Tesla Inc. (TSLA) designs, develops, manufactures, and sells electric vehicles and stationary energy storage products. It operates primarily in the United States, China, Norway and internationally. Tesla Inc., formerly known as Tesla Motors Inc (NASDAQ:TSLA)., is headquartered in Palo Alto, California.

The company has long been a darling of those with an eye on the future as the founder--Elon Musk--has a variety of projects underway of interest to those looking to get in on the ground floor of disruptive technologies and business models.

Tesla does re-usable private rockets. They have technology that may solve issues related to solar and wind power inconsistency--battery storage. They want to build a sci-fi sounding "hyper-loop" personal-transportation system. And, of course, they have a car company that makes electric vehicles.

The automobile portion of Tesla's business was all over the news last week because the market cap of the firm now surpasses that of auto giant Ford and trails--barely--that of GM. This creates a conundrum for skeptical investors, because the company continues to lose money despite sales of $7 billion last year.

But, the stock continues to climb in value, with an increased of @41% so far in 2017. How can we explain this phenomena? Investors believe the company is positioned for the future, and thus they find find it far more attractive to buy a company with a projected P/E Ratio of @270 than stalwarts like GM with a ratio of @6 or Ford with a ratio of @7.

That's a big assumption for any company, let alone one whose products--with the exception of the cars it can produce--are largely speculative, unproven, and far from being market ready. In 2016, the company sold only 76,000 cars. Compare that to Ford's 2016 number of 2,614,697 vehicles and GM's 2016 sales of 3,042,773 vehicles.

One factor driving Tesla's recent share-price gains is the fact that the company is finally ready to bring a cheaper electric car option to market rather than the status-symbol electric cars currently popular with the rich and famous. Their Model 3 sedan is supposed to begin production in a few months, Analysts and investors believe that this car will finally bring the company's advanced technology to market in a package that is more affordable--@$35k-- for "regular folks."

Of course, our models do not run on sentiments, hope for the future, or any other subjective measures. They can only digest hard financial data like earnings, past price movements, etc. So, despite bullish investor sentiment, we do not rate this company as a worthy investment right now. Our SELL rating is based on past performance and our systems find that the P/E ratio, valuation, and other data points are nowhere near the leaders of our universe. The valuation is particularly worrisome.

But, as we have seen in the past, when a newcomer catches the imagination and seems to have a handle on the products of the future--like Apple (NASDAQ:AAPL), it can go stratospheric in terms of market cap even against other firms that would seem to have more assets, income, etc.--like Exxon Mobil (NYSE:XOM).

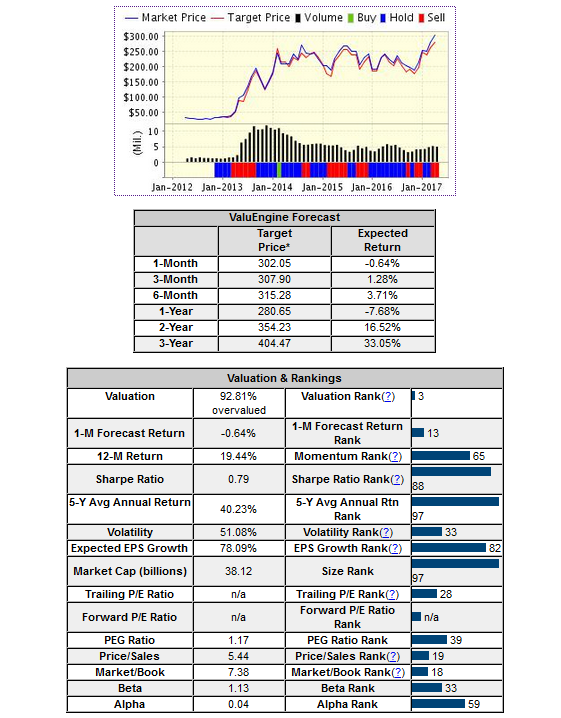

Below is today's data on Tesla (TSLA):

VALUENGINE RECOMMENDATION: ValuEngine continues its SELL recommendation on Tesla for 2017-04-13. Based on the information we have gathered and our resulting research, we feel that Tesla has the probability to UNDERPERFORM average market performance for the next year. The company exhibits UNATTRACTIVE Book Market Ratio and Price Sales Ratio.