The last time we wrote about USD/ZAR was in the spring of 2021. The pair was trading around 14.30, down almost 26% from its 2020 top of 19.35. Trends, however, don’t last forever, especially in the Forex market. So instead of joining the bears in anticipation of more weakness, we took a different approach.

After examining the Elliott Wave structure of that decline, we concluded USD/ZAR can surge by at least 15%. This conclusion was based entirely on the chart below, published on Apr. 27, 2021.

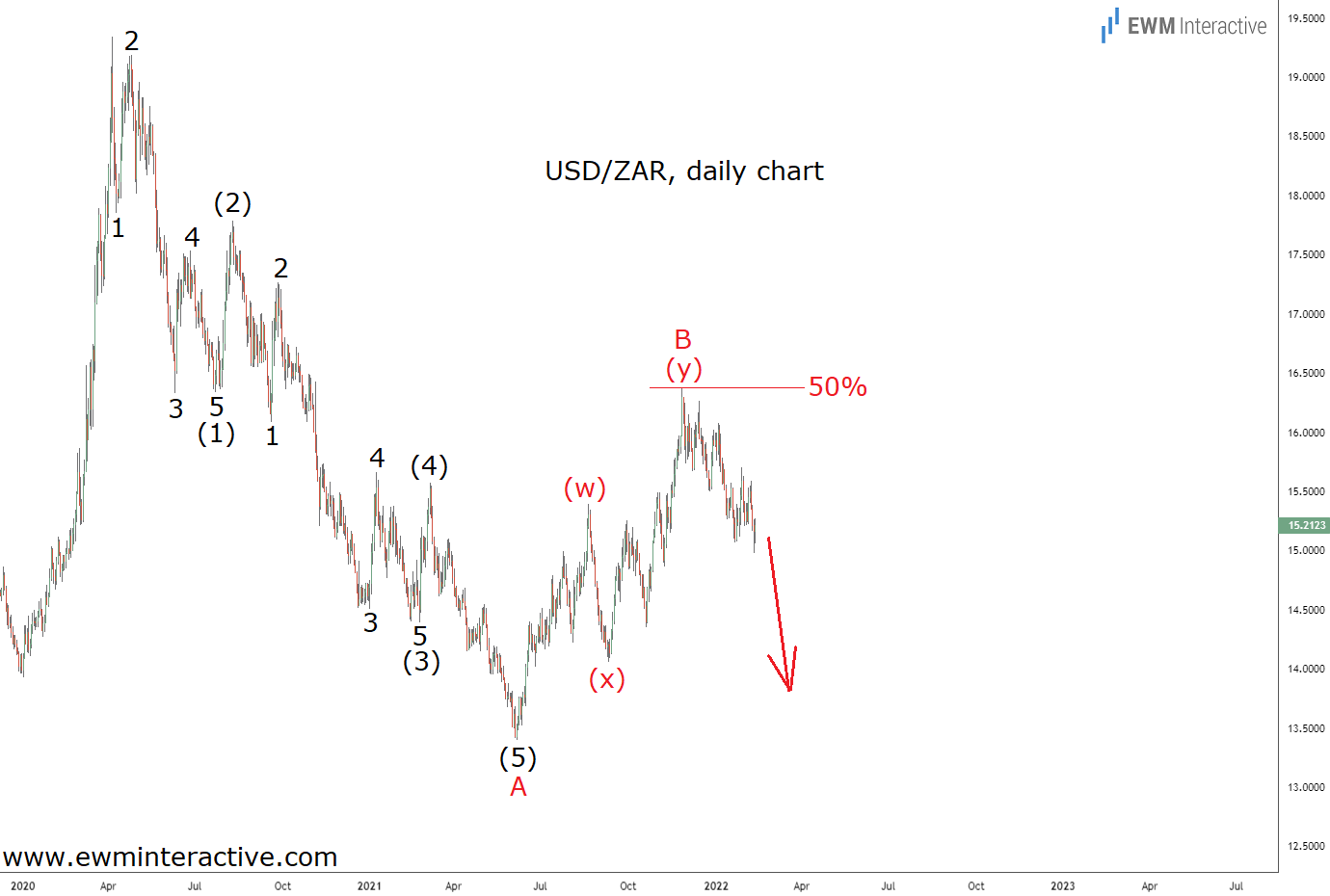

The decline from 19.35 looked like a textbook five-wave impulse. We labeled the pattern (1)-(2)-(3)-(4)-(5), where the five sub-waves of waves (1) and (3) was also visible. The fifth and final wave was still in progress. According to the theory, a three-wave recovery in wave B was supposed to begin as soon as wave (5) ended.

The area between 16.00 and 16.50 looked like a reasonable bullish target. Once there, a bearish reversal for the start of wave C down should be expected. Ten months later now, the updated chart below shows how things went.

Wave A bottomed out at 13.40 in early-June. Wave B started with a swift reversal, which eventually led the pair up to 16.37 in late-November. It is interesting to notice that wave B corrected exactly half of wave A. The following slide to 14.98 last week must be part of wave C.

C-waves usually exceed the end of the corresponding A-wave. In USD/ZAR ‘s case, this makes the levels below 13.40 a plausible target going forward. As long as the pair trades under 16.37, the bears remain in charge.