USD/JPY has taken a pause after sharp losses in the Thursday session. In North American trade, USD/JPY is trading at 111.38, down 0.05% on the day. In the US, PPI and Core PPI both missed their estimates, with declines of 0.01%. On the employment front, unemployment claims jumped to 261 thousand, above the forecast of 246 thousand. Later in the day, Japan releases Bank Lending and Current Lending. On Friday, the US releases key consumer indicators for December, with the release of CPI and retail sales reports.

On Wednesday, the yen soared to its highest level since late November. The Japanese currency has gained 1.6% this week. The catalyst for the rally was a report China that it was considering slowing or halting the purchase of US government bonds. China boasts the largest currency reserves, estimated at $3 trillion. It is also the biggest holder of US government bonds, in the amount of $1.19 trillion. Why would China make this move? One reason is that it may consider US treasuries less attractive compared to other assets. As well, it could be part of China’s strategy to flex some muscle as a possible trade war looms between the US and China, which are the two largest economies in the world. The report has pushed US Treasury yields higher and sent the US dollar downwards.

The yen also benefited this week after the BoJ decided to reduce its bond purchases, raising speculation that the Bank will taper its massive stimulus program. The Bank trimmed its purchase of 10 to 25 year bonds and 25 to 40 bonds by JPY 10 billion yen each, to JPY 190 billion yen and 80 billion respectively. The cuts to the 10-25 year bonds was the first in more than a year. If the BoJ does reduce stimulus, the yen could respond with sharp gains.

USD/JPY Fundamentals

Thursday (January 11)

- 00:00 Japanese Leading Indicators. Estimate 108.7%. Actual 108.6%

- 8:30 US PPI. Estimate 0.2%. Actual -0.1%

- 8:30 US Core PPI. Estimate 0.2%. Actual -0.1%

- 8:30 US Unemployment Claims. Estimate 246K. Actual 261K

- Tentative – IBD/TIPP Economic Optimism. Estimate 52.3

- 10:30 US Natural Gas Storage. Estimate -318B. Actual -359B

- 13:01 US 30-year Bond Auction

- 14:00 US Federal Budget Balance. Estimate -34.5B

- 15:30 US FOMC Member William Dudley Speaks

- 18:50 Japanese Bank Lending. Estimate 2.7%

- 18:50 Japanese Current Lending. Estimate 2.19T

Friday (January 12)

- 8:30 US CPI. Estimate 0.1%

- 8:30 US Core CPI. Estimate 0.2%

- 8:30 US Core Retail Sales. Estimate 0.4%

- 8:30 US Retail Sales. Estimate 0.5%

- 10:00 US Business Inventories. Estimate 0.3%

*All release times are GMT

*Key events are in bold

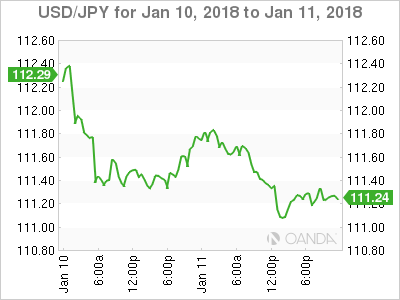

USD/JPY for Thursday, January 11, 2018

USD/JPY January 11 at 11:15 EDT

Open: 111.43 High: 111.88 Low: 111.32 Close: 111.38

USD/JPY Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 108.21 | 109.11 | 110.10 | 111.53 | 112.57 | 113.55 |

USD/JPY posted gains in the Asian session but retracted in European trade. The pair has ticked lower in North American trade.

- 110.10 is providing support

- 111.53 is a weak resistance line.

Current range: 110.10 to 111.53

Further levels in both directions:

- Below: 110.10, 109.11 and 108.21

- Above: 111.53, 112.57, 113.55 and 114.59

OANDA’s Open Positions Ratios

USD/JPY ratio is showing movement towards long positions. Currently, long positions have a majority (59%), indicative of trader bias towards USD/JPY reversing directions and moving higher.