The Canadian dollar has recorded small losses in the Thursday session. Currently, USD/CAD is trading at 1.2684, down 0.15% on the day. On the release front, Canada releases retail sales reports. The markets are expecting soft numbers, with an estimate of 0.1% for Core Retail Sales and 0.0% for Retail Sales. In the US, unemployment claims is expected to remain unchanged at 230 thousand. On Friday, Canada releases a host of CPI indicators, led by CPI.

The Federal Reserve released the minutes of its January meeting, and as expected, the benchmark rate was left unchanged at a rate between 1.25% and 1.50%. The message from policymakers was that further rate hikes could be in the cards, due to strong economic conditions in the US. In the words of the minutes, policymakers “anticipated that the rate of economic growth in 2018 would exceed their estimates of its sustainable longer-run pace and that labor market conditions would strengthen further”. At the December meeting, the Fed penciled in three rate hikes in 2018, and there was no reference to a quicker pace of hikes in the January minutes. As for inflation, the minutes did not reveal any concern. Most Fed members were of the opinion that inflation would rise towards the Fed target of 2 percent.

The week started on a sour note for Canadian indicators, as Wholesales Sales declined 0.5%, short of the estimate of 0.4%. It marked the first decline in three months. The markets are expecting another soft release from Core Retail Sales, a key barometer of consumer spending. The indicator posted a strong gain of 1.6% in December, but is forecast to slow to just 0.1% in January. If the retail sales reports miss their estimates, the Canadian dollar could lose more ground. The Canadian dollar is under pressure, and has shed 1.0% so far this month.

USD/CAD Fundamentals

Thursday (February 22)

- 00:15 US FOMC Member Randal Quarles Speaks

- 8:30 Canadian Core Retail Sales. Estimate 0.1%

- 8:30 Canadian Retail Sales. Estimate 0.0%

- 8:30 US Unemployment Claims. Estimate 230K

- 10:00 US CB Leading Index. Estimate 0.7%

- 10:00 US FOMC Member William Dudley Speaks

- 10:30 US Natural Gas Storage. Estimate -121B

- 11:00 US Crude Oil Inventories. Estimate 2.2M

- 12:10 US FOMC Member Raphael Bostic Speaks

Friday (February 23)

- 8:30 Canadian CPI. Estimate 0.4%

*All release times are GMT

*Key events are in bold

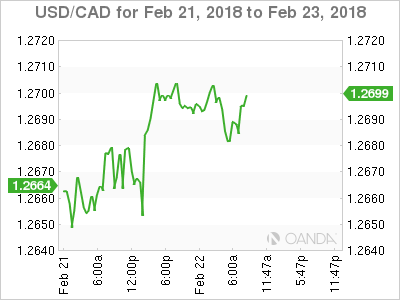

USD/CAD for Thursday, February 22, 2018

USD/CAD, February 22 at 8:00 EST

Open: 1.2703 High: 1.2713 Low: 1.2676 Close: 1.2684

USD/CAD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.2351 | 1.2494 | 1.2630 | 1.2757 | 1.2855 | 1.2920 |

USD/CAD has posted small gains in the Asian and European sessions

- 1.2630 is providing support

- 1.2757 is the next resistance line

- Current range: 1.2630 to 1.2757

Further levels in both directions:

- Below: 1.2630, 1.2494, 1.2351 and 1.2190

- Above: 1.2757, 1.2855 and 1.2920

OANDA’s Open Positions Ratio

USD/CAD ratio is unchanged in the Thursday session. Currently, short positions have a slender majority (52%), indicative of slight trader bias towards USD/CAD reversing directions and moving lower.