDX) and Nike (NYSE:NKE), both world-class brands, and both report Thursday afternoon, June 24, 2021.

Presently, I own more FedDex than Nike, and neither position is top 10. Paychex (NASDAQ:PAYX) will give readers greater insight into private sector payrolls and where payroll growth is actually occurring (which sectors that is), which is a Friday morning release.

Charts and Tables

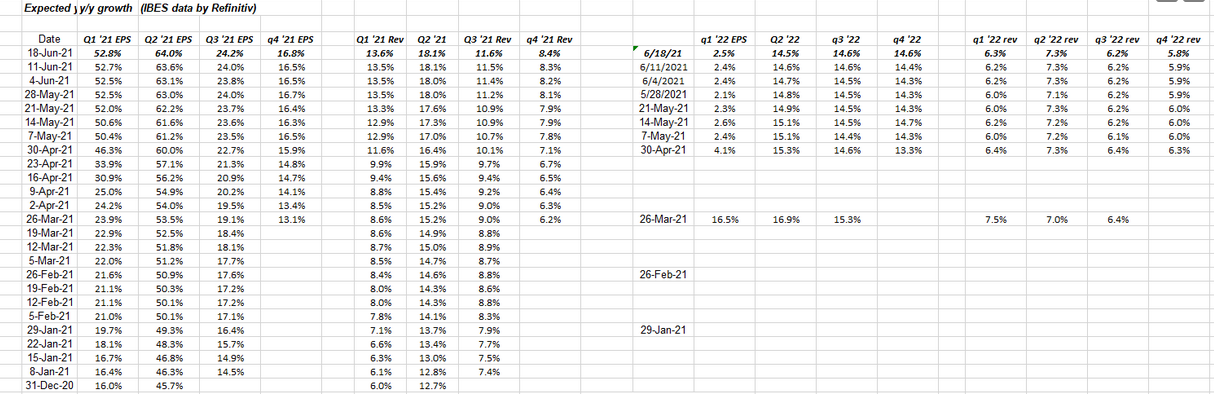

Data Source: IBES by Refinitiv

This table I crafted myself to show readers the progression in “expected” EPS and revenue growth rates over the next 8 quarters, or through the end of 2022.

Just to demonstrate to readers how dramatically the Street has underestimated S&P 500 earnings growth. Note in the first column or Q1 ’21 expected EPS growth, that on Dec. 31, 2020, the expected growth rate for Q1 ’21 S&P 500 EPS was 16% y/y. By Friday, June 18, 2021, the Q1 ’21 “expected” growth rate, which will be pretty close to the actual growth rate, is 52.8%. That is quite an underestimation of S&P 500 EPS growth.

How will Q2 ’21 S&P 500 EPS growth look? Since Dec. 31, 2020, the expected growth rate has already risen 20% or 2000 basis points, from 45.7% to 64% as of Friday.

My educated guess is that will be higher by mid-August ’21, maybe much higher, as we lap the last easiest quarterly compare for the pandemic-impacted S&P 500 in 2020.

Will it matter to stock prices though? That is the question.

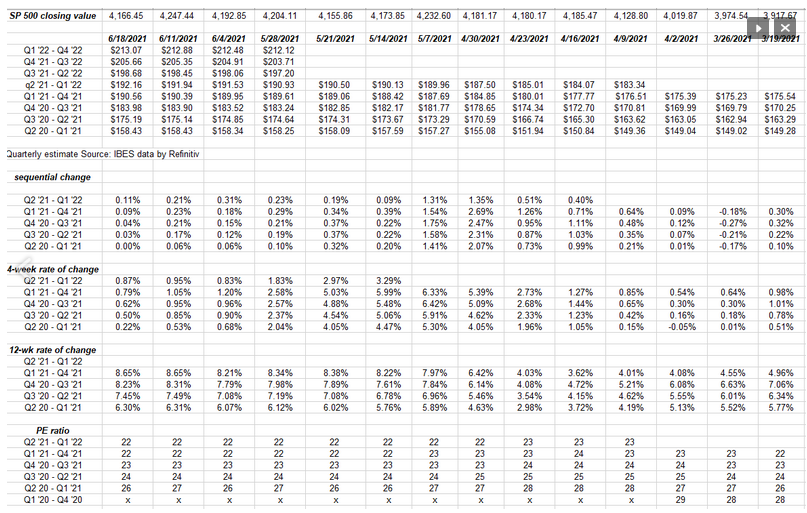

Forward-4 quarter EPS curve

Data source: IBES by Refinitiv

Again, the goal of this table was to plot forward S&P 500 EPS points by rolling quarter to see what the Street is saying for various timeframes.

Expect the forward estimates to stagnate or even decline a little in the next two – three weeks as we near the end of the 2nd quarter and begin the third. The analysts slow their revisions and usually wait until the full quarter is done before updating their models.

Again, like the last few weeks, note the “12-week rate of change.”

Remains robust.

Last chart

Doug Busch, a pretty good technician who occasionally sends me his work, posted this chart of the iShares U.S. Medical Devices ETF (NYSE:IHI) to Twitter on Friday. Currently long the IHI ETF for clients, IHI looked poised for a another breakout. Doug’s Twitter handle is @chartsmarter.

Finally, the key S&P 500 data that is sometimes inadvertently not updated regularly for readers:

- The forward 4-quarter EPS estimate for the S&P 500 rose again last week to $192.17 from the previous week’s $191.93.

- The PE ratio on the S&P 500 forward estimate was 21.68x.

- The S&P 500 earnings yield rose to 4.61% last week, the highest print since Jan. 29, 2021’s 4.61% and before that the 4.70% in May ’20.

- For most of 2019 or “pre-pandemic” the S&P 500 earnings yield averaged between 5.30% and 5.80%.

- The Q2 ’21 quarterly bottom-up estimate last week was $44.69; the same as the week before. As the opening paragraph in “Charts and Tables” above suggested, the expectation is that Q2 ’21’s final bottom-up estimate should be above $50 by mid to late August ’21.

Summary/conclusion

With just 8 trading days left in the 2nd quarter, the correction at the end of last week appeared to be Fed-driven. Chair Jerome Powell’s comments last week, and the flattening in the yield curve, looked to catch investors off guard.

The selling in the S&P 500 was mainly all the sectors which took off on Nov. 1, 2020, i.e., financials, basic materials, Commodities, etc.

Listening to Fast Money while writing on Friday afternoon, June 18, 2021, Melissa Lee noted the damage to the KRE or SPDR® S&P Regional Banking ETF, which was down 7.2% last week, with half the drop coming Friday, but the CNBC chart noted the KRE was still up 57% over the last 12 months.

This correction was a long-time coming. I’m trying to think of when the last 10% correction was for the S&P 500—peak-to-trough and pre-pandemic—and just from eyeballing the chart, it was probably Q4 ’18. It’s been a good market for a while.

The S&P 500 earnings trends are still fine, but take everything you read here and any other site with substantial skepticism. Invest based on your financial profile, and your ability to handle market volatility.

The markets—both stock and bond markets—can change suddenly. Markets can change direction for some time without the underlying secular bull or bear market remaining unchanged.