- Specialty coffee retailer SBUX stock is up over 12% in the past year.

- Starbucks operates in over 80 countries and has close to 34,000 stores.

- Long-term investors could consider buying the dips in SBUX shares, especially if they decline toward $110.

Investors in the specialty coffee chain Starbucks (NASDAQ:SBUX) saw double-digit returns in 2021. Over the past 12 months, SBUX stock has returned around 12.30%.

By comparison, the S&P Food & Beverage Select Industry Index returned 14.4% in the past 52 weeks. And the Dow Jones US Restaurants & Bars Index is up 19.4%.

In late July 2021, SBUX shares hit $126.32—a record high. However, they've come under pressure and lost about 8% since then. The stock's 52-week range has been $95.92 - $126.32, while the market capitalization (cap) stands at $136.7 billion.

Starbucks celebrated its 50th anniversary in 2021. It currently has close to 34,000 stores across the world. Around 51% of them are company-operated, and the rest are licensed.

Recent metrics show that the global coffee shop market is expected to reach almost $81 billion in 2024. The current market size in the US is about $36 billion. Starbucks is the 'Coffee shop chain with highest brand value worldwide' and the 'Leading coffee shop chain in the US, by sales.'

Starbucks ranks number six among Fortune’s most admired companies and number one within the Food Services industry. The coffee chain has top ranking in attributes such as 'Innovation,' 'People Management,' 'Use of Corporate Assets,' and 'Long-Term Investment Value' among others.

As part of its social media push, management has recently announced a partnership with the streaming giant Netflix's (NASDAQ:NFLX) Book Club. The two will create monthly literary and entertainment content for Netflix's social media channels.

Management announced Q4 and FY21 metrics on Oct. 28. Revenue was $8.1 billion, up 31% year-over-year (YoY). Adjusted earnings per share (EPS) came in at $1. Investors were pleased to see that Q4 Comparable Store Sales increased by 17% worldwide and 22% in the US.

During the conference call, CEO Kevin Johnson said:

"Our performance accelerated throughout FY 2021, fueling revenue growth of 21%, non-GAAP operating income grew 139%, and translated to a non-GAAP earnings of $3.24 per share, near the high end of our guidance for the year."

Before the release of the quarterly results, SBUX stock was trading around $114. The day after the announcement, shares hit an intraday low of $104.02. The stock is currently hovering at $116.15. Finally, the current price supports a dividend yield of 1.69%.

What To Expect From Starbucks Stock

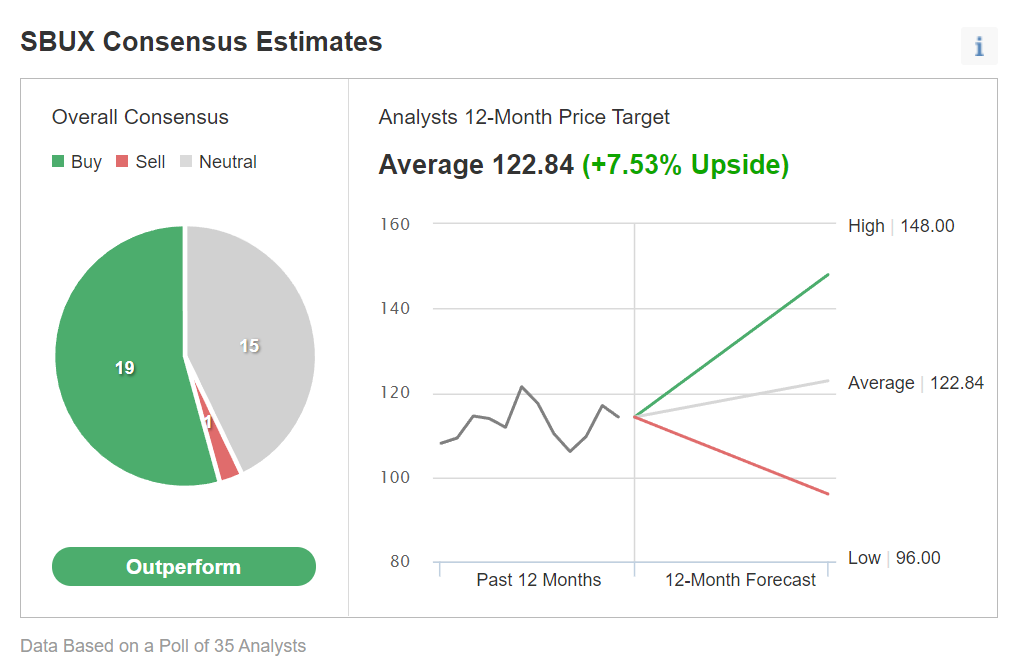

Metrics on Investing.com show that among 35 analysts polled, the average 12-month target is $122.84, implying an upside of 7.53% from current levels.

Chart: Investing.com

The 12-month price range currently stands between $96 and $148.

Similarly, according to a number of valuation models, such as those that might consider P/E, P/B, P/S or revenue multiples, the average fair value for SBUX stock stands at $121.99—a value very close to the estimate above.

Meanwhile, if we look at the company’s financial health determined by ranking more than 100 factors against peers in the consumer discretionary sector, we find that in terms of profit health and price momentum, SBUX scores 4 out of 5 (top score). Its overall performance is rated “good.”

Trailing P/E and P/S ratios for Starbucks stock are 32.6x and 4.7x. By comparison, those metrics for peers stand at 19.1x and 2.1x.

We can also take a closer look at comparable metrics for Restaurant Brands International (NYSE:QSR). They are 25.2x and 5.0x. And the numbers for McDonald’s (NYSE:MCD) stand at 27.6x and 8.9x.

Finally, those who also pay attention to technical charts might be interested to know that several of SBUX's short- and intermediate-term indicators are at overbought levels thereby cautioning investors. As the company is expected to report Q1 metrics in late January, there could be further choppiness in the Starbucks share price.

In the coming weeks, we expect SBUX stock to potentially trade in a range between $105 and $120, and form a base from which a new leg can start later in the year.

Therefore, investors who are not concerned with short-term choppiness in SBUX stock could consider buying the dips.

Alternatively, those who are long-term bullish on SBUX shares but concerned about the short-term volatility might use options. For instance, they could put together a covered call position. We have covered numerous examples before (using Apple and AMD, for example).

Covered Calls On SBUX Stock

Intraday Price: $116.15

For every 100 shares of SBUX held, the strategy requires the trader to sell one call option with an expiration date at some time in the future.

Intraday Tuesday, Starbucks stock was trading at $116.15. Therefore, for this post, we'll use this price.

A stock option contract on SBUX (or any other stock) is the option to buy (or sell) 100 shares.

Investors who believe there could be further volatility or profit-taking soon might use a slightly in-the-money (ITM) covered call. A call option is ITM if the market price (here, $116.15) is above the strike price ($115.00).

So the investor would buy (or already own) 100 shares of Starbucks stock at $116.15 and, at the same time, sell an SBUX Feb. 18 115.0-strike call option. This option is currently offered at a price (or premium) of $4.95.

An option buyer would have to pay $4.95 X 100 (or $495) in premium to the option seller. This call option will stop trading on Friday, Feb. 18.

This premium amount belongs to the option writer (seller) no matter what happens in the future, for example, on the day of expiry.

Assuming a trader would now enter this covered call trade at $116.15, at expiration, the maximum return would be $380, i.e., ($495 - ($116.15 - $115.00) X 100), excluding trading commissions and costs.

Risk/Reward Profile For Unmonitored Covered Call

An ITM covered call's maximum profit is equal to the extrinsic value of the short call option.

The intrinsic value would be the tangible value of the option if it were exercised now. Thus, our SBUX call option's intrinsic value is ($116.15 - $115.00) X 100, or $115.

The extrinsic value is the difference between the market price of an option (or the premium) and its intrinsic price. In this case, the extrinsic value would be $380, i.e., ($495 - $115). Extrinsic value is also known as time value.

The trader realizes this gain of $380 as long as the price of Starbucks stock at expiration remains above the call option's strike price (i.e., $115.00).

On expiration day, if the stock closes below the strike price, the option would not get exercised, but would instead expire worthless. Then, the stock owner with the covered call position gets to keep the stock and the money (premium) s/he was paid for selling the option.

At expiration, this trade would break even at a SBUX stock price of $111.20 (i.e., $115.00 - $3.80), excluding trading commissions and costs.

Another way to think of this break-even price is to subtract the call option premium ($4.95) from the underlying SBUX stock price when we initiated the covered call (i.e., $116.15).

On Feb. 18, if SBUX stock closes below $111.20, the trade would start losing money within this covered call setup. Therefore, by selling the covered call, the investor has some protection against a potential loss in the case of a decline in the underlying shares. In theory, a stock's price could drop to $0.

Bottom Line

Starbucks has been a great long-term investment for many retail portfolios. We continue to remain bullish on the stock. However, as the company gets ready to report earnings in a few weeks, shares could come under pressure.

The exact market-timing of when SBUX shares could take a breather is difficult to determine, even for professional traders. But options strategies provide tools that might prepare for sideways moves or even drops in price, especially around the earnings release date.