Celsius' terms of services say users might be unable to recover their crypto used in the "Earn" service or as collateral in the event of bankruptcy.

Troubled crypto lender Celsius Network, which paused customer withdrawals more than one month ago, filed for bankruptcy late Wednesday. In a statement, the company said it has $167 million in cash on hand, which will provide liquidity to support certain operations during the restructuring process.

Meanwhile, Celsius’s terms of use do not offer guarantees to protect user deposits in the event of insolvency, meaning customer funds are likely lost.

Celsius Files for Bankruptcy, Starts Restructuring

Celsius has filed for Chapter 11 bankruptcy more than a month after freezing customer assets in the wake of sharp turbulence in the crypto market after the catastrophic implosion of Terra. The company was valued at $3.25 billion when it extended its “oversubscribed” Series B financing round to $750 million in November last year.

In the filing, the New Jersey-headquartered startup said it had between $1 billion and $10 billion in assets and liabilities and more than 100,000 creditors. The crypto lender also claimed it has $167 million in cash on hand, providing ample liquidity to support certain operations during the restructuring process.

Alex Mashinsky, co-founder and chief executive of Celsius, said the move is “the right decision” for the community and the company. He stated:

“We have a strong and experienced team in place to lead Celsius through this process. I am confident that when we look back at the history of Celsius, we will see this as a defining moment, where acting with resolve and confidence served the community and strengthened the future of the company.”

The announcement follows weeks of speculation about the financial status of the company. Over the past several days, Celsius has repaid some of its debt. The company has paid $183.6 million debt in DAI stablecoin since Jul. 1 to Maker DAO and settled its $303 million Aave loan.

Celsius Does Not Request Authority to Resume User Withdrawals

Celsius said it is not requesting authority to resume customer withdrawals. On the other hand, the company has asked for court approval to pay employees and continue their benefits while also resuming business operations. The company said:

“To ensure a smooth transition into Chapter 11, Celsius has filed with the Court a series of customary motions to allow the Company to continue to operate in the normal course. These ‘first day’ motions include requests to pay employees and continue their benefits without disruption, for which the Company expects to receive Court approval. Celsius is not requesting authority to allow customer withdrawals at this time. Customer claims will be addressed through the Chapter 11 process.”

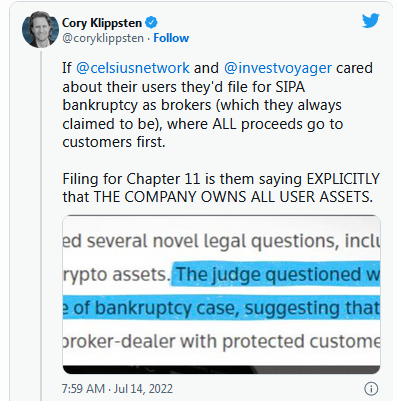

According to Cory Klippsten, CEO of SwanBitcoin.com, if Celsius wanted to pay users first, it should have filed for SIPA bankruptcy as a broker. “Filing for Chapter 11 is them saying explicitly that the company owns all user assets,” he added.

Moreover, since Celsius is not a bank, there is no insurance that user deposits are protected in insolvency. The crypto lender has clearly stated in its terms of services that users might not be able to recover their crypto used in the “Earn” service or as collateral.

Celsius users “will not be able to exercise rights of ownership,” have no claim to any compensation Celsius gets for lending out those assets, and if it goes bankrupt, “may not be able to recover or regain ownership of such Digital Assets,” the company’s terms of services says.