USD/JPY is showing limited movement at the start of the week. The pair has posted small losses on Monday and is trading at 111.50 in North American trade. In Japan, the BoJ released its Summary of Opinions for the June policy meeting, and SPPI was unchanged at 0.7%, matching the forecast.

In the US, durable goods orders were soft, Core Durable Goods came in at 0.1%, missing the forecast of 0.4%. Durable Goods Orders declined 1.1%, short of the forecast of -0.5%. On Tuesday, we’ll get a look at CB Consumer Confidence and Fed Chair Janet Yellen will speak at an event in London.

The BoJ Summary of Opinions didn’t contain any nuggets with regard to monetary policy, as policymakers said that inflation would likely remain at low levels for an extensive period, which meant that the bank’s ultra-loose accommodative policy would stay in place until a stronger economy pushed up prices. At the same time, the board members acknowledged that it was important for the BoJ to clearly communicate its plans to the markets.

In the immediate present, that meant that the markets should be discouraged from speculating that the bank would withdraw monetary stimulus anytime soon. Japan’s economy has shown improvement, leading to speculation on the part of the markets that the BoJ might taper its policy, but the BoJ has reiterated that this is a non-starter before inflation moves closer to the bank’s target of 2.0%.

US durable goods releases were weak in May. Core Durable Goods broke a streak of two straight declines, but the weak gain of 0.1% missed expectations. Durable Goods declined 1.1%, its sharpest decline since June 2016. The slowdown in orders of business equipment could weigh on second quarter growth. Last week, it was the turn of construction numbers to disappoint, as Housing Starts and Building Permits both missed expectations.

Later in the week, the economy receives a report card, with the release of Final GDP for the first quarter. Preliminary GDP, which was released in May, came in at 1.2%, and this is the forecast for the upcoming GDP report. Consumer spending has also been softer than expected, and this means that Final GDP could miss expectations. If economic growth in the first quarter falls short of this modest estimate, the dollar could respond with losses.

USD/JPY Fundamentals

Sunday (June 25)

- 19:50 BoJ Summary of Opinions

- 19:50 Japanese SPPI. Estimate 0.7%. Actual 0.7%

Monday (June 26)

- 8:30 US Core Durable Goods Orders. Estimate 0.4%. Actual 0.1%

- 8:30 US Durable Goods Orders. Estimate -0.5%. Actual -1.1%

Tuesday (June 27)

- 10:00 US CB Consumer Confidence. Estimate 116.2

- 13:00 US Federal Chair Janet Yellen Speaks

*All release times are GMT

*Key events are in bold

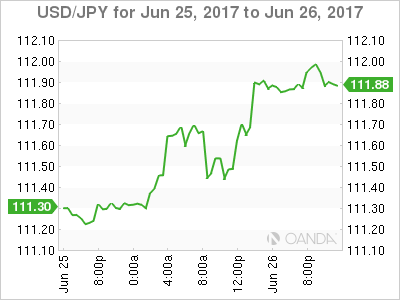

USD/JPY for Monday, June 26, 2017

USD/JPY June 26 at 11:30 EDT

Open: 111.30 High: 111.73 Low: 111.17 Close: 111.44

USD/JPY Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 108.13 | 109.77 | 110.94 | 112.57 | 113.55 | 114.37 |

USD/JPY showed little movement in the Asian session. The pair posted gains in European trade but has retracted in the North American session

- 110.94 is providing support

- 112.57 is the next resistance line

- Current range: 110.94 to 112.57

Further levels in both directions:

- Below: 110.94, 109.77, 108.13 and 106.68

- Above: 112.57, 113.55 and 114.37

OANDA’s Open Positions Ratio

In the Monday session, USD/JPY ratio is showing long positions with a majority (61%). This is indicative of trader bias towards USD/JPY continuing to climb to higher levels.