The Canadian dollar ended 2017 with gains, and the positive trend has continued into the New Year. In the Tuesday session, the pair is trading at 1.2537, down 0.33%. On the release front, there are no major events on the schedule. Both Canada and the US will release Manufacturing PMI reports.

At the Federal Reserve December meeting, policymakers raised rates by 25 basis points, to a range between 1.25-1.50%. The Fed will release the minutes of the meeting on Wednesday, and traders should consider the event a market-mover. The December hike marks a vote of confidence in the US economy, and if the minutes are hawkish, the US dollar could reverse directions and gain ground. If the US economy continues to expand at a clip exceeding 3%, the Fed is expected to raise rates up to four times in 2018. Currently, the CME Group (NASDAQ:CME) has priced in a January rate hike at 98.5%. Although inflation remains well below the Fed target of 2.0%, outgoing Fed Chair Janet Yellen and other FOMC members have said that they expect that the strong labor market will lead to higher inflation. Although this is yet to materialize, of significance to the markets is the commitment of the Fed to press ahead with rate hikes, despite low inflation.

The Canadian dollar enjoyed a respectable 2017, posting gains of 6.6% against its US cousin. Will the positive trend continue in January? With the US economy booming, the Federal Reserve raised rates in December, and another move is expected this month. This will put strong pressure on the Bank of Canada to match with a rate hike, or risk seeing the Canadian dollar lose ground as investors move to a more attractive US dollar.

USD/CAD Fundamentals

Tuesday (January 2)

- 9:30 Canadian Manufacturing PMI

- 9:45 US Final Manufacturing PMI. Estimate 55.0

*All release times are GMT

*Key events are in bold

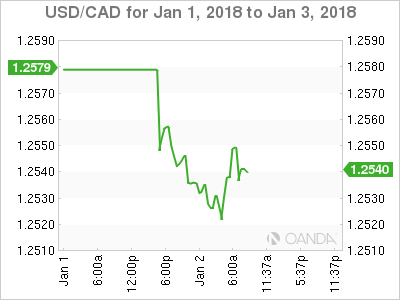

USD/CAD for Tuesday, January 2, 2018

USD/CAD, January 2 at 5:45 EDT

Open: 1.2578 High: 1.2581 Low: 1.2520 Close: 1.2538

USD/CAD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.2190 | 1.2351 | 1.2494 | 1.2630 | 1.2757 | 1.2860 |

USD/CAD posted losses in the Asian session. In European trade, the pair posted small losses but has retracted.

- 1.2494 is providing support

- 1.2630 is the next resistance line

- Current range: 1.2494 to 1.2630

Further levels in both directions:

- Below: 1.2494, 1.2351 and 1.2190

- Above: 1.2630, 1.2757, 1.2860 and 1.3015

OANDA’s Open Positions Ratio

In the Tuesday session, USD/CAD ratio is showing long positions with a majority (58%). This is indicative of trader bias towards USD/CAD reversing directions and moving higher.