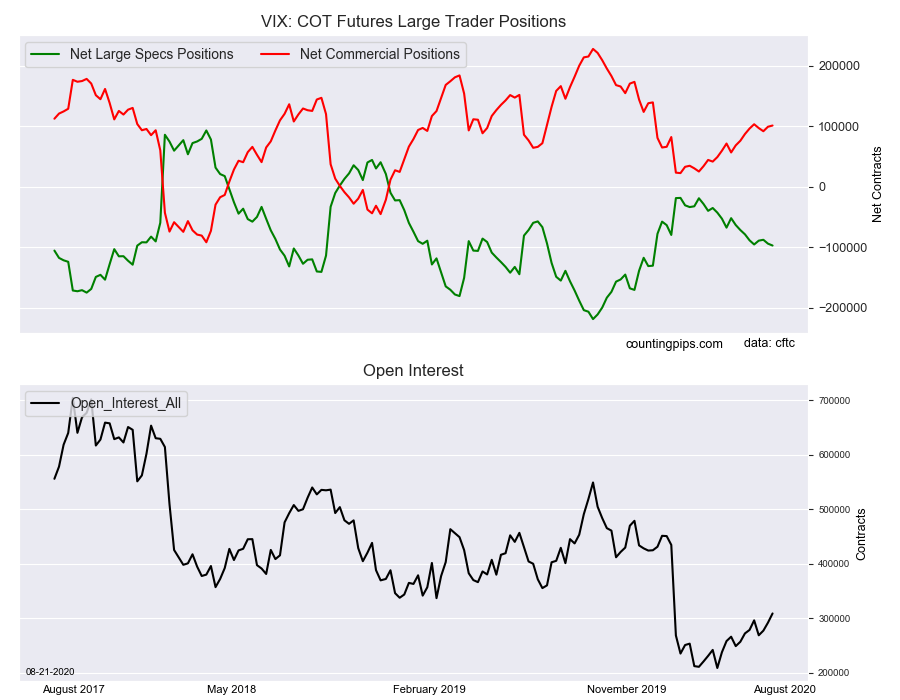

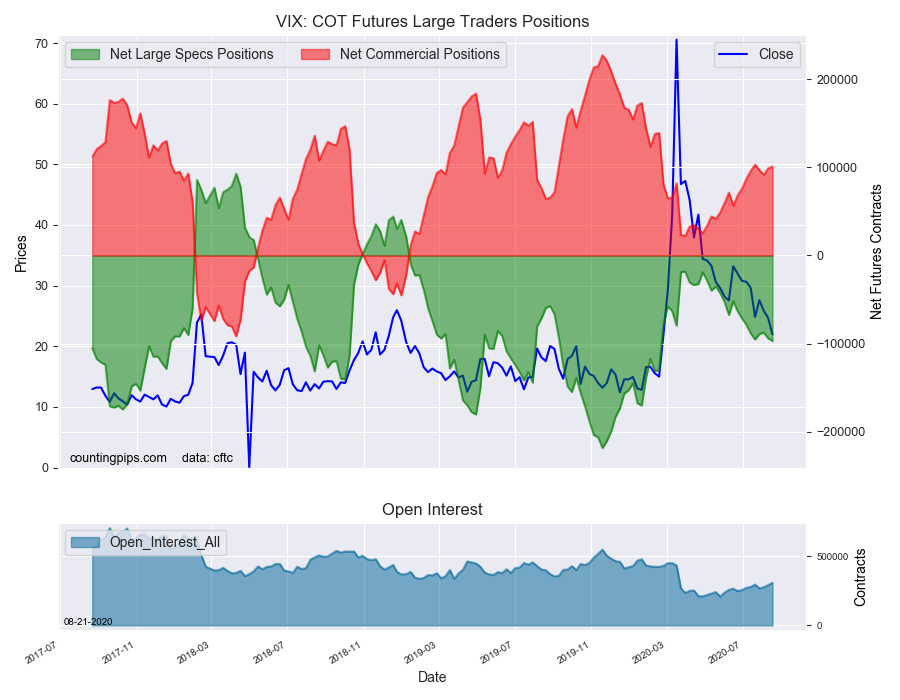

VIX Non-Commercial Speculator Positions:

Large volatility speculators added to their bearish net positions in the VIX futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of VIX futures, traded by large speculators and hedge funds, totaled a net position of -96,984 contracts in the data reported through Tuesday, August 18th. This was a weekly change of -3,131 net contracts from the previous week which had a total of -93,853 net contracts.

The week’s net position was the result of the gross bullish position (longs) decreasing by -8,065 contracts (to a weekly total of 48,688 contracts) while the gross bearish position (shorts) fell by a lesser amount of -4,934 contracts for the week (to a total of 145,672 contracts).

The VIX speculators increased their bearish bets for a second straight week and pushed the overall net bearish standing to the highest level in the past twenty-six weeks. Bearish positions rose to -96,984 contracts this week as speculators continue to wager on a lower VIX score which means less volatility in the S&P 500 stock index. This week’s level marked the most bearish since February 18th when the VIX speculator position totaled -130,229 contracts.

VIX Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 101,057 contracts on the week. This was a weekly boost of 2,029 contracts from the total net of 99,028 contracts reported the previous week.

VIX Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the VIX Futures (Front Month) closed at approximately $21.95 which was a decrease of $-2.73 from the previous close of $24.68, according to unofficial market data.