The Canadian dollar has ticked higher in the Wednesday session. Currently, USD/CAD is trading at 1.2744, down 0.27% on the day. On the release front, it’s a busy day, so we could see some movement from the pair during the North American session. The markets are expecting Core Durable Goods to slow to 0.4%, and unemployment claims to drop to 241 thousand. UoM Consumer Sentiment is forecast to soften to 98.2 points. As well, the Federal Reserve releases the minutes of its November policy meeting. On Thursday, Canada releases Core Retail Sales.

Is NAFTA in trouble? A fifth round of talks over the trade agreement failed to lead to significant progress, prompting the US to send an ominous warning to Canada and Mexico. The US wants to raise the North American content of vehicles from 62.5% to 85% and require that 50% of content come from the US. As well, the US wants to put restrictions on Canadian and Mexican agriculture. Unsurprisingly, Mexico and Canada have rejected these proposals. Negotiators are hoping to wrap up a new deal by March 2018, but the US chief negotiator warned that “absent rebalancing, we will not reach a satisfactory result”.

US housing indicators continue to impress the markets. On Monday, it was the turn of Existing Home Sales, which climbed to a 4-month high. On Friday, Building Permits and Housing Starts impressed the markets. Building Permits for single-family homes jumped to 1.30 million, above the estimate of 1.25 million. The annualized pace of 839,000 building permits in October was the fastest since September 2007. Housing Starts also sparkled, accelerating to 1.29 million, compared to an estimate of 1.19 million. The catalyst for the strong numbers were hurricanes Harvey and Irma, which caused massive damage in the southern part of the US. With rebuilding efforts well underway, construction numbers should remain strong in the fourth quarter.

USD/CAD Fundamentals

Wednesday (November 22)

- 8:30 US Core Durable Goods Orders. Estimate 0.4%

- 8:30 US Unemployment Claims. Estimate 241K

- 8:30 US Durable Goods Orders. Estimate 0.4%

- 10:00 US Revised UoM Consumer Sentiment. Estimate 98.2

- 10:00 US Revised UoM Inflation Expectations

- 10:30 US Crude Oil Inventories. Estimate -1.4M

- 12:00 US Natural Gas Storage. Estimate -51B

- 14:00 US FOMC Meeting Minutes

Thursday (November 23)

- 8:30 Canadian Core Retail Sales. Estimate 0.9%

*All release times are GMT

*Key events are in bold

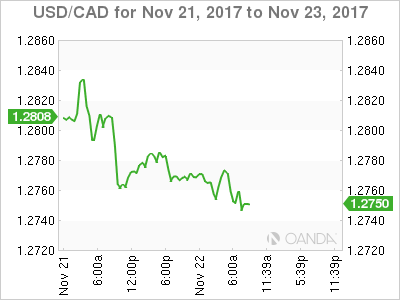

USD/CAD for Wednesday, November 22, 2017

USD/CAD, November 22 at 8:10 EDT

Open: 1.2779 High: 1.2788 Low: 1.2740 Close: 1.2744

USD/CAD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.2432 | 1.2532 | 1.2630 | 1.2757 | 1.2860 | 1.3015 |

USD/CAD ticked lower in the Asian session and has edged lower in European trade

- 12630 is providing support

- 1.2757 is fluid. Currently, it is a weak resistance line

- Current range: 1.2630 to 1.2757

Further levels in both directions:

- Below: 1.2630, 1.2532 and 1.2432

- Above: 1.2757, 1.2860, 1.3015 and 1.3165

OANDA’s Open Positions Ratio

USD/CAD ratio is showing little change in the Wednesday session. Currently, long positions have a majority (57%), indicative of trader bias towards USD/CAD reversing directions and moving higher.