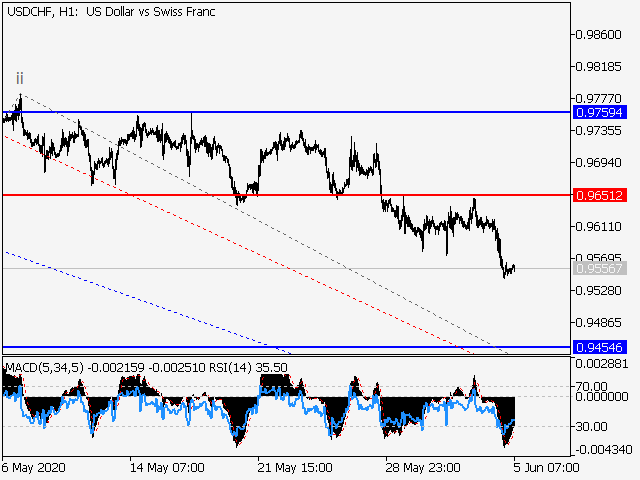

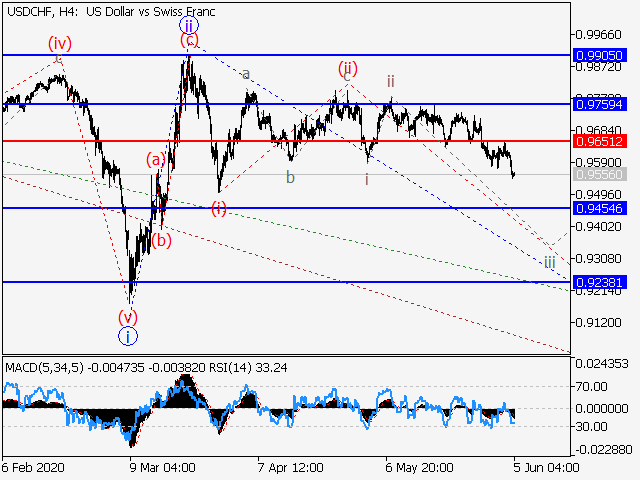

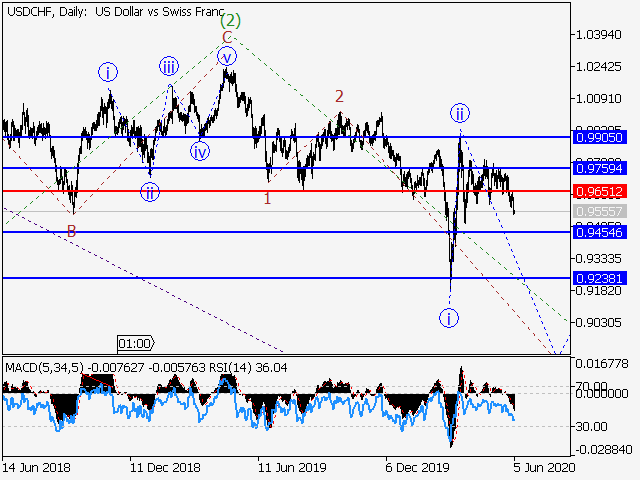

USD/CHF remains likely to fall. Estimated pivot point is at a level of 0.9651.

Main scenario: Consider short positions from corrections below the level of 0.9651 with a target of 0.9454 – 0.9238.

Alternative scenario: Breakout and consolidation above the level of 0.9651 will allow the pair to continue rising to the levels of 0.9759 – 0.9905.

Analysis: Supposedly, the third descending wave of larger degree (3) continues developing on the daily time frame, with wave 3 of (3) forming inside. On the 4-hour time frame, a correction finished developing in the form of wave ii of 3 and wave iii of 3 is forming. Apparently, the third wave of smaller degree (iii) of iii is forming on the H1 time frame, with wave iii of (iii) forming inside. If the presumption is correct, the pair will continue to drop to the levels of 0.9454 – 0.9238. The level of 0.9651 is critical in this scenario. Its breakout will allow the pair to continue rising to the levels 0.9759 – 0.9905.