It’s been an interesting start to trading on Tuesday, following a lacklustre session at the start of the week driven largely by the Presidents Day bank holiday in the US.

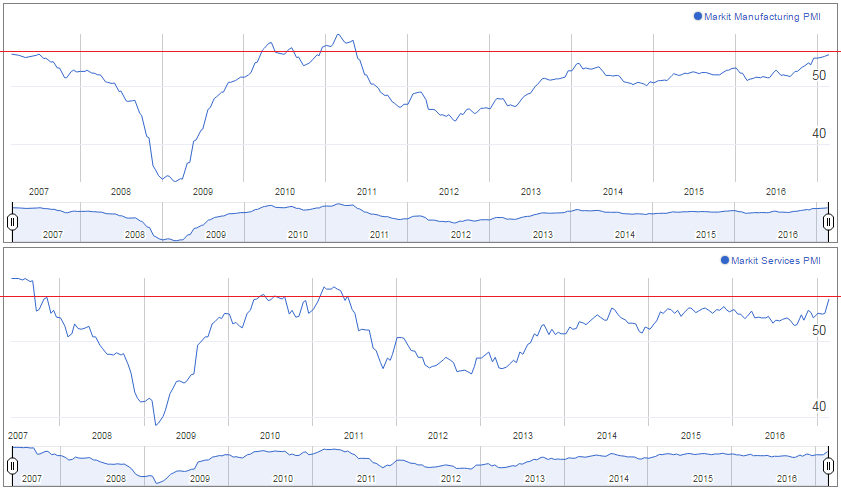

European equity markets have been buoyed this morning by a selection of PMIs for the eurozone, Germany and France which pointed to much stronger growth in the region than was expected, particularly in France which has for a long time been a drag on the region. It would appear that confidence in the euro area economy is finally on the rise and growth could finally pick up from the rather subdued rates we’ve seen in recent years, which is particularly surprising given that we’re entering a period of heightened political uncertainty.

The uptick in the French services sector was both welcome and surprising given that we’re only a few months away from an election in which the current front-runner – albeit only in the first round of voting – wants to withdraw the country from the eurozone and threaten dismantling the project altogether. While sentiment may be eased as we approach the election itself and possibly beyond, it’s certainly encouraging as it would suggest that the foundations may well finally be in place for a stronger recovery in the region should it overcome the political hurdles facing it in 2017, not including Brexit which will likely persist for much longer.

USD/JPY – Yen Dips Despite Strong Japanese Mfg. PMI

Despite the boost from the data this morning, the euro is coming under pressure this morning, particularly against the US dollar which has been given a boost itself by an increase in hawkish commentary from Fed officials which has forced investors to re-evaluate their expectations for the March meeting. Expectations for a rate hike at the meeting remain quite low but they have picked up considerably and recent comments from Patrick Harker who claimed a rate hike in March is not off the table – echoing similar views of other officials including Chair Janet Yellen last week – are driving these moves. We’ll hear from three Fed officials throughout today’s session – including Harker who is due to speak again this afternoon – which may shed further light, particularly on the March meeting. Of the other two officials, Neel Kashkari is also a voter on the FOMC this year while John Williams will be in 2018.

Gold has been surprisingly resilient to the moves in the dollar so far this month despite the usual correlation between the two but it would appear the relationship may have strengthened once again today. Gold failed to break above its 2017 highs in recent days which may be a sign that the trend is weakening and with the dollar now responding positively to the Fed’s position on interest rates, the path of least resistance for the yellow metal may well be lower with a key test below coming around $1,216.40.

Oil on the other hand is rallying again today in spite of the moves in the greenback and looks likely to seriously test the upper end of the trading range that it has been bound by for most of the year so far.

Given its ability to largely shrug off the substantial inventory builds over the last couple of weeks, it perhaps shouldn’t come as a surprise that we’re seeing these upper bounds being tested, particularly coming on the back of reports of high levels of compliance on the production cut which was agreed at the back end of last year.