For today’s bulletin, we take a look at our latest STRONG BUY and BUY upgrades. We also provide a link to download a FREE STOCK REPORT on Esterline Technologies Corporation (NYSE:ESL), one of our top upgrades for the day.

VALUATION WATCH: Overvalued stocks now make up 34.11% of our stocks assigned a valuation and 12.81% of those equities are calculated to be overvalued by 20% or more. Three sectors are calculated to be overvalued.

For today’s edition of our upgrade list, we used our website’s advanced screening functions to search for UPGRADES to BUY or STRONG BUY with complete forecast and valuation data. They are presented by one-month forecast return. Iradimed (NASDAQ:IRMD) and Esterline Tech are rated STRONG BUY. The rest of our list components are rated BUY.

Esterline Technologies is a specialized manufacturing company serving principally aerospace and defense markets. Esterline views the company’s businesses in three segments related to its set of core competencies: Avionics & Controls, Sensors & Systems, and Advanced Materials. Avionics & Controls segment focus on technology interface systems for commercial and military aircraft and similar devices for land- and sea-based military vehicles, cockpit displays and integration systems and other high-end industrial applications. The Sensors & Systems segment includes operations that produce high-precision temperature and pressure sensors, specialized harsh-environment interconnect solutions, electrical power distribution equipment, and other related systems principally for aerospace and defense customers. Advanced Materials focuses on process-related technologies including high-performance elastomer products used for a wide range of military and commercial aerospace purposes.

Q4 2018 results were strong. Adjusted earnings from continuing operations were $55.3 million, or $1.87 per diluted share. Consolidated fiscal-year 2018 revenue was $2.035 billion compared with the fiscal 2017 revenue result of $2.000 billion.

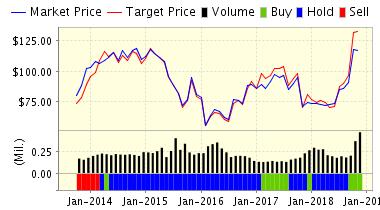

ValuEngine updated its recommendation from BUY to STRONG BUY for Esterline Technologies Corporation on 2018-11-20. Based on the information we have gathered and our resulting research, we feel that Esterline Technologies Corporation has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Momentum and Company Size.

The company entered into a definitive agreement and plan of merger pursuant to which Transdigm Group Incorporated (NYSE:TDG) will purchase all of the outstanding shares of Esterline common stock for $122.50 per share in cash. The transaction is expected to close in 2019.