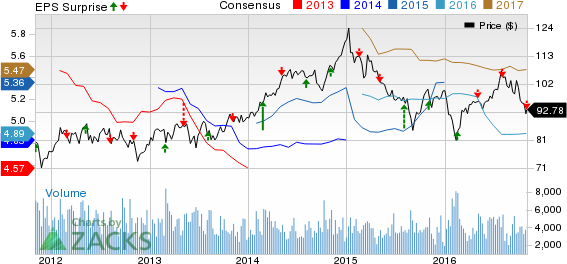

Vornado Realty Trust (NYSE:VNO) reported third-quarter 2016 funds from operations (“FFO”) per share of $1.24, missing the Zacks Consensus Estimate of $1.28. The adjusted FFO per share for third-quarter 2015 was $1.21.

Results reflect a fall in occupancy in both the New York and Washington DC portfolio.

Total revenue came in at $633.2 million for the quarter, up 0.9% year over year. Also, it surpassed the Zacks Consensus Estimate of $625 million.

Quarter in Detail

In the New York portfolio, Vornado leased 335,000 square feet of office space and 7,000 square feet of retail space. The company leased 177,000 square feet of office space in Washington DC.

At quarter end, same-store occupancy in the New York portfolio was 95.8%, reflecting a contraction of 20 basis points (bps) sequentially and 40 bps year over year. On the other hand, same-store occupancy in the Washington DC portfolio was 83.9%, down 10 bps sequentially and 80 bps year over year.

Same-store earnings before interest, tax, depreciation and amortization for New York portfolio increased 4.9% from a year ago and for Washington DC, it rose 5.2% year over year.

As of Sep 30, 2016, Vornado had $1.35 billion of cash and cash equivalents, down from $1.84 billion as of Dec 31, 2015.

Other Important Developments

On Sep 6, the company closed a $675 million refinancing of theMART, a commercial building in Chicago.

On Aug 3, a joint venture, in which Vornado has 49.9% ownership interest, closed an $80 million refinancing of a Manhattan residential complex.

Our Viewpoint

Vornado’s results in the third quarter were disappointing. Though strategic acquisitions and divestitures including spin-offs are projected to improve growth in the long term, its portfolio-repositioning efforts, through property dispositions have earnings dilutive effects. Further, stiff competition and any hike in interest rates remain concerns for the company.

Currently, Vornado has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Some REITs which are slated to report results later this week include EPR Properties (NYSE:EPR) , Lamar Advertising Co. (NASDAQ:LAMR) and Federal Realty Investment Trust (NYSE:FRT) .

Note: FFO, a widely used metric to gauge the performance of REITs, is obtained after adding depreciation and amortization and other non-cash expenses to net income. All EPS numbers presented in this write up represent FFO per share.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks’ best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

LAMAR ADVER CO (LAMR): Free Stock Analysis Report

FED RLTY INV (FRT): Free Stock Analysis Report

EPR PROPERTIES (EPR): Free Stock Analysis Report

VORNADO RLTY TR (VNO): Free Stock Analysis Report

Original post