Over the past two years, we have seen inflation soar. And with that has coming rising interest rates.

This week’s CPI and PPI data have only confirmed consumers' fears. But how much of the latest inflation data is baked into current interest rates?

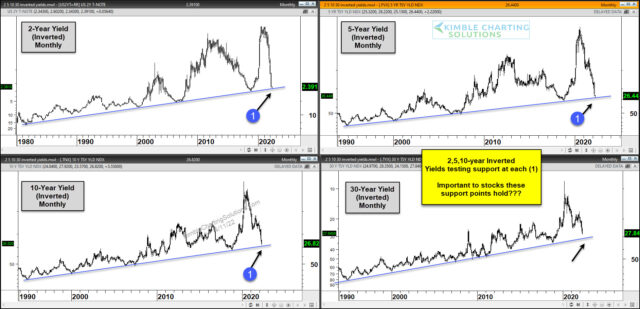

Today, we take a look at a chart 4-pack of the United States 2-Year, 5-year, 10-year and 10-year U.S. treasury bond yields. And as we have done in the past we invert the charts. This flips the script and takes away some or our current bias.

So line (1), which is overhead resistance, is shown here on the “inverted” chart as support. Note that line (1) is a long-term trend line with major implications.

On the “inverted” chart, it is important for stocks, bonds and consumers that these support lines hold. if not, rates could surge higher and signal a trend change. Stay tuned.