The Canadian dollar continues to lose ground this week. On Tuesday, USD/CAD is trading at 1.3014, up 0.28% on the day. On the release front, there are no Canadian events. In the US, the focus is on consumer inflation data. CPI is expected to remain pegged at 0.2% and Core CPI is forecast to stay unchanged 0.1% percent. On Tuesday, the US will release PPI reports and the Federal Reserve is expected to raise interest rates to a range between 1.75% and 2.00%.

The leaders of the US and North Korea met in a historic summit in Singapore on Tuesday. The joint statement put out by leaders was short on details, but President Trump said that President Kim Jong-un had reaffirmed its full commitment to complete denuclearization of North Korea. Although the crucial issue of verification was not addressed, there’s no denying that tensions have significantly eased and that the summit could mark a first step in bringing peace to the Korean peninsula.

Canada could prove to be one of the big losers of the G-7 debacle on the weekend, as the fault lines between President Donald Trump and the other six members were far worse than expected. Trump openly clashed with the other leaders over his recent tariffs against the European Union and Canada and pulled back his endorsement of the traditional post-summit statement put out by the other members. The undiplomatic Trump also tweeted that Canadian Prime Minister Trudeau, who hosted the summit, was “dishonest and weak”. Canada and the EU are furious over recent US tariffs, especially because Trump pushed them through on the basis of ‘national security’. The glaring cracks in G-7 unity could cast a long shadow on trade relations between the U.S and the “G-6”, with business confidence and capital spending at risk if the tariff spat continues. This could spell trouble for the export-reliant Canadian economy. With some 80 percent of Canadian exports going to the United States, Canada can ill-afford a protracted trade war with its giant neighbor.

The Canadian dollar could face some headwinds on Wednesday, as the Federal Reserve holds its monthly policy meeting. The Fed is widely expected to raise the benchmark rate by a quarter-point, with a likelihood of 94%, according to the CME Group). Although the rate increase has been priced in, the Canadian dollar could still lose ground, as the rate hike will make the greenback more attractive to investors.

USD/CAD Fundamentals

Tuesday (June 12)

- 6:00 US NFIB Small Business Index. Estimate 105.2. Actual 107.8

- 8:30 US CPI. Estimate 0.2%

- 8:30 US Core CPI. Estimate 0.1%

- 13:01 US 30-Year Bond Auction

- 14:00 US Federal Budget Balance. Estimate -119.0B

Wednesday (June 13)

- 8:30 US PPI. Estimate 0.3%

- 8:30 US Core PPI. Estimate 0.2%

- 14:00 US FOMC Economic Projections

- 14:00 US FOMC Statement

- 14:00 US Federal Funds Rate. Estimate

- 14:30 US FOMC Press Conference

*Key events are in bold

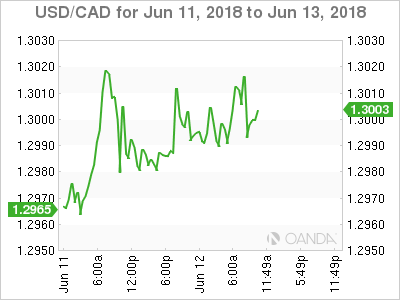

USD/CAD for Tuesday, June 12, 2018

USD/CAD, June 12 at 8:10 DST

Open: 1.2981 High: 1.3017 Low: 1.2978 Close: 1.3014

USD/CAD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.2757 | 1.2850 | 1.2943 | 1.3015 | 1.3125 | 1.3224 |

USD/CAD ticked higher in the Asian session and has posted slight gains in European trade.

- 1.2943 is providing support

- 1.3015 was tested earlier in resistance. It could break in the North American session

- Current range: 1.2943 to 1.3015

Further levels in both directions:

- Below: 1.2943, 1.2850 and 1.2757

- Above: 1.3015, 1.3125, 1.3224 and 1.3315

OANDA’s Open Positions Ratio

USD/CAD ratio is showing little movement in the Tuesday session. Currently, long positions have a majority (63%), indicative of USD/CAD continuing to move higher.