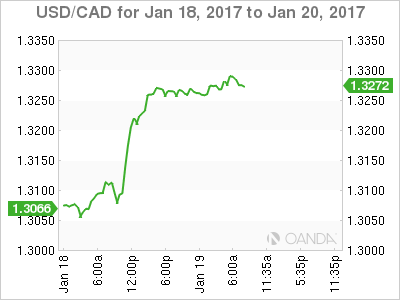

The Canadian dollar is slightly lower in the Thursday session, after strong losses in the Wednesday session. Currently, USD/CAD is trading slightly below the 1.33 line. On the release front, it’s a busy day ahead. Canada will release Manufacturing Sales, while in the US has key events – Building Permits, Philly Fed Manufacturing Index and Unemployment Claims. Friday is Inauguration Day in the US, and the markets will be closely monitoring President-elect Trump’s inaugural address to the nation. On Friday, Canada publishes CPI and Core Retail Sales, both of which should be treated as market-movers.

As expected, the Bank of Canada maintained the benchmark rate at 0.50 percent on Wednesday. However, a pessimistic outlook from the BoC sent the Canadian dollar tumbling 1.5 percent. BoC Governor Stephen Poloz expressed his unease, saying he expected Canada to take a “material” hit from a much more protectionist United States after Donald Trump becomes president.

Poloz added that the bank was closely monitoring its southern neighbor and biggest economic partner, and that a rate cut was on the table. Poloz’s bearish remarks sent the Canadian dollar sharply lower, and the currency has dropped to 2-week lows against the greenback on Thursday. Traders should be prepared for volatility on Friday, with the Trump inauguration speech and Canada releasing key consumer spending and inflation data.

Ahead of Inauguration Day on Friday, there is a feeling of unease in the air. Donald Trump’s upset election victory in November was warmly received by the markets, as the US stock market and the US dollar have climbed higher. However, confidence and hope are starting to give way to confusion and uncertainty, as Trump has failed to outline any specifics on his economic policies, while continuing to tangle with the media and fire off controversial Twitter messages.

Trump’s comments earlier this week about the US dollar helped send the currency lower. In an interview with the Wall Street Journal on Monday, Trump complained that the currency was “too strong”. These sentiments were echoed on Tuesday by Trump advisor Anthony Scaramucci. Speaking at the World Economic Forum in Davos, Scaramucci warned that “we must be careful of a rising dollar.”

Trump broke with the unwritten rule that US presidents refraining from commenting on the US dollar, and his comments could be a taste of more to come, as Trump is unlikely to veer from his habit of making controversial comments that could affect market movement.

BoC Pessimism Sends CAD Sharply Lower

USD/CAD Fundamentals

- 8:30 Canadian Manufacturing Sales. Estimate 0.2%

- 8:30 Canadian Foreign Securities Purchases. Estimate 10.23B

- 8:30 US Building Permits. Estimate 1.22M

- 8:30 US Philly Fed Manufacturing Index. Estimate 16.3

- 8:30 US Unemployment Claims. Estimate 252K

- 8:30 US Housing Starts. Estimate 1.19M

- 10:30 US Natural Gas Storage. Estimate -235B

- 11:00 US Crude Oil Inventories. Estimate 0.1M

- 20:00 US Fed Chair Yellen Speech

Upcoming Key Events

Friday (January 20)

- 8:30 Canadian CPI

- 8:30 Canadian Core Retail Sales

- Tentative – President Trump Speech

*All release times are GMT

*Key events are in bold

USD/CAD for Thursday, January 19, 2017

USD/CAD January 19 at 7:00 EST

Open: 1.3262 High: 1.3296 Low: 1.3252 Close: 1.3282

USD/CAD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.3003 | 1.3120 | 1.3253 | 1.3371 | 1.3457 | 1.3599 |

- USD/CAD broke through two resistance lines on Wednesday. On Thursday, the pair was flat in the Asian session and has posted slight gains in European trade

- 1.3253 is a weak support level

- 1.3371 is the next resistance line

Further levels in both directions:

- Below: 1.3253, 1.3120, 1.3003 and 1.2922

- Above: 1.3371, 1.3457 and 1.3599

- Current range: 1.3253 to 1.3371

OANDA’s Open Positions Ratio

USD/CAD ratio is showing strong gains in short positions, as strong gains by USD/CAD on Wednesday has covered long positions. Currently, long positions have a majority (55%), indicative of trader bias towards USD/CAD continuing to move higher.