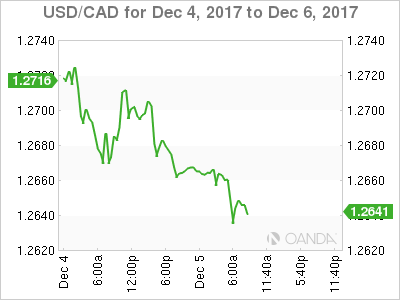

The Canadian dollar continues to move higher on Tuesday, after starting the week with slight gains. Currently, USD/CAD is trading at 1.2644, down 0.24% on the day. On the release front, both Canada and the US release Trade Balance, and the US will also publish ISM Non-Manufacturing PMI. On Wednesday, the Bank of Canada will set the benchmark rate and the US releases ADP Nonfarm Employment Change.

The Bank of Canada is expected to maintain interest rates at 1.00% on Wednesday, but may have to consider another rate hike early in 2018, if Friday’s sparkling numbers Friday continue. Canadian employment change soared to 79.5 thousand, crushing the estimate of 10.2 thousand. This marked 12 straight months of job gains and helped drive the unemployment rate down to 5.9%. As well, September GDP rebounded with a gain of 0.2%, edging above the estimate of 0.1%. The impressive numbers boosted the Canadian dollar by some 1.6% on Friday, its strongest 1-day gain in 2017. If the BoC rate statement sounds optimistic about the Canadian economy, the Canadian dollar could continue to rally.

The US Senate passed a tax reform bill on the weekend, but the vote was a razor thin 51-49. The vote went along party lines, with one Republican voting against the bill. Now that that the House and the Senate have passed tax bills, a conference committee will try and hammer out a uniform bill which can be sent to President Trump and signed into law. There are some differences in the two bills, notably individual tax rates, the alternative minimum tax, mortgage interest deductions and the estate tax. The Senate and House will have to work out their differences quickly, as the new “merged” bill will have to pass through in both houses. If the bill does become law, it will mark the first major tax reform in the US in 30 years, and could boost the US dollar against the euro and other major currencies.

USD/CAD Fundamentals

Tuesday (December 5)

- 8:30 Canadian Trade Balance. Estimate -2.3B

- 8:30 US Trade Balance. Estimate -46.2B

- 9:45 US Final Services PMI. Estimate 55.4

- 10:00 US ISM Non-Manufacturing PMI. Estimate 59.2

- 10:00 US IBD/TIPP Economic Optimism. Estimate 54.6

Wednesday (December 6)

- 8:15 US ADP Nonfarm Employment Change. Estimate 191K

- 8:30 Canadian Labor Productivity

- 10:00 BoC Rate Statement

- 10:00 BoC Overnight Rate. Estimate 1.00%

*All release times are GMT

*Key events are in bold

USD/CAD for Tuesday, December 5, 2017

USD/CAD, December 5 at 7:50 EDT

Open: 1.2674 High: 1.2684 Low: 1.2632 Close: 1.2644

USD/CAD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.2368 | 1.2494 | 1.2630 | 1.2757 | 1.2860 | 1.3015 |

USD/CAD was flat in the Asian session and has edged lower in European trade

- 1.2630 is a weak support line. It could break during the Tuesday session

- 1.2757 is the next resistance line

- Current range: 1.2630 to 1.2757

Further levels in both directions:

- Below: 1.2630, 1,2494, and 1.2368

- Above: 1.2757, 1.2860 and 1.3015

OANDA’s Open Positions Ratio

USD/CAD ratio is almost unchanged in the Tuesday session. Currently, long positions have a majority (58%), indicative of trader bias towards USD/CAD reversing directions and moving lower.