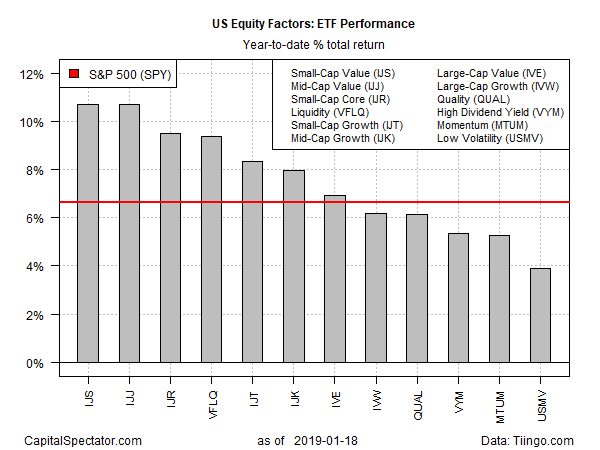

Trading is set to resume today for the US stock market with value firmly in the lead for year-to-date performance for the major equity factors, based on a set of exchange-traded funds. In fact, a positive bias prevails across the board for stocks so far in 2019. Headwinds may be brewing via several areas of concern, including softer global growth and the ongoing partial government shutdown. But as the crowd returns to work after a long weekend, value enjoys a sizable performance edge in the new year.

The iShares S&P Small-Cap 600 Value (NYSE:IJS) is posting a 10.7% return year to date, edging out the second-place performer, iShares Core S&P Mid-Cap (NYSE:IJH), by a fraction. Together, the two value ETFs are comfortably leading the field, based on prices through Friday, Jan. 18.

The weakest factor performer at the moment: low volatility via iShares Edge MSCI Minimum Volatility USA (NYSE:USMV). The ETF is up a relatively light 3.9% so far in 2019. Note, too, that the momentum factor is posting the second-weakest year-to-date return: iShares Edge MSCI USA Momentum Factor (MTUM) is up 5.3%. Meanwhile, equities overall are ahead by 6.6% this year, as of Friday’s close, based on SPDR S&P 500 (NYSE:SPY).

There’s no shortage of risk threats lurking as US markets are poised to reopen. At the top of the list is the partial government shutdown, which is slowly but surely weighing on the economic outlook. The odds remain low of an imminent end to the political stalemate in Washington. The Senate Republican leader is set to introduce legislation to resolve the impasse, but Bloomberg this morning reports that “Democrats have already said they’ll reject” the bill.

Recent economic estimates still reflect moderate growth for the US. But the headwinds are strengthening from several corners, including shutdown blowback.

“The US expansion continues, but the forecast remains for a deceleration with the unwinding of fiscal stimulus,” advises economist Gina Gopinath, director of research at the IMF. The calculus includes effects from the ongoing partial government shutdown, which poses “downside risks” for the global economy, she warned.