Market Movers today

In terms of economic data releases, it is a quiet day. Most important is Fed Bullard's speech tonight. Bullard is one of the dovish FOMC members but so far he has only hinted he wanted one cut. It is interesting whether he has changed his stance given the latest development in the trade war and markets. Yesterday, Fed governor Brainard said she is 'monitoring developments closely' when asked about US stocks.

In Germany, factory orders for June are due for release at 08:00 CEST. It will be watched to see whether the German manufacturing sector remains under pressure, as indicated by e.g. PMIs.

In Sweden, NIER economic forecasts are due out at 09:15 CEST and industrial orders and production value data for June are due out at 09:30 CEST.

Selected Market News

The weakening of risk appetite continued yesterday and major US indices ended the day lower by 3-3.5%. It is the biggest one-day drop so far in 2019 and the VIX volatility index surged more than 20% to 24.6 - the highest level since the December sell-off last year. The market is increasingly pricing in that the trade war will have long-term consequences. Yesterday, 10Y US break-evens fell to 1.60%, the lowest since 2016. Basically the market is telling the Fed that it is behind the curve and that rate cuts will not be able to push up long-term inflation meaningfully. The lower break-even level and the risk-off sentiment have pushed 10Y US treasury yields down by more than 12bp to 1.72%. 10Y US treasury yields have now dropped more than 30bp in three trading days.

The recent escalation in the trade war pushed USD/CNY above the psychological level of 7.0 on Monday and market participants are increasingly discussing if China is using the currency in the trade war. Trump has little doubt about it when he tweets and overnight the US Treasury officially named China a currency manipulator. The move came outside the normal semi-annual updates. The labelling is primarily symbolic given the new tariffs already in place, but the move is certainly yet another escalation of the trade war and markets reacted negatively to the move.

However, importantly, the People's Bank of China did not let the yuan weaken further overnight and USD/CNY stabilised slightly above 7 this morning. China has been selling yuan-denominated bills and the mid-point for onshore trading was set a stronger level than expected this morning. The stronger yuan level has helped stabilise US equity futures.

Officially, the Chinese central bank says the weakening on Monday reflects market moves in light of the protectionist measures from the US. We argue that China will not pull the currency weapon as it could (1) backfire as capital outflow could accelerate, (2) China wants to be a reliable economic power in the global economy and (3) China will see a significant setback in its intention of moving towards a market-based currency. It does not mean that the CNY cannot weaken further, as we expect. In our view market flows point to a move towards 7.20 in 6M time. For more see this research update .

Scandi Markets

In Sweden private sector production data (a weighted average of manufacturing, services and construction) for June are released today. The May print (2.3% y/y) was the lowest since November last year. Having said that, the numbers are subject to considerable volatility. In any case the new figures (plus possible revisions) could give some hint to the direction of revisions of the relatively modest Q2 GDP released last week (-0.1% q/q / 1.4% y/y).

Fixed Income Markets

US government bonds continue to decline and 10Y yields are now back to the level before Trump was elected president in 2016 on the back of the escalation of the trade war between US and China. Today, the US Treasury is selling some USD38bn of 3Y bonds and given the expectations for rate cuts from the Federal Reserve, we expect to see solid demand.

When we look at the European government bond market it is a more mixed picture, with the core-EU curves steepening from the short end, while the periphery curves flattened from the long end. Italy is underperforming the core and the other peripheral markets on the back of the political noise from Italy, but this is expected to be short-lived.

In the Danish mortgage bond market the prepayments for the October term were a recordhigh DKK185bn. Despite the significant prepayment wave, the low-coupon 30Y Danish mortgages are doing fine and the market has limited issues with absorbing the solid amount of 1% 30Y callables, but pressure is on the high-coupon bonds such as the 2% callables. The big reinvestment need is supporting the 1% 30Y callables and the opening of a 0.5% 30Y callable mortgage bond is putting pressure on the high-coupon callable. However, with the 1% 30yr callables closed for issuance, the issuance will move to the 1% 30Y IO callables, while we wait for the 30Y 0.5% to increase in price.

FX Markets

Poor risk sentiment amid an escalating trade war and poor macro data (read second-quarter GDP) have weighed heavily on the SEK recently, with EUR/SEK up 2.5% since the 25 July trough at 10.49. Next technical resistance is seen at 10.80 and 10.85 (both local highs from May). At the same time RSI has reached stretched levels, which may suggest a pause. Next week’s CPI data may be a positive, albeit temporary, relief for the krona as our forecast is above the Riksbank’s. Today’s production data are very volatile on a monthly basis and should thus be taken with a grain of salt, but may nonetheless have some market impact. More generally, we stick to our bullish medium-term view on EUR/SEK.

We have revised lower our EUR/USD forecast to 1.10 in 1M and 3M and 1.13 in 6M and 1.15 in 12M as we have become less convinced that the Fed will get ahead of the curve in the short term in terms of easing monetary policy and weakening the USD. Furthermore, we expect further JPY strength and now forecast USD/JPY to fall to 105 in 3M – see more in FX Forecast Update, 5 August 2019. In addition, note that we now forecast a move in USD/CNY to 7.20 in 6M and 12M. However, we do not expect China to turn to devaluation as a weapon in the trade war (see FX Strategy USD/CNY breaks 7 but devaluation is not on the cards, 5 August 2019).

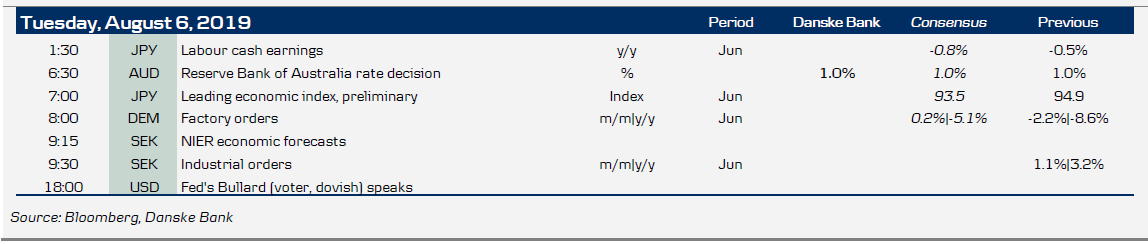

Key Figures And Events