The Canadian dollar has ticked lower in the Wednesday session. Currently, the pair is trading at 1.2520, down 0.12%. On the release front, US employment numbers were a mixed bag. The ADP Payrolls report jumped to 250 thousand, crushing the estimate of 191 thousand. However, unemployment claims rose to 250 thousand, higher than the forecast of 241 thousand. In Canada, RMPI jumped 5.5%, compared to 3.8% a month earlier. On Friday, there are key events on both sides of the border, led by US Nonfarm Payrolls, wage growth and Canadian Employment Change. Traders should be prepared for some movement from USD/CAD during Friday’s North American session.

As expected, the Federal Reserve minutes from December were positive in tone. At that meeting, the Fed raised interest rates for a third time in 2017. Policymakers noted in the minutes that economic activity was expanding at a “solid pace”, buoyed by improved consumer and business spending, as well as a stronger global economy. FOMC members revised upwards their projection for GDP in 2018, from 2.1% to 2.5%. The minutes noted that new tax reform is expected to raise economic growth, but the Fed is unsure on the impact of the new law in areas such as the labor market. As for inflation, Fed officials remain concerned that inflation levels are well below the target of 2%, and this trend could continue.

The Canadian dollar started the New Year on a positive note, as USD/CAD briefly broke below the 1.25 line for the first time since mid-October. The currency enjoyed a respectable 2017, posting gains of 6.6% against its US cousin. Will the positive trend continue in January? With the US economy booming, the Federal Reserve raised rates in December, and another move is expected this month. This will put strong pressure on the Bank of Canada to match with a rate hike, or risk seeing the Canadian dollar lose ground as investors move to a more attractive US dollar.

USD/CAD Fundamentals

Thursday (January 4)

- 7:30 US Challenger Job Cuts. Actual -3.6%

- 8:15 US ADP Nonfarm Employment Change. Estimate 191K. Actual 250K

- 8:30 US Unemployment Claims. Estimate 241K. Actual 250K

- 8:30 Canadian RMPI. Estimate 4.0%. Actual 5.5%

- 9:45 US Final Services PMI. Estimate 52.4. Actual 53.7

- 10:30 US Natural Gas Storage. Estimate -221B

- 11:00 US Crude Oil Inventories. Estimate -5.2M

*All release times are GMT

*Key events are in bold

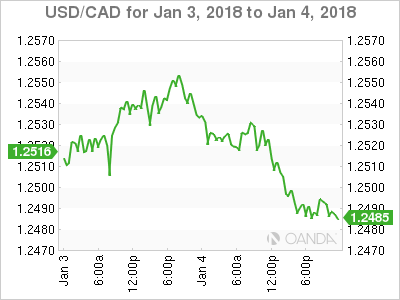

USD/CAD for Thursday, January 4, 2018

USD/CAD, January 4 at 11:40 EDT

Open: 1.2535 High: 1.2556 Low: 1.2508 Close: 1.2520

USD/CAD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.2190 | 1.2351 | 1.2494 | 1.2630 | 1.2757 | 1.2860 |

USD/CAD ticked lower in the Asian session. The pair was steady in European trade and has posted slight losses in the North American session.

- 1.2494 remains a weak support level

- 1.2630 is the next resistance line

- Current range: 1.2494 to 1.2630

Further levels in both directions:

- Below: 1.2494, 1.2351 and 1.2190

- Above: 1.2630, 1.2757, 1.2860 and 1.3015

OANDA’s Open Positions Ratio

USD/CAD ratio is slight movement towards long positions. Currently, long positions have a majority (61%), indicative of trader bias towards USD/CAD reversing directions and moving higher.