FTSE 100 UKX

The FTSE FT100 TR (UKX) ended the week down by -2.01%. For the week ahead we could see a consolidation between 7.400 - 7.350 followed by a reversal to the upside.

Indicators

In the short to medium term, we believe that the lateral price action in place since the beginning of 2022 between 7.300-7.600 can continue and any reversals resumed quickly, as happened in March.

For the week ahead, we might expect a consolidation at the bottom of that channel followed by a test of the 7.500-7.550 levels.

MACD and RSI still show a positive scenario, albeit slightly down with the former continuing to remain above the 0 line (positive momentum), while the RSI is below 50 (bearish).

We remain neutral on the FTSE 100 and believe that possible market reversals, also due to a recovery in GBP/USD, could offer attractive long opportunities.

Support at 7.300

Resistance at 7.450

FTSEMIB

The FTSE MIB Net Total Return (Lux) had a week down by -2.50%. This coming week could see a consolidation between 23.500 - 24.000.

Indicators

After the rebound from the March 2022 reversal, we believe that the FTSEMIB is retracing slightly to support levels that we identify in both the 24.000 and 23.200 area.

For the week ahead, we might expect a consolidation at the bottom at 23,200 to then, in our view, gradually move higher.

The bearish trendline, which coincides with the 50MA (yellow line), in existence since the beginning of 2022, continues to be respected and only its gradual overcoming will confirm a possible change in trend.

MACD and RSI show an encouraging scenario: the former is slightly below 0 (bullish momentum) and the RSI continues to respect the bullish trendline despite a gradual decline.

We are positive on the FTSEMIB, but expect strong volatility in the short term which we believe will then lead to a gradual reversal to the upside.

Support at 22.900

Resistance at 24.000

DAX 40

The DAX ended the week down by -2.37%. This week, we view favorably a consolidation between 13.600 -13.800 with the possibility of moves to the upside in the short term.

Indicators

The index continues to fluctuate near the 50MA (yellow line) which is playing the role of moving resistance: we are in favor of a break to the upside in the short term, but in the meantime, we believe the index will first consolidate between 13.600 and 13.800.

MACD and RSI, in our opinion, support these scenarios by being first, very close to crossing the 0 line upwards (positive momentum), and second, near the 50 line (bullish) even if slightly decreasing.

We remain positive on the DAX and believe that a gradual breakout of 13.800 could then lead to short to medium term gains.

Support at 13.600

Resistance at 14.050

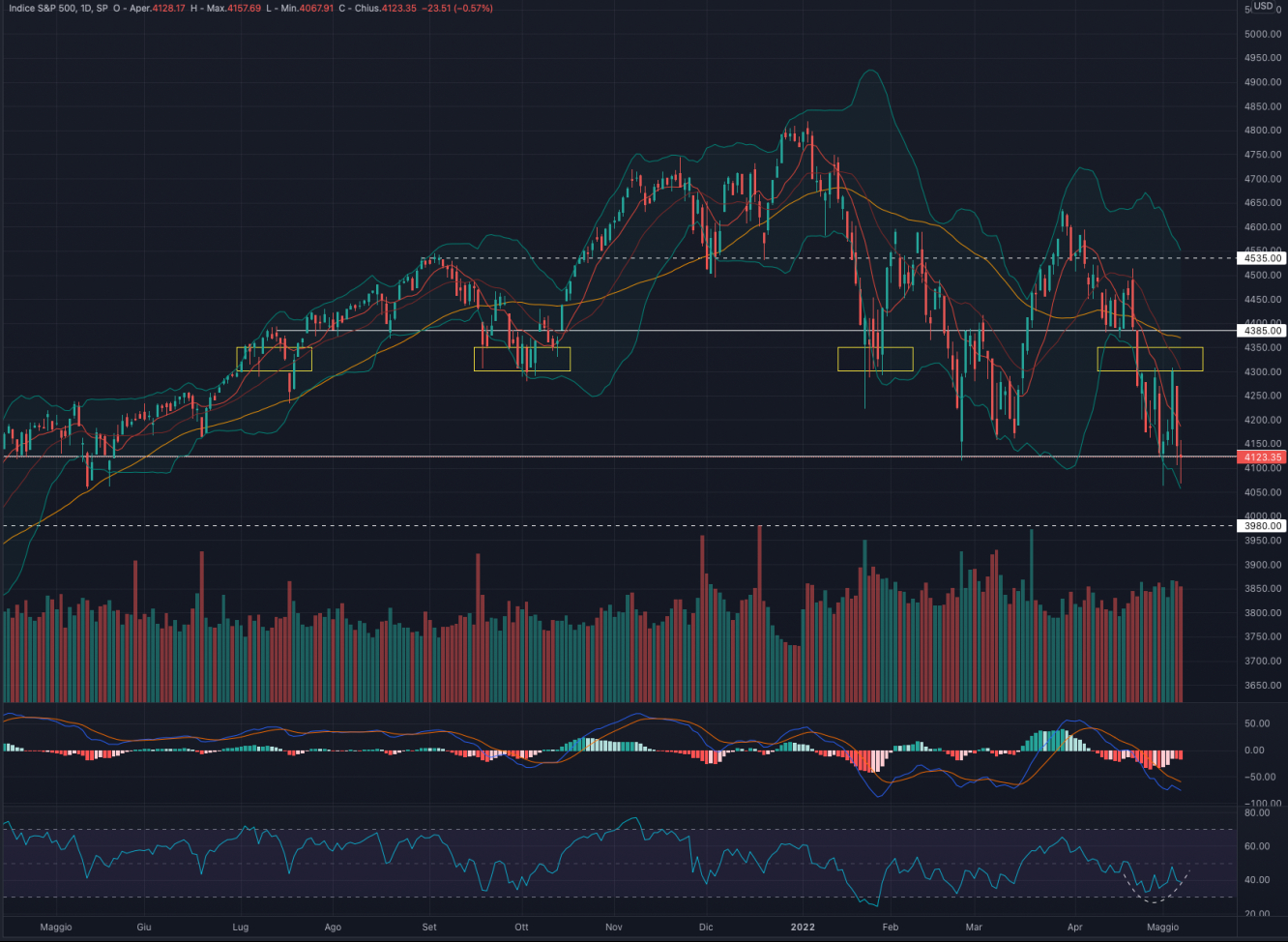

S&P 500

The S&P 500 dropped by -0.01% last week. For the week ahead, we are in favor of a recovery to at least 4.300.

Indicators

A week of indecision, ended with a "doji" candle hovering over the current support level. The strong downward extensions of the past few weeks now shift the risk/reward ratio more towards a possible upside reversal rather than a continuation to the downside.

MACD and RSI are both very extended to the downside with the second in positive divergence with the price action.

We are positive on the S&P 500 and we believe that the index can consolidate between 4.050 and 4.150 and then reverse upwards

Support at 4.125

Resistance at 4.385

NASDAQ 100

The NASDAQ ended the week down by -0.97%. For the week ahead, a consolidation between 12.600-13.000 followed by a possible reversal to the upside is in view.

Indicators

Despite another bearish week, we believe that the index may soon begin a slow upward recovery. This thesis is also supported by a slowdown in the weekly decline. The swings of the past week continue to be above the bearish trendline which we believe to be a positive indicator.

MACD and RSI are both very extended to the downside, which makes us shift the risk/return ratio in favor of possible price recovery and short term trend reversals. We also note a slight positive divergence between RSI and price

The price action on the trendline combined with the extension of internal indicators make us remain positive on the NASDAQ and favoring a price recovery.

Support at 12.600

Resistance at 13.855

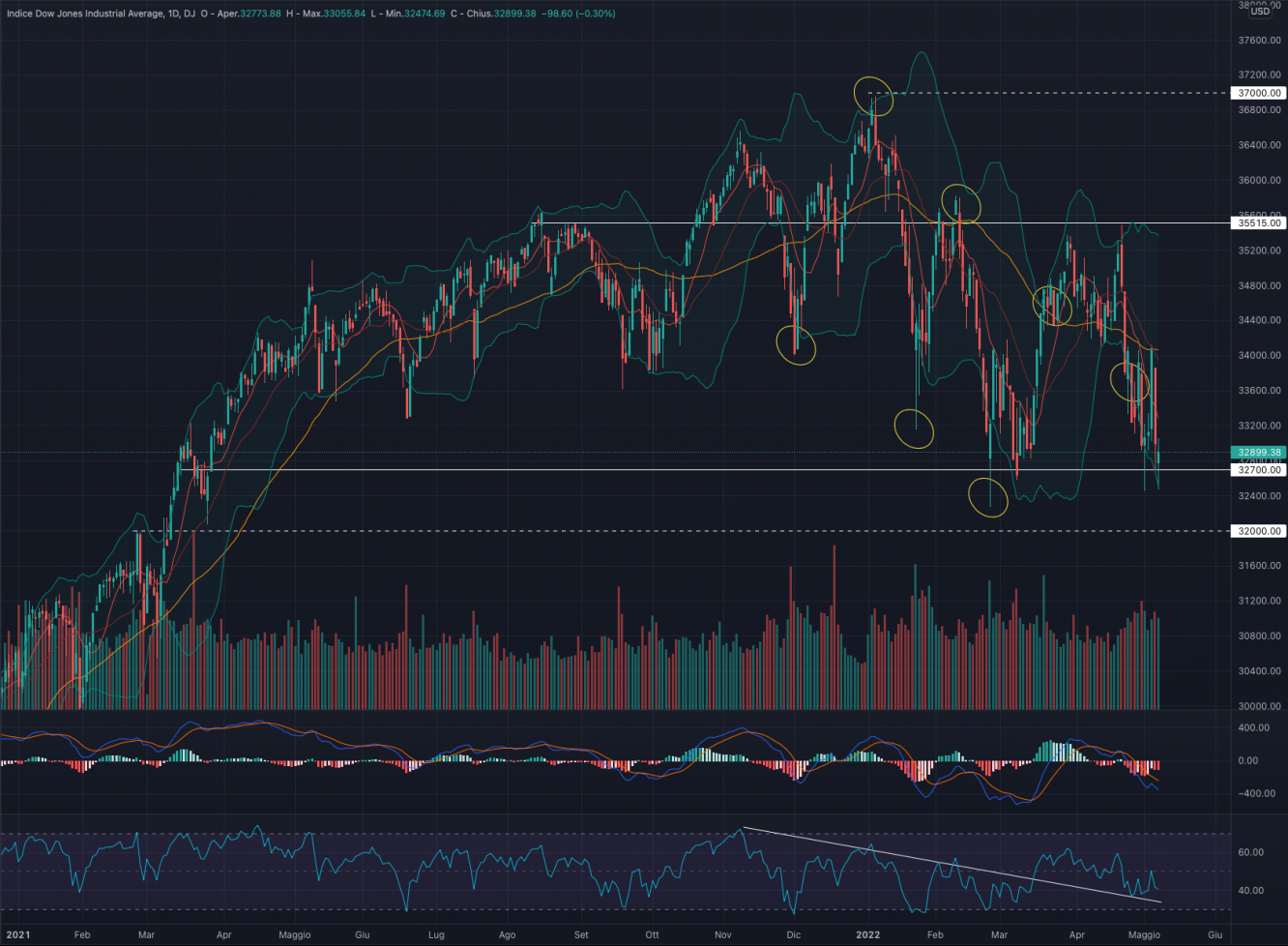

Dow Jones

Dow Jones ended the week down by -0.16%. For the week ahead, we expect a bullish recovery to at least 34.000.

Indicators

The slowdown in bearish swings on a weekly basis is a good indicator of a possible recovery in the short term. Further confirmation can be found in similarities with the price action in February, where the DJI consolidated between 32.700 and 33.200 to then reverse upwards.

MACD and RSI are both negative, with the latter still above the bearish trendline and in slight positive divergence with the price.

The combination of the strong support level at 32.700 coupled with fairly downward extension of internal indicators make us more inclined towards a recovery of the index.

Support at 32.700

Resistance 35.515