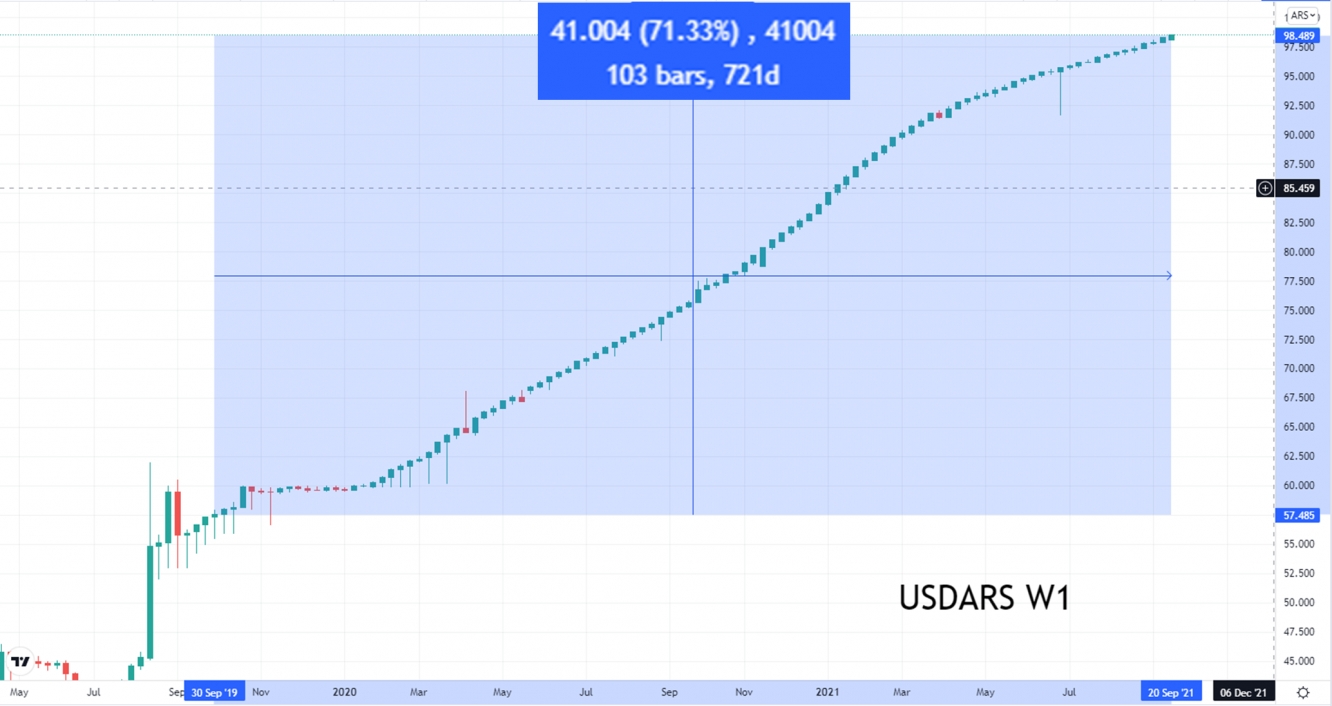

The Argentine Peso has lost 71% of its value against the US Dollar in the past two years. At the end of September 2019, USD/ARS closed at 57.54. As we close in on September 2021, the official exchange rate is now approximately 98.5 Argentine Peso per USD.

Source: Tradingeconomics.com

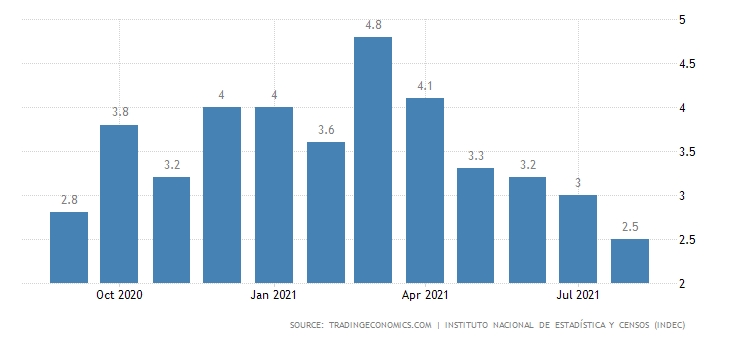

Several factors have contributed to the Peso devaluation. Argentina's inflation rate is no doubt the primary factor. As of August 2021, consumer prices in the country have jumped 51.4% yearly. In comparison, the USD has inflated 51.6% over the past twenty years (representing a 2.11% average annual inflation rate).

Tracking The USD/ARS Weekly Movements

The tight, almost indecisive rise of the weekly candles raises suspicions about the USD/ARS chart. It suggests that maybe unnatural market forces are controlling the ARS's depreciation. It just so happens, the Central Bank of Argentina, The Banco Central de la República Argentina, manipulates the value of the ARS, directly buying and selling Pesos on the open market to help stabilize the national currency.

The Argentinian government also has a hand in protecting the value of the ARS. For instance, it is illegal for exporters to conduct transactions in a currency other than the ARS. Similarly, reminiscent of 1970's style foreign exchange, special permission must be sought to sell pesos for foreign currency by individuals and firms in the country.

What Is The True Value Of The ARS?

To figure this out, we can consider the black market value of the Argentine Peso, the unofficial value that is beyond the control of the Banco Central de la República Argentina. As of September 2021, one USD is traded for ~190 ARS on the black market, representing a true value of ~52% weaker than the official exchange rate. Effectively, the Argentines peso's actual market value is half that of the official rate.

Investigating The June 2021 Anomaly In The USD/ARS

A peculiar anomaly appears in the USD/ARS chart. It stands in stark contrast to the indecisive candles of the many weeks before and after. A better view of this anomaly is seen in the daily charts as this anomaly occurred on one day.

On June 30, 2021, A flash crash in the USD/ARS saw the pair briefly trade at a low of 91.73, equalling a -4% drop from the open price of the USD. However, the pair eventually settled 0.21% higher by the end of the trading day. The Argentine Peso was granted a short spell of good fortune.

The crash in the USD/ARS happened around two pivotal economic events for the ARS. The first is the Argentine government's agreement with the Paris Club to defer $2 billion debt repayment until March 2022. The deferment shored up Argentina to tackle a US $45 billion debt with a more prominent creditor, the IMF.

The second major economic event concerning Argentina is the ending of a self-imposed full-ban on beef exports, which happens to be the country's most significant export. While a partial ban continues, the government relaxed restrictions to China and Israel, close to the time of the crash, to maintain an amicable trade relationship with two of its largest beef buyers.

Disclaimer: BlackBull Markets does not offer the Argentine Peso as a tradable instrument. As indicated in the article, the currency’s ‘official’ exchange rate is controlled by the Banco Central de la República Argentina. Thus, the Argentine Peso is too high a risk of a tradable instrument. A South American currency that BlackBull Markets does offer as a tradable instrument, is the Mexican Peso.