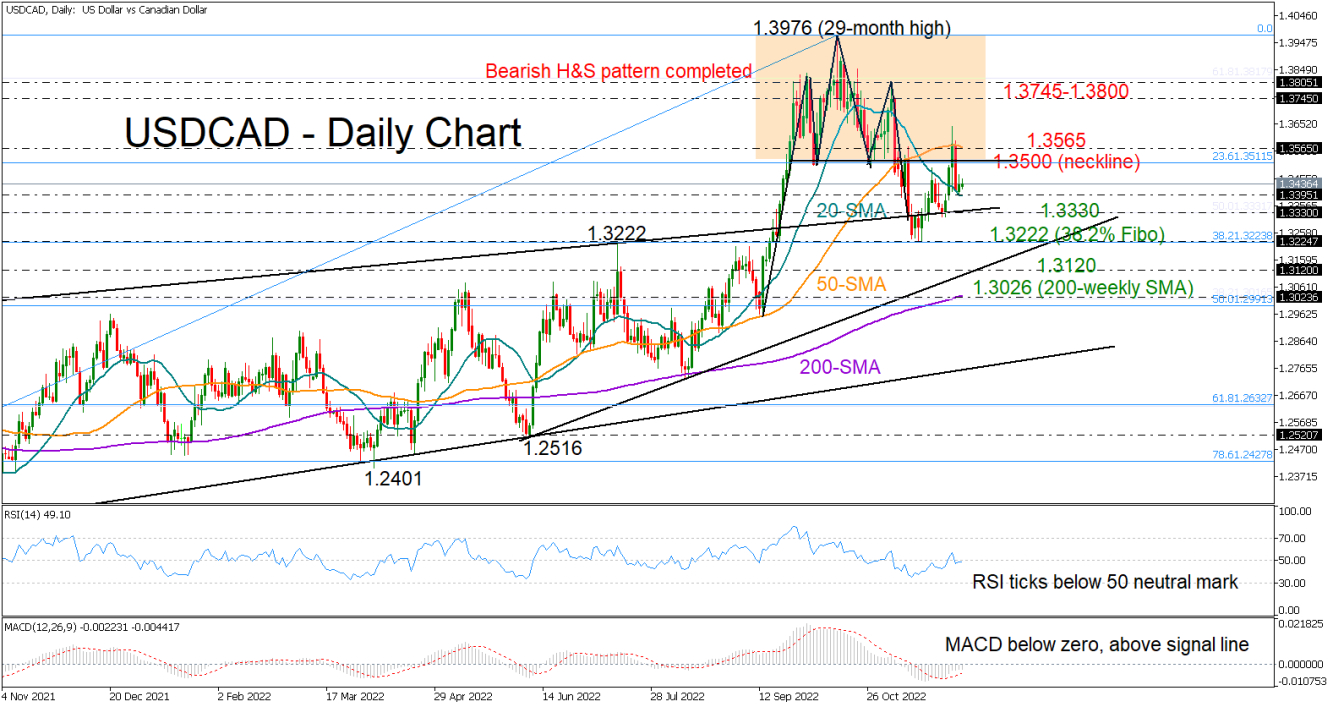

USDCAD had a lukewarm start to December, barely gaining bullish traction despite taking support from the 20-day simple moving average (SMA) at 1.3394.

The pair has completed two consecutive negative months, charting a bearish head and shoulders pattern around the 29-month peak of 1.3976. Even though the bulls attempted to deactivate the bearish structure above the 1.3500 neckline this week, the 50-day simple moving average (SMA) pressed the price aggressively lower, keeping negative trend risks alive.

In momentum indicators, the RSI and the MACD have been trending up since mid-November, but the former has yet to climb successfully above its 50 neutral mark, while the latter hasn’t exited the negative zone.

Nevertheless, there are a couple of support levels that may prevent an outlook deterioration. The upper constraining line from August 2021 might immediately attract attention around 1.3330 if the 20-day SMA at 1.3400 gives way. Then, the 38.2% Fibonacci retracement of the 1.2006-1.3976 at 1.3222 could defend the neutral trajectory in the short-term picture. Should selling forces persist, the tentative ascending trendline could next come to the rescue near 1.3120. Otherwise, the decline may stretch towards the 200-day SMA and the 50% Fibonacci of 1.2990.

On the upside, the 1.3500–1.3565 zone and the 50-day SMA will be closely watched. A sustainable move above the bar could bolster the bullish action up to the 1.3745–1.3800 resistance region. Running higher, the pair will push for new higher highs above the 1.3976 top.

In brief, USDCAD is lacking bullish signals, with traders waiting for a clear break above 1.3500-1.3565 or below 1.3330 to direct the market accordingly.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

USD/CAD Steps on 20-SMA; Bears still Lurk

ByXM Group

AuthorTrading Point

Published 12/02/2022, 07:02 AM

Updated 02/07/2024, 09:30 AM

USD/CAD Steps on 20-SMA; Bears still Lurk

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.