The Japanese yen continues to have an uneventful week. In Wednesday’s North American session, USD/JPY is trading at 109.05, up 0.29% on the day. On the release front, Japanese indicators were mixed. Preliminary Industrial Production jumped 2.7%, well above the estimate of 1.5%. However, Housing Starts came in at -2.1%, marking a sixth straight decline. The markets had predicted a gain of 1.1%. Later in the day, Japan releases Final Manufacturing PMI, with an estimate of 54.4 points. In the US, ADP Nonfarm Payrolls slowed to 234 thousand, but this was much stronger than the estimate of 186 thousand. There was positive news from the housing sector, as Pending Home Sales improved to 0.5%, matching the estimate. Later in the day, the Federal Reserve will release a rate statement, and is expected to hold rates at a range between 1.25% -1.50%. On Thursday, the US releases unemployment claims and the ISM Manufacturing PMI.

The Bank of Japan has continually said that it has no plans to end its massive stimulus program, but may have sent its most direct message (warning?) on Wednesday. The Bank increased its purchases of 3-5 year government bonds (JGB), while at the same time senior members were on the offensive. BoJ Governor Haruhiko Kuroda and Deputy Governor Kikuo Iwata said that the Bank would maintain “powerful” easing as long as inflation was well below of the BoJ target of 2 percent. Iwata stressed that the BoJ had no plans to change its yield target levels “for the time being.” Under current yield curve policy, short-term interest rates are at -0.10% and 10-Year government bonds are at 0.0%. The Japanese economy has heated up, raising speculation that the Bank could taper its stimulus program and even raise interest rates. However, the BoJ appears determined to hold the course until inflation moves higher.

All eyes are on the Federal Reserve, which will issue a rate statement later on Wednesday. This will be the final rate statement under Janet Yellen’s watch. The tone of the rate statement could affect investor sentiment and have an impact on the currency markets. It’s a virtual certainty that the Fed will leaves rates unchanged this time around, although it’s likely that the Fed will raise rates by a quarter-point at the March meeting. Yellen will make way for Jerome Powell, who takes over as chair in early February. Powell is expected to hold the course on monetary policy, which was marked by small, incremental interest rates in order to keep the robust US economy from overheating.

USD/JPY Fundamentals

Tuesday (January 30)

- 18:50 BoJ Summary of Opinions

- 18:50 Japanese Preliminary Industrial Production. Estimate 1.5%. Actual 2.7%

Wednesday (January 31)

- 00:00 Japanese Housing Starts. Estimate +1.1%. Actual -2.1%

- 00:02 Japanese Consumer Confidence. Estimate 44.9. Actual 44.7

- 8:15 US ADP Nonfarm Employment Change. Estimate 186K. Actual 234K

- 8:30 US Employment Cost Index. Estimate 0.5%. Actual 0.6%

- 9:45 US Chicago PMI. Estimate 64.2. Actual 65.7

- 10:00 US Pending Home Sales. Estimate 0.5%. Actual 0.5%

- 10:30 US Crude Oil Inventories. Estimate 0.1M. Actual 6.8M

- 14:00 US FOMC Statement.

- 14:00 US Federal Funds Rate. Estimate <1.50%

- 19:30 Japanese Final Manufacturing PMI. Estimate 54.4

- 22:45 Japanese 10-year Bond Auction

Thursday (February 1)

- 8:30 US Unemployment Claims. Estimate 237K

- 10:00 ISM Manufacturing PMI. Estimate 58.7

*All release times are GMT

*Key events are in bold

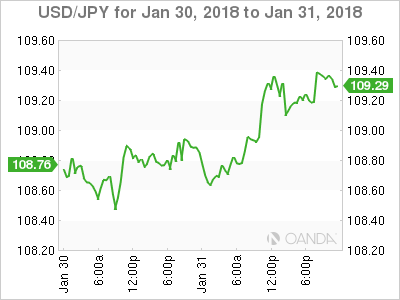

USD/JPY for Wednesday, January 31, 2018

USD/JPY January 31 at 11:00 EDT

Open: 108.78 High: 109.18 Low: 108.60 Close: 109.05

USD/JPY Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 106.14 | 107.29 | 108.21 | 109.11 | 110.10 | 111.53 |

USD/JPY showed little movement in the Asian session. The pair posted small gains in European trade and is flat in the North American session

- 108.21 is providing support

- 109.11 is under pressure in resistance. It could break in the North American session

Current range: 108.21 to 109.11

Further levels in both directions:

- Below: 108.21, 107.29 and 106.14

- Above: 109.11, 110.10, 111.53 and 112.57

OANDA’s Open Positions Ratios

USD/JPY is almost unchanged in the Wednesday session. Currently, long positions have a majority (68%), indicative of trader bias towards USD/JPY continuing to move higher.