The Canadian dollar continues to have a quiet week. Currently, USD/CAD is trading at 1.2148, up 0.31% on the day. On the release front, there are no Canadian releases on the schedule. Later in the day, the US releases JOLTS Jobs Openings, which is expected to slow to 5.96 million. On Wednesday, the US releases PPI, with an estimate of 0.3%.

With only one Canadian event this week, much of this week’s movement of USD/CAD will be due to readings from US indicators, notably inflation and retail sales data. Will the Canadian dollar resume its rally? The currency has now put together 4 consecutive winning weeks, and was boosted last week by the Bank of Canada, which caught markets by surprise when it raised the benchmark rate 25 basis points to 1.00%, up from 0.75%. Last week, USD/CAD dropped to a low of 1.2060, its lowest level since May 2015. Will the pair fall below the symbolic 1.20 level this week?

With North Korea celebrating its 69th anniversary of independence, there were concerns that Pyongyang would use the occasion to flex some muscle and test a nuclear bomb or missile. North Korea marked last year’s anniversary by exploding its fifth nuclear test. This occasion passed without incident, although the US, along with its allies Japan and South Korea, remain on alert for further provocations from the north. Asian and European stock markets have started the week with solid gains, as investors are displaying a greater appetite for risk. This could translate into gains for risk currencies such as the Canadian dollar.

The US economy has been performing well in the second quarter. Preliminary GDP came in at a sizzling 3.0%, and the labor market remains close to capacity. Still, the Achilles heel of the economy remains stubbornly low inflation levels. Wage pressure has been limited, despite the fact that many businesses cannot fill job openings. Weak inflation has hampered the Fed’s plans to raise interest rates a third time this year, and the odds of a December hike have dipped to just 31%, as the markets are increasingly doubtful that the Fed will make a move before next year. Will the inflation picture improve? We could see better numbers this week for August inflation – PPI is expected to improve to 0.3% on Tuesday, and the same gain is forecast for CPI on Wednesday. Both estimates are higher than the July readings.

USD/CAD Fundamentals

Tuesday (September 12)

- 6:00 US NFIB Small Business Index. Estimate 104.8. Actual 105.3

- 8:15 Canadian Housing Starts. Estimate 216K. Actual

- 10:00 US JOLTS Job Openings. Estimate 5.96M

- 13:01 US 10-y Bond Auction

Upcoming Key Events

Wednesday (September 13)

- 8:30 US PPI. Estimate 0.3%

*All release times are GMT

*Key events are in bold

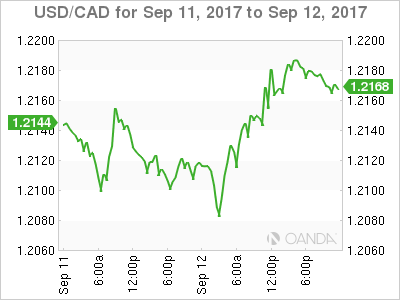

USD/CAD for Tuesday, September 12, 2017

USD/CAD Tuesday, September 12 at 8:55 EDT

Open: 1.2110 High: 1.2153 Low: 1.2082 Close: 1.2146

USD/CAD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.1825 | 1.1949 | 1.2126 | 1.2218 | 1.2302 | 1.2459 |

USD/CAD was flat in the Asian session. In European trade, the pair initially posted small losses but then reversed directions and recorded gains

- 1.2126 remains a fluid line. Currently, it is a weak support level

- 1.2218 is the next resistance line

- Current range: 1.2126 to 1.2218

Further levels in both directions:

- Below: 1.2126, 1.1949, 1.1825, and 1.1673

- Above: 1.2218, 1.2302 and 1.2459

OANDA’s Open Positions Ratio

USD/CAD ratio is showing slight movement towards long positions. Currently, long positions have a strong majority (66%), indicative of trader bias towards USD/CAD continuing to move upwards.