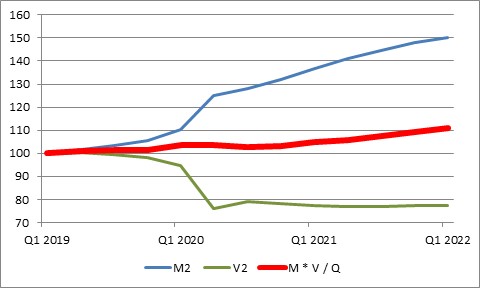

As M2 money growth soared throughout the COVID and post-COVID period of direct stimulus check-writing funded by massive quantitative easing (QE), monetarism novices thought that this would not result in inflation because money velocity simultaneously collapsed. Consequently, they argued, M*V was not growing at an outrageous rate.

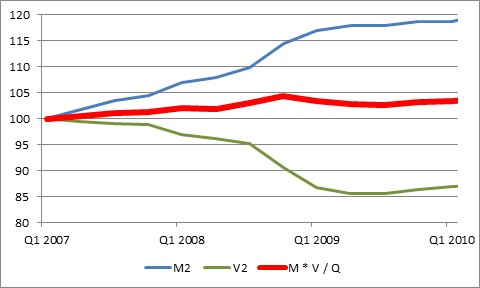

There was precedence for such optimism. In the Global Financial Crisis of 2008-09, money supply grew rapidly with the onset of QE and money velocity declined, never to recover. The chart below shows in a normalized fashion the rise in M, the decline in V, and the relative quiescence of MV/Q, which is of course P by definition as long as you choose your Ms, Vs, and Qs right.

A similar thing happened in this episode, so why would this be any different?

There are many reasons why these episodes are different. To name a few:

- The absolute scale of the rise in M2 was 2.5x the rise in 2007-2010, and that’s being generous since that measures the growth in 2007-2010 starting almost 2 years before the first QE in November 2008 compared to only 15 months in the second case.

- As I’ve written previously, QE in the first case was directed at banks; at the same time that the Federal Reserve was adding reserves it was also paying banks interest on reserves – because the point was to strengthen banks, not consumers.

- 5y interest rates came into 2008 at 3.44%; they came into 2020 at 1.69%. Since velocity is most highly correlated to interest rates, there was less room for this factor to be a lasting downward influence on velocity (after the crisis began in 2008, 5y Treasury rates never exceeded 3% again except for a few days in 2018).

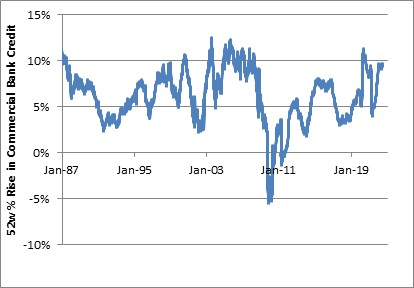

- Bank credit growth never stopped in the 2020 crisis, while it contracted at a 5% rate in the 2008 crisis (see chart, source Board of Governors of the Fed).

The monetarist novices (you can tell they’re novices because they say things like “Friedman said velocity was constant,” which is false, or “velocity is just a plug number [true] and has no independent meaning of its own [false]”) insisted that velocity was in a permanently declining state and that there was no reason at all to expect it to ever “bounce.” After all, it bounced only slightly after the GFC; why should it do so now?

But after 2008, as I noted, interest rates bounced only briefly before declining again…with the added phenomenon that some global debt came to bear negative yields, calling into fair question whether there was in fact any natural “bottom” to velocity if interest rates are the main driver! And velocity, obediently, dripped lower as well.

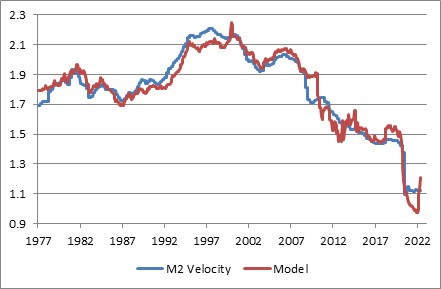

There is at least one other big driver to money velocity, although it is rarely important and almost never for very long. And that is economic uncertainty, which creates a demand to carry excess cash balances (implying lower money velocity). A model driven (mainly) by rates and a measure of uncertainty has done a pretty good job at explaining velocity over time (see chart, source Enduring Investments), including explaining the collapse in velocity during the COVID crisis out-of-sample.

Now, explaining velocity is a helluva lot easier than predicting it, because it isn’t easy to predict interest rates. Nor is it easy to predict the precautionary demand for money – but at least we can count on that being somewhat mean-reverting. The latest point from the model shown above uses current data, and suggests (largely because of the rise in interest rates, but also because precautionary balances are declining) that money velocity should bounce. Not that the model predicts it will happen this week, but it should not be surprising when it does.

A rise in velocity would be a really bad thing, because the money supply is very unlikely to decline very far especially while bank credit growth continues to grow. The only reason we have been able to sustain 6% or 8% money growth for a very long time has been because we could count on velocity to keep declining with interest rates. If money growth ticks up at, say, a mere 6% while money velocity rises 5%, then nominal GDP is going to rise 11%…and most of that will be in prices.

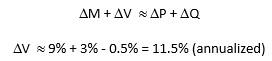

Now, this is a very slow-moving story. I mention it now for one specific reason, and that is that we are almost certain to see a rise in velocity in Q2 when the GDP figures come out in late July. That’s because money growth for the quarter has been very slow so far. So far, the Q2 average M2 is 0.06% higher than the Q1 average. My best wild guess is that we will end up with an 0.5% annualized q/q growth rate. The Atlanta Fed GDPNow model estimates 0.25% GDP growth in Q2 (the Blue Chip Consensus is still at 3%). And if the inflation market is right, Q/Q inflation in Q2 will be about 11.7%. That’s CPI, so let’s be generous and say 9%. We don’t know all of these numbers, but we know 2/3 of all of them. Let’s use the Blue Chip consensus for GDP and assume M2 doesn’t spike next month and the price level doesn’t collapse. Then:

If that happened, the increase would be the largest quarterly jump in money velocity – absent the reactionary bounce in 2020Q3 after the 20% plunge in 2020Q2 – since 1981. And here’s the rub: because of the mathematics of declines and recoveries, that would still leave us with velocity that prior to 2020 would have been an all-time record low.

Does this matter? Not if you believe the monetarism dabblers, who will say this is a mechanical adjustment that will soon be reversed as velocity continues its long slide to oblivion. Nor will it matter to the Fed, who at best will take executive notice of the fact before ignoring it since they aren’t monetarists any longer.

But for those who think that inflation comes from too much money chasing too few goods? It’s scary.