USD/JPY is subdued on Friday, as the Japanese markets are closed in observance of the Emperor’s Birthday. In the US, the week wraps up with UoM Consumer Sentiment, with the markets expecting a strong improvement to 98.2 points. We’ll also get a look at New Home Sales, which is expected to dip to 575 thousand. There are only a few US releases during the week of Christmas, but it will be business as usual in Japan, highlighted by Household Spending and Tokyo Core CPI.

After an uneventful week, there was plenty of data for the markets to digest on Thursday. US Final GDP for the third quarter posted an excellent gain of 3.5%, above the forecast of 3.3%. Durable goods reports were a mixed bag. Core Durable Goods Orders gained 0.5%, above the forecast of 0.2%. Durable Goods Orders posted a sharp decline of 4.6%, but this was better than the forecast of -4.9%. On the employment front, unemployment claims jumped to 275 thousand, much weaker than the forecast of 255 thousand. Still, the 4-week average of jobless claims remains at very low levels.

It’s full steam ahead for the US economy, which continues to grow at a brisk clip. Final GDP, the last of three GDP reports, was revised upwards to 3.5%, beating the estimate of 3.3%. The previous GDP forecast was 3.2%. The stellar reading can be attributed to stronger consumer spending and an increase in business investment, and marked the strongest growth rate since the third quarter of 2015.

Now that the Federal Reserve has taken the leap and raised rates by a quarter point, what can we expect from the Fed in the coming months? In September, when speculation of a rate hike began to heat up, Fed officials said they expected two rate hikes in 2017. However, with the US economy showing solid growth and the labor market close to capacity, the Fed is now projecting three or even four hikes next year. However, projections can change based on conditions, and the markets will understandably be somewhat skeptical about Fed rate forecasts. As well, the incoming Trump administration could play a critical role in the Fed’s monetary stance. Trump’s economic platform remains sketchy, but there is growing talk about ‘Trumpflation’, with the markets predicting that Trump’s plans to cut taxes and increase fiscal spending will lead to higher inflation. If inflation levels do heat up in early 2017, there will be pressure on the Fed to step in and raise interest rates.

Friday (December 23)

- 10:00 US New Home Sales. Estimate 575K

- 10:00 US Revised UoM Consumer Sentiment. Estimate 98.2

*All release times are GMT

*Key events are in bold

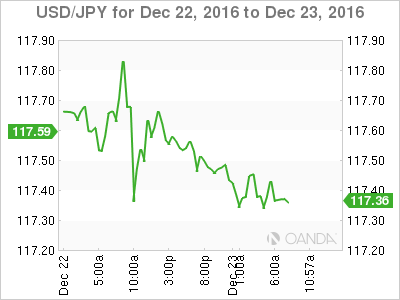

USD/JPY for Thursday, December 23, 2016

USD/JPY December 23 at 5:45 EST

Open: 117.53 High: 117.56 Low: 117.27 Close: 117.40

USD/JPY Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 114.83 | 115.88 | 116.88 | 118.05 | 118.85 | 119.83 |

- USD/JPY has shown limited movement in the Asian and European sessions

- 116.88 is providing support

- 118.05 is the next resistance line

- Current range: 116.88 to 118.05

Further levels in both directions:

- Below: 116.88, 115.88 and 114.83

- Above: 118.05, 118.85, 119.83 and 121.44

OANDA’s Open Positions Ratio

USD/JPY ratio remains unchanged this week. Currently, long positions have a majority (55%). This is indicative of trader bias towards USD/JPY reversing directions and moving higher.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.