Valley National Bancorp (NYSE:VLY) announced that it has received all necessary approvals to acquire Clearwater, FL-based USAmeriBancorp, Inc. The latest nod was from the shareholders of both the companies.

Earlier in October, Valley National got all requisite banking regulatory approvals (including that from the Fed and the Office of the Comptroller of the Currency) to close the transaction, announced in July. Now, both the companies project the deal to be effective Jan 1, 2018, subject to the completion of remaining closing customary conditions.

Deal Details & Benefits

Per the agreement terms, shareholders of USAmeriBancorp will receive 6.1 shares of Valley National for each share held, subject to adjustment if Valley National's stock price falls below $11.50 or rises above $13.00 prior to closing. The transaction was valued at about $816 million, based on Valley National's closing stock price on Jul 25, 2017.

The transaction is expected to be accretive to Valley National's earnings per share within 12 months from closing of the transaction.

As of Sep 30, 2017, USAmeriBancorp, with a branch network of 30 offices, held roughly $4.5 billion in assets, $3.6 billion in net loans and $3.6 billion in deposits. Following the closure of the deal, the combined company will have more than $28 billion in assets and 238 branches.

After closing of the deal, USAmeriBancorp’s CEO, Joseph V. Chillura, will join Valley National as executive team member while the Chairman of the acquired company, Jennifer W. Steans, will join as a board member.

Road Ahead

The deal will significantly boost Valley National’s presence in the Tampa Bay market. The acquisition will also bring Valley National to the Birmingham, Montgomery and Tallapoosa areas in Alabama.

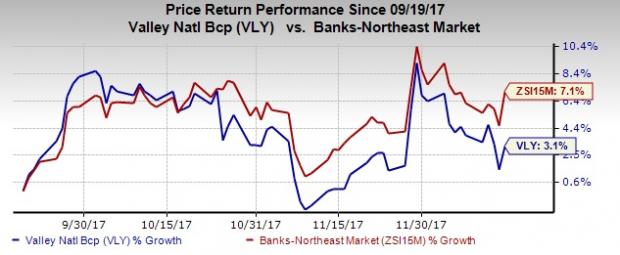

Driven by stable balance sheet position, Valley National is expected to continue with its inorganic growth strategy. Further, over the past three months, the company’s shares have rallied 3.1%, underperforming the industry’s gain of 7.1%.

Currently, Valley National carries a Zacks Rank #4 (Sell).

Stocks Worth Considering

Some better-ranked stocks in the same space are First Commonwealth Financial Corporation (NYSE:FCF) , S&T Bancorp, Inc. (NASDAQ:STBA) and Two River Bancorp (NASDAQ:TRCB) . All these stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

First Commonwealth Financial’s current-year earnings estimates have been revised 2.5% upward over the past 60 days. The company’s share price has been up around 15.6% in six months’ time.

S&T Bancorp’s Zacks Consensus Estimate for current-year earnings have moved 1.7% upward over the past 60 days. The company’s share price has been up around 14.9% over the past six months.

Two River Bancorp’s current-year earnings estimates have been revised 2.1% upward, over the past 60 days. Over the past six months, the company’s share price has been up 8.7%.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

S&T Bancorp, Inc. (STBA): Free Stock Analysis Report

First Commonwealth Financial Corporation (FCF): Free Stock Analysis Report

Valley National Bancorp (VLY): Free Stock Analysis Report

Two River Bancorp (TRCB): Free Stock Analysis Report

Original post

Zacks Investment Research