The US stock markets and the demand for risks, in general, are growing against the background of debt markets stabilization. In addition, the asset prices recovery is supported by the comments of the head of the Chicago Fed Evans, that the central bank will take into account in its policy the economic situation in China and the Eurozone.

Nevertheless, the released macroeconomic data did not meet the analysts’ expectations and can restrain the positive market participants attitude.

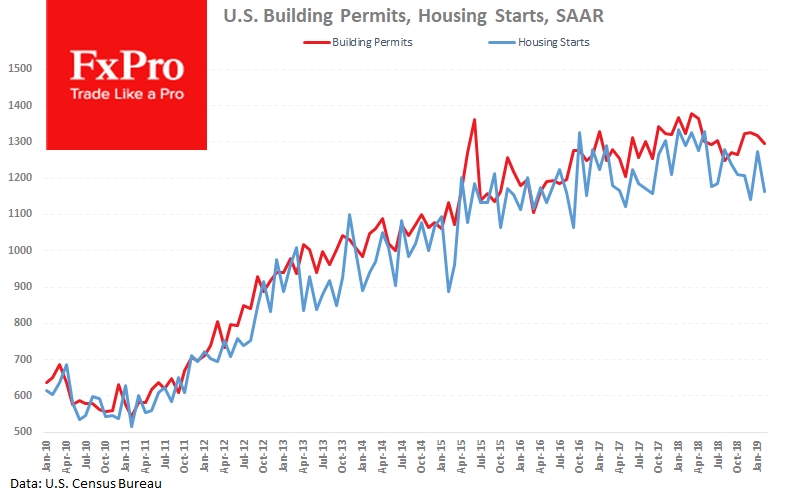

The housing starts in the United States fell by 8.7% in February, compared with the expected 0.8% decline. In addition, the number of building permits is decreasing for the second straight month. These indicators decline often reflects a more cautious attitude of households, being an indicator of economic slowdown.

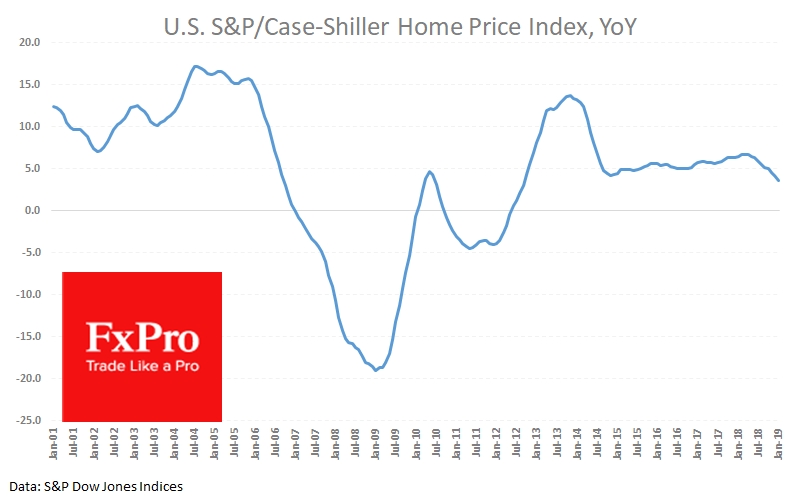

A further slowdown of housing prices also confirms this trend. The S&P/Case-Shiller index of the 20 largest metropolises slowed down the annual growth rate to 3.6% (minimum since September 2012).

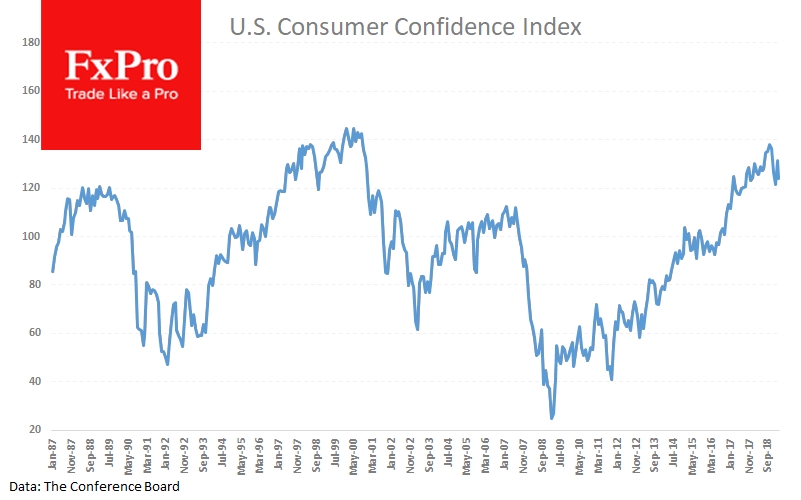

The decline of consumer confidence from CB also should not be ignored. Instead of the expected recovery from 131.4 to 132.1, this indicator declined to 124.1. Thus, there is more evidence of deterioration in consumer sentiment. Ultimately, this may lead to further economic slowdown, despite the positive dynamics of stock markets lately.

Alexander Kuptsikevich, the FxPro analyst