In the first part of this research article, we briefly discussed the recent price and global economic events related to the 2018 to 2020 U.S. stock market volatility and the COVID-19 virus event. The premise of this research post was to highlight the current upside parabolic price trend that initiated shortly after the 2015~16 U.S. election cycle event. It is almost impossible to look at the Nasdaq 100 chart below and not see the dramatic upside price advance that took place after the November 2016 U.S. elections.

It is almost as if the U.S. stock markets had been primed by Federal Reserve intervention over the previous 5+ years and someone let the monster out of the cage. The deregulation, changes to tax structures and general perception of market opportunity changed almost immediately after the November 2016 elections and really never looked back.

Bubble Psychology & Process

A close friend of mine suggested the current tax structures provide a very clear advantage for corporations that allows them to retain a minimum of 14% more revenue annually. This is a huge advantage for any profitable U.S. corporation when one considers all aspects of tax laws. Additionally, President Donald Trump changed the system from a “global” to a “territorial” structure. (Source:https://en.wikipedia.org) This provided additional tax reductions for multinational corporations and prompted U.S. companies to stay within the U.S. These new tax laws had a major impact on the bottom line after-tax revenues for thousands of U.S. companies over the past 3+ years.

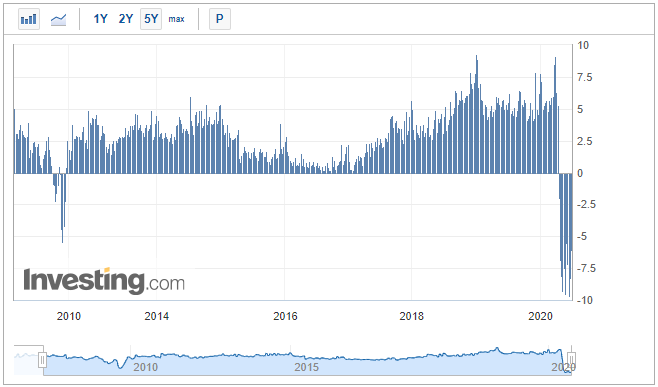

Yet, one has to earn a profit to be able to take advantage of these tax law changes, and the COVID-19 virus event has put a serious dent in the earning capabilities of thousands of the U.S. and foreign companies. The Redbook YoY data, representing Retail and Consumer Merchandise activity, has continued to post negative levels that appear to be far greater than at any time over the past 20+ years.

(Source: https://www.investing.com/economic-calendar/redbook-911 )

How can one rationalize the upward parabolic price trend continuing while the consumer sector, the largest segment of U.S. GDP, has collapsed to levels that are more than double those of the 2008-09 credit crisis?

The only answer in our minds is that a euphoric “bubble” has set up in the minds of speculative and foreign traders. This “bubble psychology” takes place when certain factors have been put into place. Typically, these factors include

– Displacement: when new technology, process, innovation or product/production capabilities disrupt and displace existing technologies. This creates an opportunity for traders and investors to “shift focus” and creates a new, untested, valuation process for the company or asset.

– Credit Creation: when central banks act in a manner to support the credit market, capital investment, and corporate enterprise. This creates the opportunity for new enterprises, businesses, and corporations to “startup” and creates a facility for capital investment from speculators, traders, VCs and investors.

– Euphoria: the feeling that nothing can go wrong. You can invest in almost anything and make money. You could stand on the corner and sell empty cardboard boxes for $400 all day long because something thought they could “flip them” for $800 to the next person that walked by. This euphoria phase is a “self-feeding frenzy” that improperly validates very destructive behavior. In this phase, everyone feels utterly fantastic – until...

Now, you have to start asking yourself a few questions at this point in time. Have we seen any of these phases over the past 10+ years? If so, how far along are we into these phases?

Bitcoin was a displacement component that didn't really start to take off until 2011~2013. After that initial rally, it launched into a euphoric phase with the historic rally to $13,880.

WeWork was another displacement component – promising a high-level remote work environment for the Gig/Millennial workers of the world. It built a foundation, found Softbank (OTC:SFTBY) to back it, rallied to extreme valuations – then what? Hundreds of other displacement companies exist that have yet to deliver any proven profits. Their valuations are incredible and their believers continue to pour more and more capital into them with the expectation that “nothing can go wrong.” All of this reminds me of the Beanie-Baby craze years ago.

What next?

Financial Distress: when traders and investors begin to pull away from the euphoria and begin to revalue their belief in the ability of the displacement company to really engage in huge revenue creation. When more and more traders and investors begin to move in this direction, suddenly we see a change in how people really value assets and future expectations. The displacement company that everyone loved 5 months ago becomes the distressed company that everyone questions.

And this leads to...

– Revulsion: when trust in the markets and valuation levels are completely lost to almost everyone. This is what I like to call the “shock-wave” of the bubble. And this revaluation process leads everyone to run for the exits before the last bobblehead on TV suggests “this is only temporary, buy everything and you'll be really happy in 20+ years – don't worry.”

(Source: https://medium.com/datadriveninvestor/the-psychology-of-financial-bubbles-924f7323b591 )

The Setup

Our research team believes we are very near to the “financial distress” phase of bubble psychology as a result of the COVID-19 virus event and the disruptions to the financial markets in 2018 and 2019. A number of critical “blips” took place over this time that very few people really paid attention to.

– The revised corporate tax laws created a revenue source for all existing corporations that prompted a massive push for capital to be deployed in the U.S. stock market. That 14%+ extra revenue suggested that everyone would see increased bottom line profits if they could make a profit.

– The Case-Schiller U.S. National Home Price Index has risen almost 70 points since 2013 (just over 7 years ago). The only other time in history the Case-Schiller U.S. National Home Price Index has risen that fast was between 2001 and 2007. Consider that for a moment.

– The U.S. Fed burped up an error in August 2018. This error prompted a change in future guidance from the U.S. Fed from a hawkish Fed to a very dovish Fed. Basically, the markets collapsed on Fed comments and the Fed became more accommodating – almost immediately.

– Speculative investments (both foreign and domestic) pushed to higher and higher levels. Homes flipped. Cars flipped. Everything flipped and traders/investors pour billions into the U.S. technology markets and other sectors because “nothing could go wrong.” Even as we knew the world was upended by geopolitical trade issues, foreign credit collapse events, BREXIT and dozens of other issues near the end of 2019, the U.S. stock market rallied to new highs well into February 2020 – even though we knew the Corona Virus was making its way around the world and could be a complete disaster.

Then, the first phase of the financial distress hit – Feb. 24, 2020. That big bad day when the markets suddenly realized “uh oh – this could be bad” and traders/investors throughout the world watched as almost the entire globe “shut down” because of the COVID-19 virus. What does that to the earning capabilities of almost all of the global corporations and businesses? How are they going to be able to sustain revenues to take advantage of those tax breaks when their businesses have collapsed by 40%, 60%, 80% or more? Is everything going to go back to the euphoric party mode or not?

Right now, the Fed has again come to the rescue with more credit and the markets ate it up like cotton-candy covered in gum-drops. Everyone wanted to get back to that euphoric feeling so badly, they jumped into the markets almost as soon as they heard that the U.S. Fed would “intervene” – off we go into parabolic trending.

If you are starting to understand what we are attempting to illustrate for you, then you already know how this article ends. The parabolic price trends we're seeing right now are likely the end stage of a hyper-inflated, credit-fuelled price trend. Yes, they could continue to rally much higher from current levels. Or, it could all suddenly come to a stop as Q2 comes to a close and everyone starts to suddenly realize “uh oh – that's not good.”

We've been warning our client and followers for almost 10+ months that our super-cycle research suggested the end of 2019 and all of 2020 and 2021 were going to be incredibly volatile periods in the markets. We warned that traders needed to start investing in Gold and Silver back in 2017 and 2018 – to hedge against risks. We issued a Black Swan warning on Feb. 21, 2020 – just days before the markets collapsed as a result of the COVID-19 virus. Now, we're warning that this current parabolic upside price trend near the end of Q2:2020 could be a massive setup for one of the biggest “revaluation” events we've seen since 1999~2000 (the last big bubble).

Our researchers believe a shift away from the global financial speculation that has driven a total global asset bubble over the past 8+ years will suddenly shift away from wild speculative euphoria and quickly transition into the realization phase of “uh oh, what have we done.” It is this point that we suddenly enter a financial distress phase where investors flee over-inflated assets to move into risk hedging strategies. Why do you think Gold has rallied to levels near $1800 over the past 4+ years? A certain segment of global investors has already had their “uh oh” moment.

The U.S. stock market has gone parabolic because a very unique set of circumstances have come together at this particular time in history. Now, we have to deal with the current and future phases of this cycle and prepare for what's next. Protect your open long trades and/or take some profits out now.

If our research is correct, we have already entered the Financial Distress phase. Q2: 2020 may be the catalyst event and that is only a few days away.