Although U.S. dollar is toothless for the past 12 consecutive sessions with 99.32 weekly-fresh-lows, USD/CAD remained bullish today and confined with 31-pips price action. Unlike USD rivals, the loonie failed to take advantage of weaker U.S dollar, tailed by collapsing crude oil levels for the past 2 weeks. The pair clocked 1.3377 high and currently shifting sail course and reversing daily bullish candle to inverse hammer candle supported by rising crude oil levels. The pair is currently trading 1.3354, slightly above its daily Pp 1.3341.

Loonie economic data is colorful today, but the main focus will be on Consumer Price Index (CPI), taking into consideration that inflation currently has reached 2.13%. Today's data could be an indicator for the coming BOC meeting for interest rates.

Fundamentals:

1- CAD - CPI today at 12:30 PM GMT.

2- CAD - CPI common, CPI median, and CPI trimmed y/y today at 12:30 PM GMT.

3- USD - Core Durable goods today at 12:30 PM GMT.

Technical :

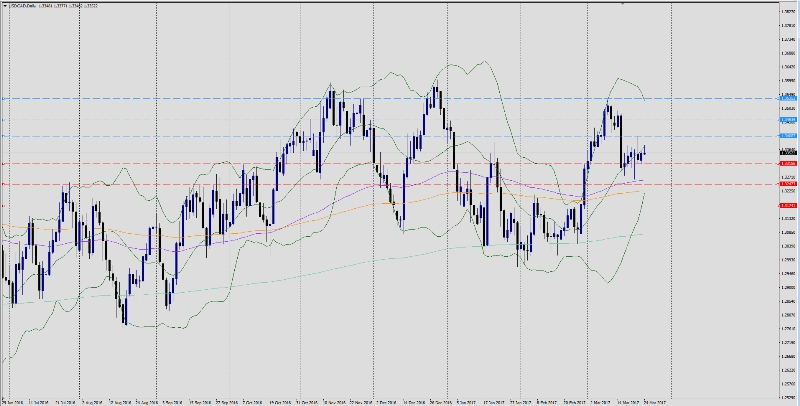

Trend: Bullish sideways

Resistance levels: R1 1.3408, R2 1.3463, R3 1.3535

Support levels: S1 1.3315, S2 1.3247, S3 1.3174

Remark: Keep an eyes on U.S Index levels as its a measurement for USD/CAD performance. Also, Canadian today is vital on the short and long run.