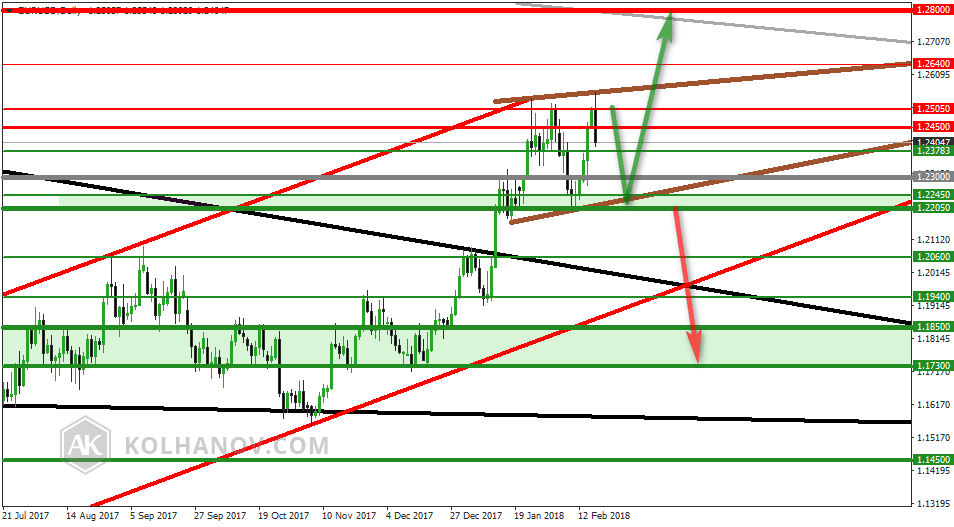

EUR/USD

Long-Term Forecast, from 19/02/18

The market is trading along an uptrend with target on 1.2800, that may be expected to continue, while market is trading above support level 1.2200.

An downtrend will start as soon, as the market drops below support level 1.2200, which will be followed by a move down to support level 1.2640 and 1.2800.

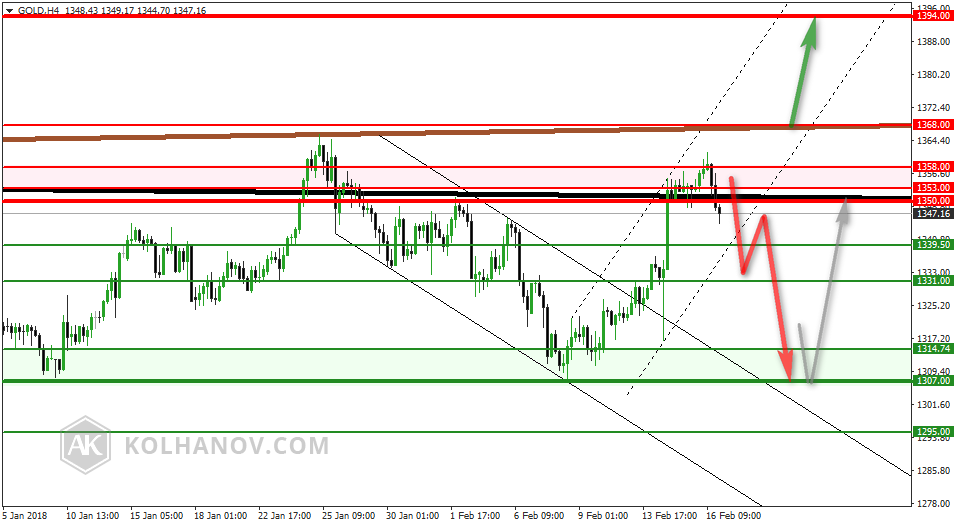

Weekly forecast, feb. 19 - 23

The market is trading along a downtrend with target on 1331 and 1307, that may be expected to continue, while market is trading below resistance level 1368.

An uptrend will start as soon as the market rises above resistance level 1368, which will be followed by a move up to resistance level 1394.

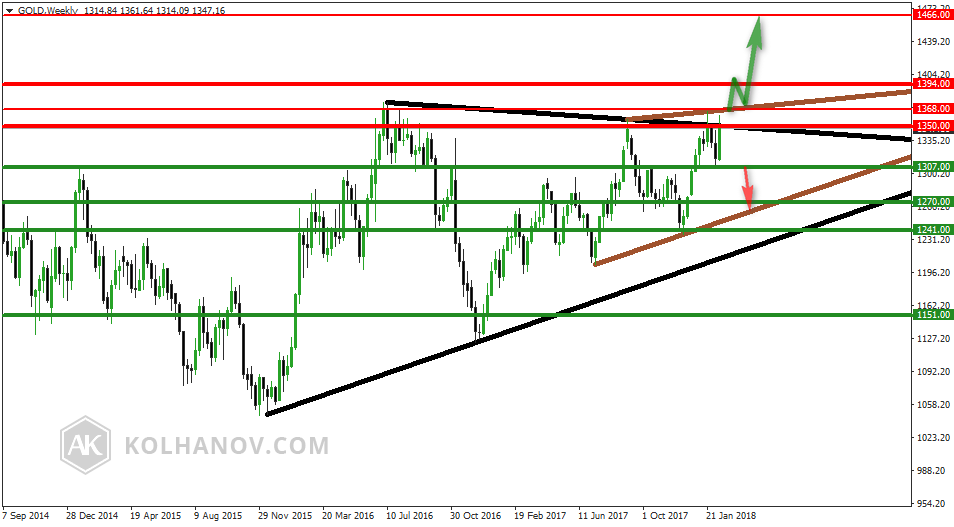

Long-Term Forecast, from 19/02/18

The market is trading along a sideways trend between support 1307 and resistance 1368.

An uptrend will start as soon as the market rises above resistance level 1368, which will be followed by a move up to resistance level 1394 and 1466.

An downtrend will start as soon, as the market drops below support level 1307, which will be followed by a move down to support level 1270.

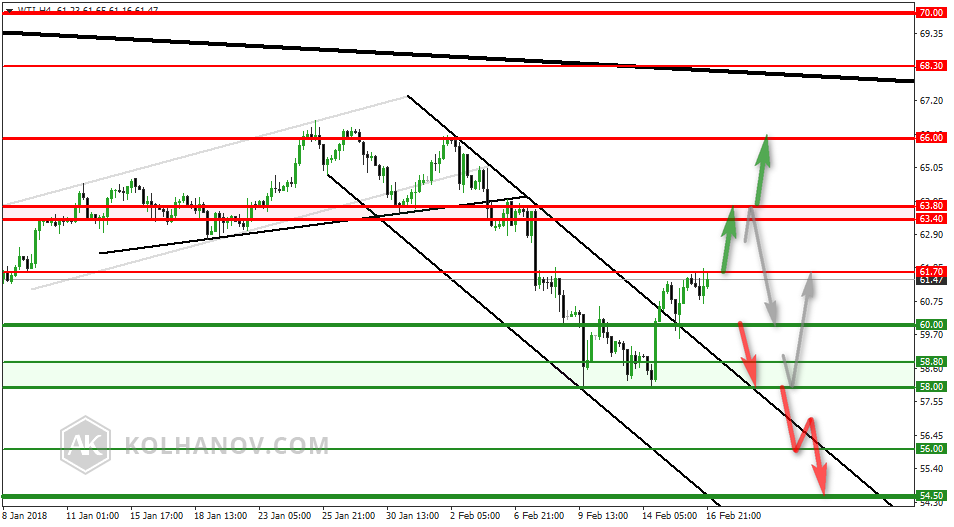

The market is trading along a sideways trend between support 60.00 and resistance 61.70.

The uptrend may be expected to continue in case the market rises above resistance level 61.70, which will be followed by reaching resistance level 63.40 - 63.80.

An downtrend will start as soon, as the market drops below support level 60.00 which will be followed by a move down to support level 58.00 and if it keeps on moving down below that level, we may expect the market to reach support level 56.00 and 54.50.

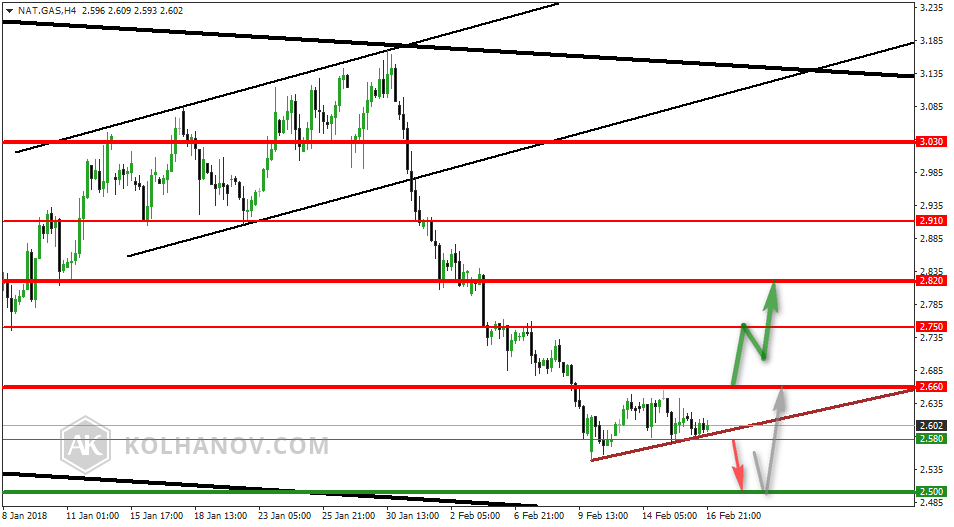

Natural Gas

An downtrend will start as soon, as the market drops below support level 2.580, which will be followed by a move down to support level 2.500.

An uptrend will start as soon as the market rises above resistance level 2.660, which will be followed by a move up to resistance level 2.750 and 2.820.

Long-Term Forecast, from 19/02/18

The downtrend may be expected to continue in case the market drops below support level 2.500, which will be followed by reaching support level 2.300.

An uptrend will start as soon as the market rises above resistance level 2.660, which will be followed by a move up to resistance level 2.820 and 3.030.