The European Union Competition Commission (EC) recently confirmed that Vodafone Group (LON:VOD) Plc. (NASDAQ:VOD) and Liberty Global Plc. (NASDAQ:LBTYA) have jointly offered some concessions to ensure regulatory clearance for their proposed joint venture (JV) in the Netherlands. Although the type of concessions offered is yet to be disclosed, the telecom operators generally divest infrastructure assets to their competitors to win regulatory approval. The EC is scheduled to take a decision on the deal by Aug. 3, subject to feedback from competitors and other interested parties.

In Feb 2016, British telecom giant Vodafone and Liberty Global -- the largest cable MSO (multi service operator) in Europe – decided to merge their Dutch operations to form a 50-50 JV. As per the agreement, Vodafone will pay €1 billion (approximately $1.12 billion) in cash to Liberty Global to bring the valuation of each of their local units on par. The two companies are expecting to achieve cost and revenue synergies of €3.5 billion (around $3.9 billion) after factoring in integration costs.

Notably, last year, the two companies had been negotiating a series of transactions including global asset swaps. However, the merger negotiations were abandoned after they failed to reach an agreement on valuations. At the moment, Vodafone and Liberty Global are combining their Dutch businesses. Both the companies have declined to comment whether there is a possibility of the deal being extended to other markets in the future.

Vodafone has a nationwide 4G LTE network in the Netherlands serving around 5.13 million mobile and about 73,000 fixed broadband subscribers. Liberty Global, through its Ziggo subsidiary, serves approximately 4.1 million pay-TV subscribers in the country. Of the total, nearly 3.1 million customers also use Ziggo’s broadband service while 2.5 million customers use its voice service.

It is worth mentioning here that Ziggo already has an MVNO (mobile virtual network operator) agreement with Vodafone Netherlands. At present, Ziggo serves around 181,000 mobile customers in the country using Vodafone’s wireless network. In the event of the deal materializing, the combined Vodafone-Liberty Global entity will pose a formidable challenge to key players like Royal KPN NV (OTC:KKPNY) and T-Mobile Netherlands of Deutsch Telekom in the country.

Last week, Reuters reported that the Dutch market regulator, Authority for Consumers and Markets (ACM) had approached the EC for permission to evaluate the Liberty Global – Vodafone JV. However, the EC hasn’t taken any decision in this regard.

Zacks Rank & Other Stocks

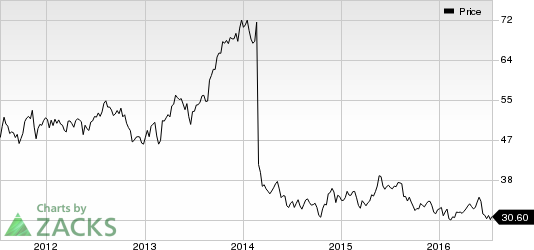

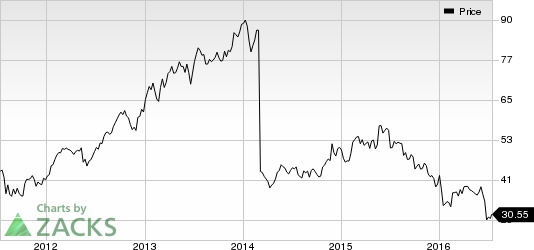

Currently, Vodafone carries a Zacks Rank #2 (Buy) while Liberty Global has a Zacks Rank #4 (Sell). A couple of better- ranked stocks are NTT DoCoMo Inc. (NYSE:DCM) and Mobile TeleSystems PJSC (NYSE:MBT) , both sporting a Zacks Rank #1 (Strong Buy).

LIBERTY GLBL-A (LBTYA): Free Stock Analysis Report

NTT DOCOMO -ADR (DCM): Free Stock Analysis Report

VODAFONE GP PLC (VOD): Free Stock Analysis Report

MOBILE TELE-ADR (MBT): Free Stock Analysis Report

Original post

Zacks Investment Research