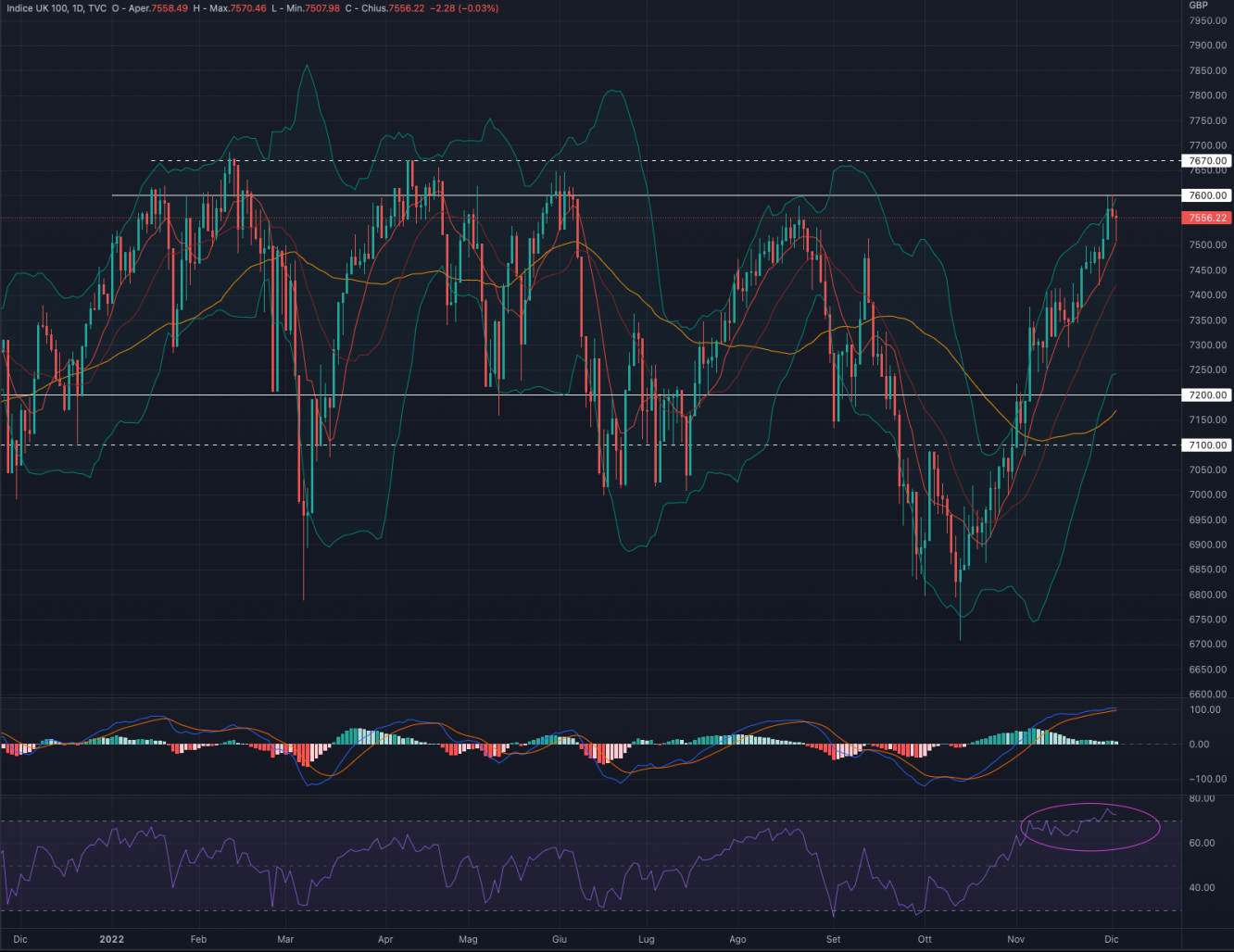

FTSE 100 (UKX)

The FTSE 100 index had a week up by +0.93%. For the week ahead, we favor a retracement in the area of 7,400.

Indicators

A positive week for the British index sees the price keep moving close to the strong level already reached in August. Despite a further positive week, we believe that the risk/reward on the UKX is now heavily unbalanced in favor of the short-medium term downside.

We believe that there are two important factors to support this thesis: the first is the price action. We can see that throughout 2022 the FTSE 100 has fluctuated on a wide lateral channel between 7,000 - 7,600.

The second aspect is internal indicators: MACD and RSI are now significantly extended to the upside, with the first seeing a slowdown in histograms, and the RSI remains in overbought territory.

Combining price action and internal indicators, we can see that the British index has more often fluctuated downwards rather than upward at current levels. The first sign of reversal, we believe, will come from the breaking of the 9-day moving average (red line), which has supported the price from mid-October till today.

We are bearish on the FTSE 100 and awaiting substantial drawdowns before considering long setups.

- Support at 7,150

- Resistance at 7,600

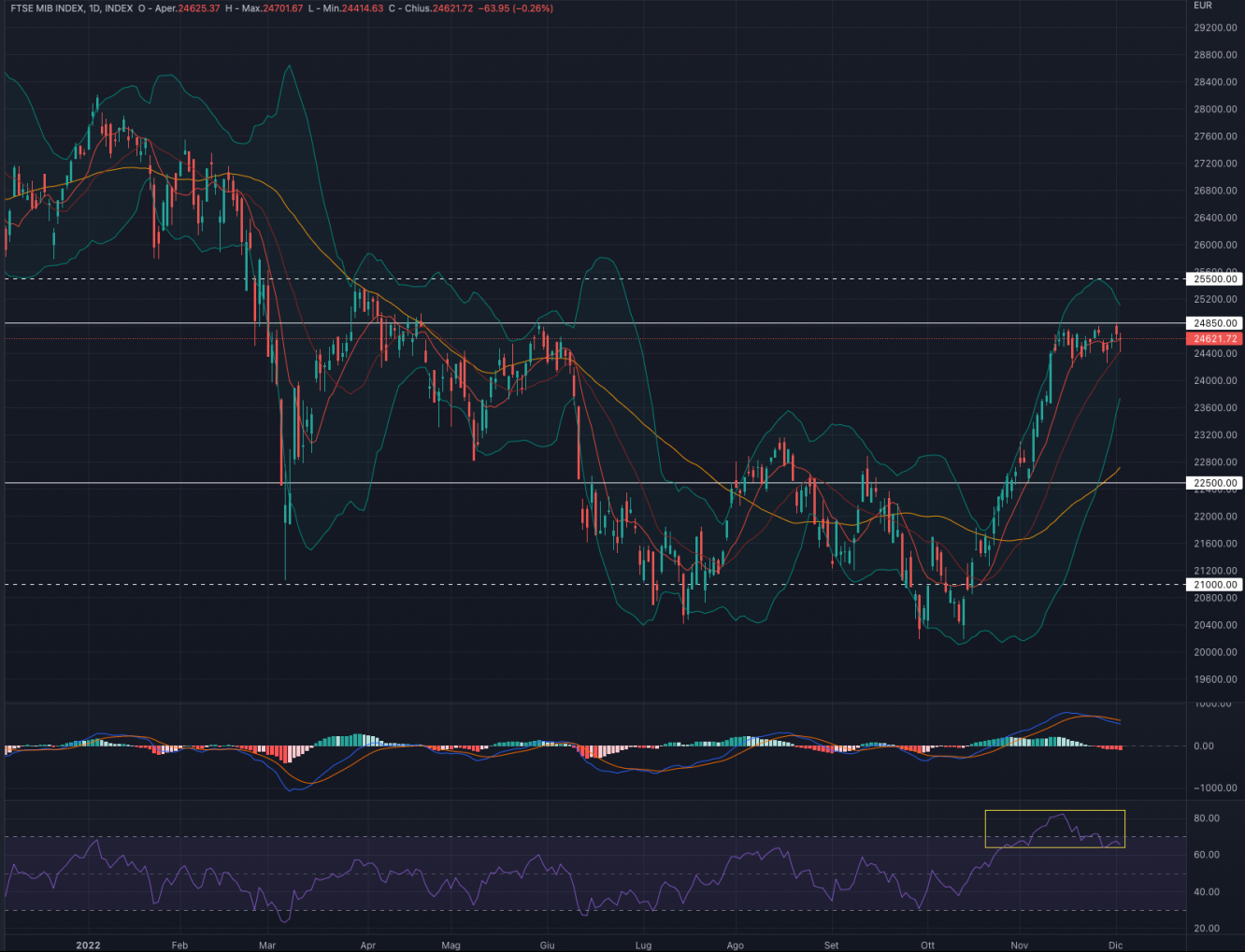

FTSE MIB

The FTSE MIB index had a week down by -0.39%. For the coming week, we favor a retracement of 23,700-23,500.

Indicators

Consolidation week for the FTSE MIB as it continues to move near the strong area of 24,850. After the strong stretches of previous weeks, the index is now stuck in a side channel: a break that will lead to strong volatility.

MACD and RSI keep being extended upwards, particularly the second in overbought territory (a scenario that has not happened since November 2021, followed by strong moves downwards). A further element of caution is the negative divergence between RSI and price.

The index is far from all major moving averages making the contour scenario unstable and subject to considerable reversals. We are bearish on the FTSEMIB as we believe that the overextension of both price and internal indicators shifted the weight in favor of possible pullbacks.

- Support at 22,500

- Resistance to 24,850

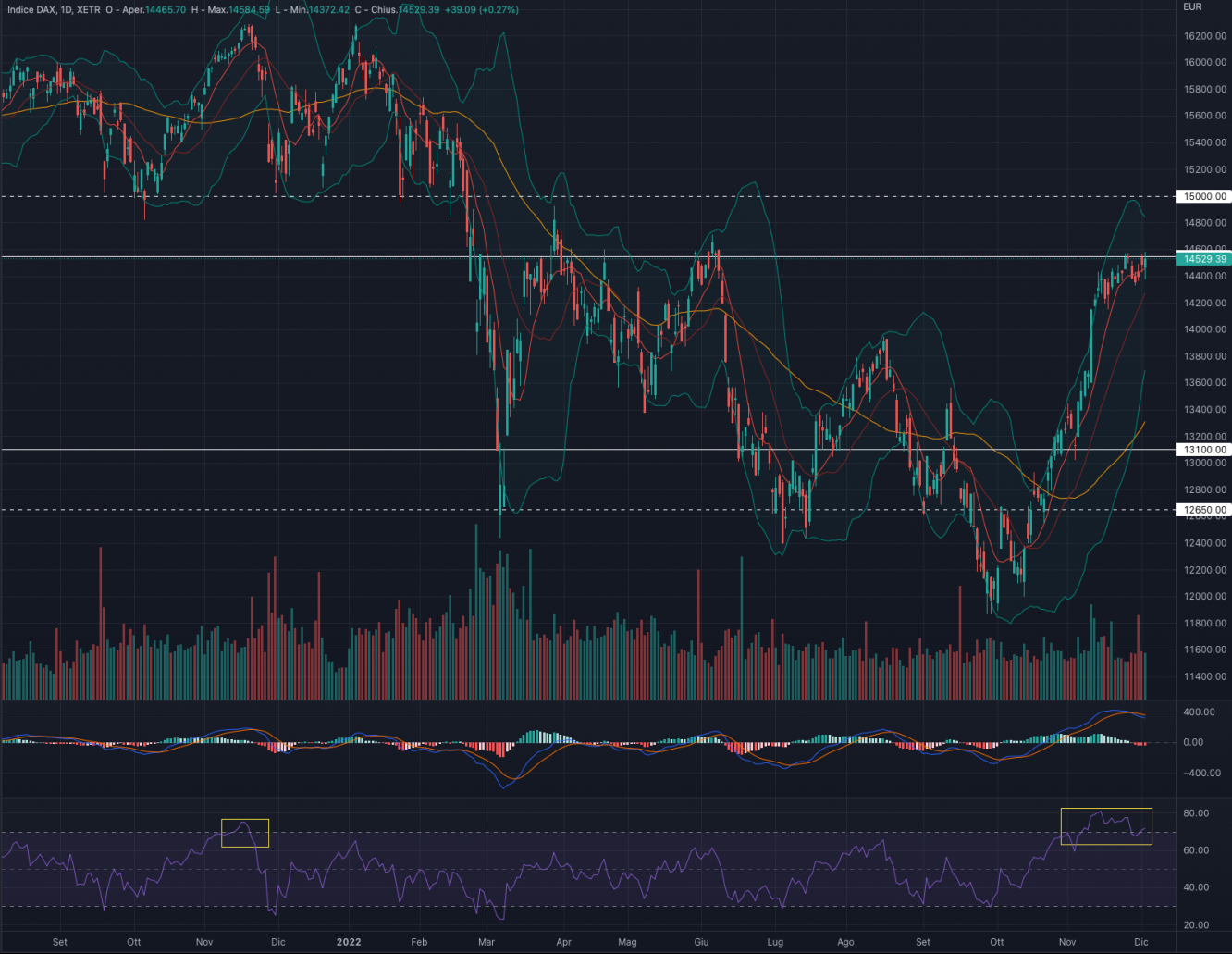

DAX 40 (DAX)

The DAX index had a week down by -0.08%. For the week to come, we are in favor of a progressive retracement to 13,900.

Indicators

Positive week for the German index that keeps the price close to the resistance level at 14,550, respecting the horizontal channel from February-March 2022.

MACD and RSI continue to be extended upwards, with the second in the overbought area: in both indicators, we notice a negative divergence with the price action.

Looking at previous swings, a pullback shortly followed once the price reached today's MACD and RSI levels. We believe that this situation is no different from the previous ones.

To allow the price to rise, the internal indicators should first retrace. We identify a possible retracement area around 13,600, without excluding a stronger pullback till 13,100.

We are bearish on the DAX and in favor of possible short-term reversals.

- Support at 13,100

- Resistance at 14,550

S&P 500

The S&P 500 index had a week up by +1.13%. For the coming week, we are in favor of a possible consolidation in the area of 4,000 - 3,900.

Indicators

Week that saw the SPX close slightly above the long bearish trendline in place since early 2022. The 9-day moving average (red line) continues to play the role of dynamic support.

MACD and RSI are extended upwards, particularly the first in a considerable slowdown. Although they are not in overbought territory, we are skeptical about the possibility of further upside potential.

We are neutral on the S&P 500: the contour scenario remains that of a bear market, and before we can change course, the obstacles are the overcoming of 4.100 and then 4,300.

We do not believe there is the strength to make extensions of this magnitude. Therefore, we prefer to wait for market reversals and retracement of internal indicators.

- Support for 3,750

- Resistance at 4.100

NASDAQ 100 (NDX)

The Nasdaq 100 index had a week up by +2.03%. For the coming week, we favor consolidation of 11,700 - 12,200.

Indicators

Positive week for the Tech index that now sees the price getting closer to the long bearish trend line that started in January 2022. MACD and RSI are positive and seem to support the index's advance.

The price stays above the 50-day average (yellow line), which we believe is an excellent medium to long-term indicator.

We are positive on the Nasdaq. At the same time, the strong downward extension of US rates to 10 years (now at 3.488%) makes us remain cautious about the index, as a recovery of vigor in the US10 could bring downward pressure on the index.

- Support at 10,400

- Resistance to 12,000

Dow Jones (DJI)

The Dow Jones index had a week up +0.24%. For the coming week, we favor an initial retracement of 33,600.

Indicators

Week that keeps the index at the August 2022 levels’. MACD and RSI are now very extended upwards, with the second in the overbought territory: the particular slowdown in histograms, we believe, is a further element of caution.

As in the past, the distance from the 50MA (yellow line) makes us cautious about the last strong upward extensions. We believe there is a fair chance of a retracement at least close to the 50-day average, or around 31,500 - 32,000.

We are bearish on the Dow Jones, given the strong upward move. We prefer to look forward to a slowdown in internal indicators, reconciliation with major moving averages, and a better relationship with volumes.

- Support for 31,200

- Resistance at 34,500