The Canadian dollar has ticked lower in the Thursday session. In the North American session, USD/CAD is trading at 1.3228, down 0.03% on the day. On the release front, Canadian Corporate Profits posted a strong gain of 3.9%, marking a 4-month high. In the U.S, banks and stock markets are closed for Thanksgiving and there no indicators on the schedule. On Friday, Canada releases CPI and retail sales reports.

U..S stock markets fell sharply on Tuesday, dragged down by technological stocks. The Dow Jones and S&P 500 indices both gave up their year-to-date gains. The drop sent the Canadian dollar reeling, as investors avoided risk assets and USD/CAD jumped over 1 percent, pushing above the 1.33 level for the first time since late June. However, stock markets have recovered, as has the Canadian dollar, which posted gains on Wednesday. The sharp drop in the equity markets points to nervousness on the part of investors, as the nagging U.S-China trade dispute has taken a bite out of both economies, and investors are concerned that the conflict will dampen the current economic expansion in the United States and further corrections in global equity markets could mean more headwinds for the wobbly Canadian dollar.

This week’s turmoil in the stock markets has raised questions about the Federal Reserve’s monetary policy. The markets had expected the Fed to raise rates up to four times in 2019, but with more signs that the U.S. economy could slow in 2019, policymakers may ease up on the pace of rate hikes. The Federal Reserve remains on track to gradually raise rates in 2019, but the pace could be slower than anticipated just a few weeks ago. There’s no denying that the U.S economy is currently in great shape, with unemployment at historically low levels and the $1.5 trillion tax cut package boosting economic growth. However, the rosy picture could change next year. The U.S-China trade war is expected to take a bite out of U.S growth, and the stimulus from the tax cut will fade over time. Economic growth has been slowing, with third-quarter growth expected at 2.7%, down from 3.5% in the second quarter. A rate increase in December remains a strong possibility, with the odds of a rate hike standing at 76%.

USD/CAD Fundamentals

Thursday (November 22)

- 8:30 Canadian Corporate Profits. Actual 3.9%

- 9:45 BOC Senior Deputy Governor Wilkins Speaks

- 10:30 BoC Financial System Review

Friday (November 23)

- 8:30 Canadian CPI. Estimate 0.1%

- 8:30 Canadian Core Retail Sales. Estimate 0.3%

- 8:30 Canadian Retail Sales. Estimate 0.1%

*All release times are DST

*Key events are in bold

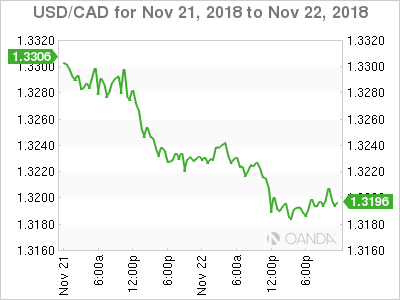

USD/CAD for Thursday, November 22, 2018

USD/CAD, November 22 at 9:10 EST

Open: 1.3332 High: 1.3245 Low: 1.3214 Close: 1.3228

USD/CAD Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.2970 | 1.3099 | 1.3198 | 1.3292 | 1.3383 | 1.3461 |

USD/CAD was flat in the Asian session and has edged lower in European trade

- 1.3198 is providing support

- 1.3292 is under pressure in resistance. This line could break in the North American session

- Current range: 1.3198 to 1.3292

Further levels in both directions:

- Below: 1.3198, 1.3099, 1.2970 and 1.2831

- Above: 1.3292, 1.3383 and 1.3461