Markets are starting to settle into the traditional “Dog Days of Summer” trade, with major indices, commodities, and currency pairs seeing relatively little movement on the day ahead of today’s highly-anticipated US CPI report.

Traders are still digesting last week’s US jobs report, but one thing is clear: The US labor market is outperforming Canada’s. Whereas the US just saw its strongest job growth in five months, a new cyclical low in its unemployment rate, and has fully recovered all of the job losses since the start of the pandemic, Canada has now seen two consecutive months of outright declines in full-time employment.

Central banks the world over remained hyper-focused on inflation, but an outright contraction in employment, especially against a backdrop of falling commodity prices and a slowing global economy, could certainly prompt some to slow or pause their tightening cycles. This now is the reality that the BOC has to wrestle with, presenting a possible bullish catalyst for the US dollar relative to the loonie.

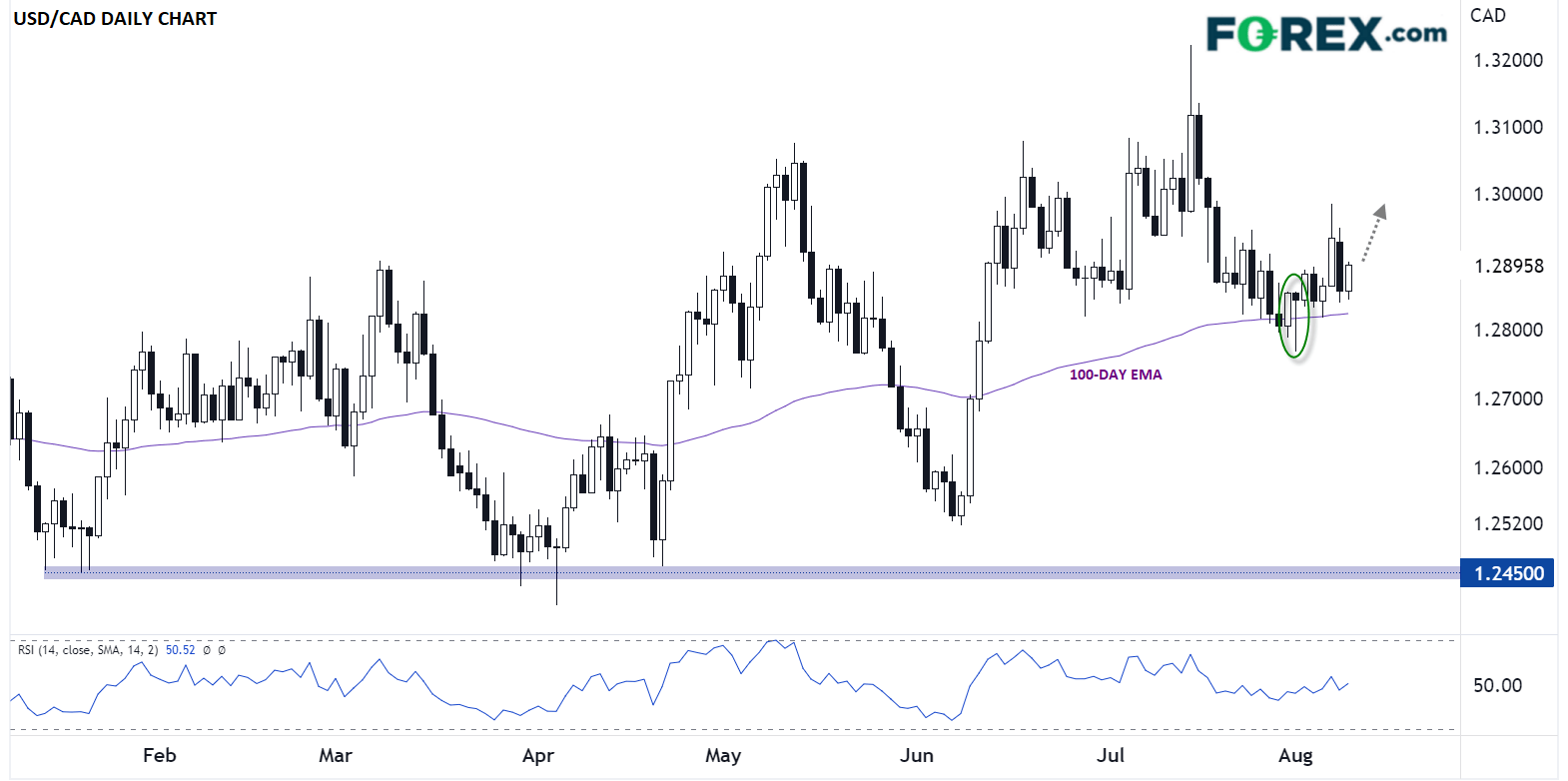

USD/CAD technical analysis

As the chart shows, USD/CAD found support at its rising 100-day EMA at the turn of the month, forming back-to-back bullish candlestick patterns in the process. Now, if traders start to price in an earlier pause for the BOC than the Fed, USD/CAD could rally back toward 1.3000 or 1.3100 in the coming days:

Source: StoneX, TradingView

Meanwhile, a break below last week’s low and the 100-day EMA around 1.2820 could erase the near-term bullish bias and leave the outlook for the North American pair more muddled than ever.