U.S. Silica Holdings, Inc. (NYSE:SLCA) announced that part of its Industrial and Specialty Products business will hike prices for most of its aggregate diatomaceous earth and clay products, and non-contracted silica sand.

Depending on the grade and product, the price is expected to increase up to 6%. Moreover, whole-grain sand prices used in glass applications are anticipated to increase up to 5%.

Price increases for aggregate diatomaceous earth and clay were effective for shipments starting Nov 1, 2019. Price hike for silica sand is expected to be effective for shipments starting Jan 1, 2020.

The company is hiking prices to support ongoing investments in improving capacity to meet the rising demand for products and offset increasing production costs.

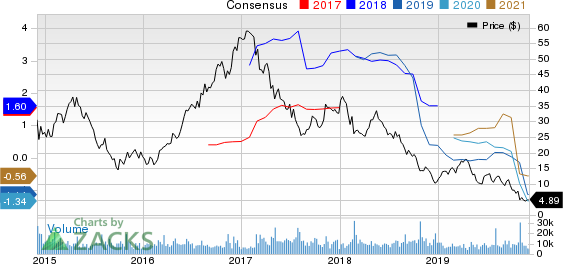

Shares of U.S. Silica have plunged 64.7% in the past year against the industry’s 4.2% growth.

In the third quarter, the company witnessed delays in purchasing decisions by certain customers in the Industrial & Specialty Products unit. Increased uncertainty in global industrial markets — intensified by tariffs, political uncertainty and increasing risk of economic slowdown — makes it tough for U.S. Silica to provide an outlook for the unit.

Per the company, the fourth quarter usually witnesses a seasonal decrease in profitability of roughly 10%.

It expects a slowdown in North America completion activity to unfavorably impact the Oil & Gas unit’s fourth-quarter results. Further, the company expects Oil & Gas sand volume to decline 10% sequentially in the said quarter.

U.S. Silica Holdings, Inc. Price and Consensus

Zacks Rank & Stocks to Consider

U.S. Silica currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are General Moly, Inc (NYSE:GMO) , Franco-Nevada Corporation (TSX:FNV) and Agnico Eagle Mines Limited (NYSE:AEM) , each currently carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

General Moly has an expected earnings growth rate of 12.5% for the current fiscal year. The company’s shares have gained 47.7% in the past year.

Franco-Nevada has a projected earnings growth rate of 46.2% for 2019. The company’s shares have rallied 37.5% in a year.

Agnico Eagle has an estimated earnings growth rate of 168.6% for the current year. Its shares have moved up 67.2% in the past year.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Franco-Nevada Corporation (FNV): Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM): Free Stock Analysis Report

U.S. Silica Holdings, Inc. (SLCA): Free Stock Analysis Report

General Moly, Inc (GMO): Free Stock Analysis Report

Original post