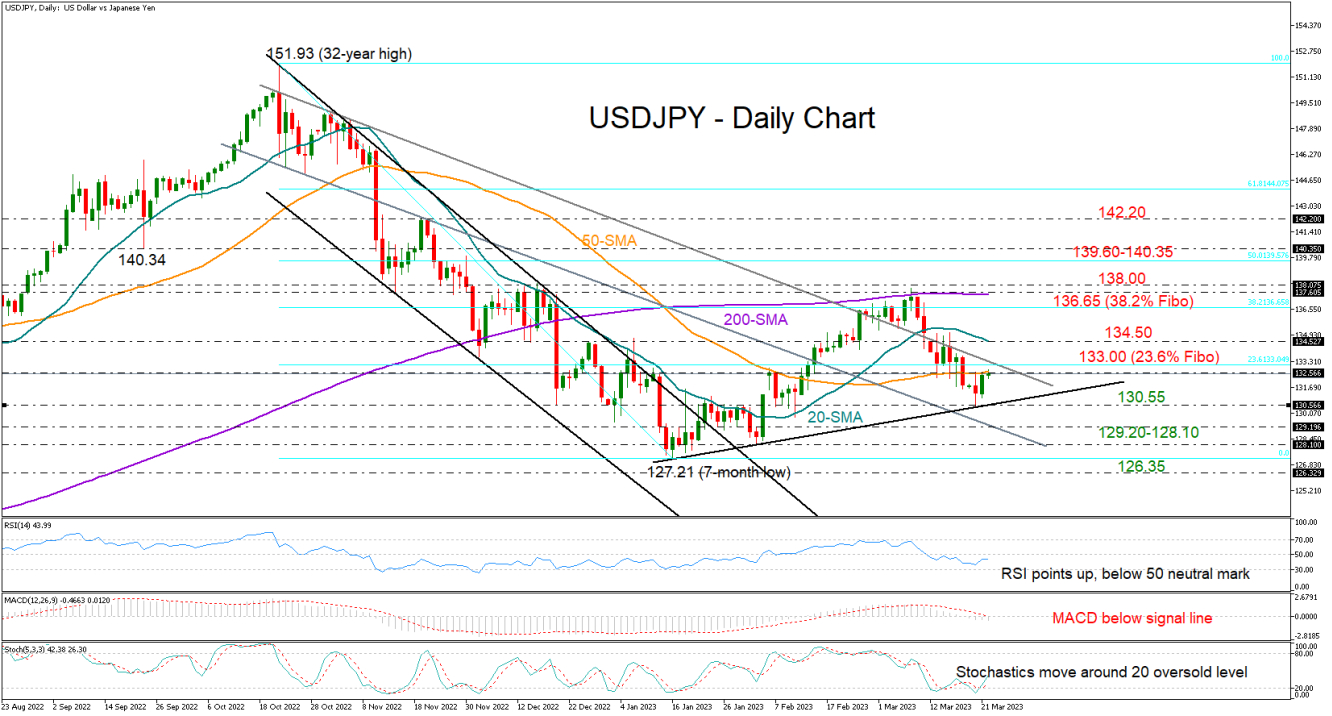

USDJPY turned green ahead of Wednesday’s FOMC policy announcement, pivoting on the tentative support trendline that joins the lows from January and February on Tuesday. Discouragingly though, the pair could not close above Monday’s high of 132.64, unable to form a bullish engulfing candlestick pattern.

The flattening 50-day simple moving average (SMA) is blocking bullish actions around the same area for the third consecutive day, while not far above, the 23.6% Fibonacci retracement of the 151.93-127.21 downleg at 133.00 might keep traders cautious as well. The extension of October’s descending line is adding extra importance to that zone.

Therefore, a break above 133.00 might be a prerequisite for an advance to the 20-day SMA at 134.50. If that proves easy to pierce through, the pair could stage a quick rally towards the crucial 136.65-137.52 territory formed by the 38.2% Fibonacci level and the 200-day SMA. The 138.00 psychological level will come under consideration too, as any step higher would put the 2023 uptrend back into play.

The momentum indicators, however, have not entered the bullish area yet, dampening hopes for a meaningful rebound in the short term. Specifically, the RSI has not crossed above its 50 neutral mark despite reversing higher. Likewise, the MACD remains comfortably below its red signal and zero lines, while the Stochastic oscillator is maintaining a neutral trajectory around its 20 oversold level.

If the 50-day SMA stands firm at 132.55, the price may drift lower to seek support around the ascending trendline at 130.55. Should the bears breach that floor this time, they may initially test the 129.20- 128.10 constraining zone before heading for the 126.35 low taken from May 2022.

In summary, Tuesday’s rebound in USDJPY has not improved market sentiment. The pair will need to overcome the 133.00 level and then violate March’s bearish wave above 134.50 in order to boost buying appetite. Yet only a surge above 138.00 would change the short-term outlook back to bullish.