by Eli Wright

The US dollar correction continued last week and major Wall Street Indices, especially the S&P 500 and Dow remained range-bound. Additionally, markets were disappointed that President-elect Trump's Wednesday press conference failed to provide any real clarity on his administrations platforms and policies.

Over the course of the week the dollar declined two percent; the Dow fell 0.4 percent, the S&P 500 shed 0.12 percent, and the NASDAQ gained a mere one percent, while Bitcoin plummeted to its lowest prices in nearly a month before regaining some of its momentum at the end of the week.

Dollar dropped, commodities rose

In the immediate aftermath of Trump’s speech, the dollar weakened yet further against most major currencies. This phase of the dollar's correction began in mid December, after the Fed hike, but in tandem with interest rates, it appears to be heading for a retracement.

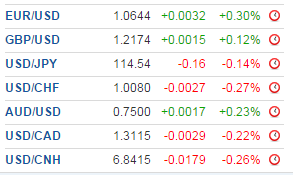

The euro, pound, yen, yuan, and Swiss franc all ended the week up versus the USD, as did the Australian and Canadian dollars.

The Dollar Index fell 1.1% on the week, to 101.19.

The weaker dollar made commodities more affordable and in the case of precious metals, more desirable. Oil and natural gas, which had been slumping through the first half of the week, rebounded approximately three percent each. Copper prices finished the week more than six percent higher. And in precious metals, gold and silver each gained approximately 2% on the week.

Bitcoin loses steam

Just two weeks ago, Bitcoin seemed unstoppable, as traders—especially in China and India—sought to hedge against local government currency manipulation and demonetization by central banks. The crypto-currency soared to $1,135, and many analysts expected it would break through its all-time high of $1,216.

However, when Chinese regulators threatened to focus a microscope on Bitcoin exchanges, traders quickly returned to the yuan and the digital currency dropped 20%. It lost close to another $100 last week, before reversing slightly, to close at $822.67. It appears that China quietly made some policy changes regarding Bitcoin trading terms on Friday, though a formal announcement has not yet been forthcoming.

Last Week’s Biggest Stock Market Gainers

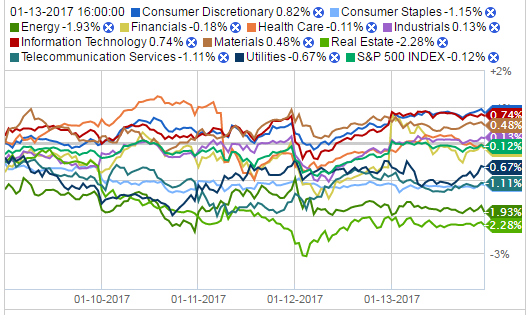

The S&P 500 ended last week down 0.12%. However, its best-performing sectors all finished the week higher: The Consumer Discretionary Index rose 0.82%; Information Technology gained 0.74%; Materials closed up 0.48%; and Industrials rose 0.13%.

Source: Fidelity.com

Consumer discretionary gains were led by Tiffany & Co (NYSE:TIF), which rose 6.17% on the week.

In information technology, semiconductor company Qorvo (NASDAQ:QRVO) jumped 8.74%; First Solar (NASDAQ:FSLR) rose 7.29%; and Applied Materials (NASDAQ:AMAT), a company that assists in the manufacturing of semiconductor chips, gained 5.46%.

Despite the S&P’s healthcare sector declining 0.11% on the week, Biotech company Illumina (NASDAQ:ILMN) was the S&P’s biggest gainer. It soared 14.9% after raising its Q4 sales expectations and unveiling new genetic sequencing technology at the JP Morgan Healthcare Conference in San Francisco.

Three other healthcare companies also landed in the top ten. Medical device companies Zimmer Biomet (NYSE:ZBH) and Boston Scientific (NYSE:BSX) gained 9.76% and 7.54%, respectively; and Cerner (NASDAQ:CERN), a supplier of health information technology solutions, rose 7.99%.

Rounding out the biggest weekly gainers were two companies on the S&P Industrials Index: power company NRG (NYSE:NRG), which rose 9.28%, and regional airline Alaska Air (NYSE:ALK), which gained 8.44%.

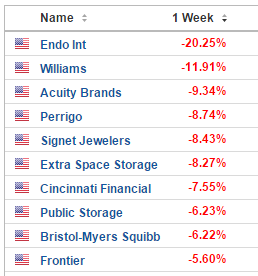

Last Week’s Biggest Losers

The hardest hit sectors in the S&P last week were real estate (-2.28%), energy (-1.93%), and telecom (-1.11%).

Among REITs, Extra Space Storage (NYSE:EXR) and Public Storage (NYSE:PSA) were two of the biggest weekly decliners, dropping 8.27% and 6.23%, respectively.

Energy companies in particular suffered, prompted by the nearly three percent fall in oil prices from the previous week. Additionally, though natural gas rose four percent last week, the gains were not enough to completely erase the effects of the previous week's twelve percent decline. Most oil and gas companies weren't among the bottom ten market decliners, but gas pipeline company Williams (NYSE:WMB) made the list, as shares declined 11.91%.

Frontier Communications (NASDAQ:FTR) fell 5.60%.

Overall, the healthcare sector fell 0.11%, after comments by Mr. Trump during his press conference made it clear he intends to focus on lowering drug prices. Bristol-Myers Squibb (NYSE:BMY) declined 6.22%; Perrigo (NYSE:PRGO), which produces over-the-counter and prescription drugs, dipped 8.74%; specialty pharma manufacturer Endo International (NASDAQ:ENDP) was the hardest hit of any company on the S&P last week, finishing down 20.25%.

Property and casualty insurer Cincinnati Financial (NASDAQ:CINF) released an 8-K filing this past Thursday; the company downgraded expectations for its Q4 2016 earnings to include pre-tax, catastrophic losses of approximately $125 million to $135 million due to property damages sustained in Hurricane Matthew, and damages caused by wildfires and wind in the Gatlinburg, Tennessee, area. Shares dropped 7.55% on the week.

Rounding out the bottom ten: Signet Jewelers (NYSE:SIG) and industrial lighting specialist, Acuity Brands (NYSE:AYI).

Signet Jewelers fell 8.43% after it downgraded its Q4 2017 earnings expectations on guidance of weak holiday sales. Same store sales decreased 4.6% compared to an increase of 5.1% in the nine weeks ended January 2, 2016 (“prior year”). And total sales decreased 5.1% compared to an increase of 5.3% in the prior year.

Acuity Brands fell nearly 15% last Monday after reported Q1 2017 earnings per share of $2.00 on $851.2M in revenue, lower than the $2.16 EPS on $895M in revenue that Wall Street had expected.

As well on Friday, the December Retail Sales release came in softer than expected, adding to the disappointment surrounding holiday season 2016.

What to expect this coming week

Markets in the US will be closed Monday for the Martin Luther King Jr. holiday. When trading resumes on Tuesday it's likely all involved will be looking for reasons to keep the Trump Rally going. Perhaps Q4 earnings will help.

With stocks trading at price-to-earnings valuations well above historical averages, many investors believe further gains will depend on strong earnings report cards over the next several weeks. Three big banks offered possible reasons to be optimistic: On Friday Bank of America (NYSE:BAC) JPMorgan (NYSE:JPM), and Wells Fargo (NYSE:WFC), all posted quarterly profits that exceeded analysts' expectations. Investors will no doubt be watching to see if that trend continues.

This coming week's economic calendar is light:

- British Prime Minister Theresa May is expected to speak about Brexit plans on Tuesday

- US Core CPI on Wednesday should provide an updated on inflation (or lack thereoff) and pricing trends

- Building Permits and Philadelphia Fed Manufacturing Index figures will be announced on Thursday

- Donald Trump will be sworn in as the 45th President of the US on Friday