The Fed delivered another 75bps of tightening but attention is turning to the end of this cycle. In Europe, German inflation could light a fire under the front-end but long-end rates seem determined to price the looming recession, with or without the ECB’s help

The peak in market rates is consistent with where the Fed now is in the cycle

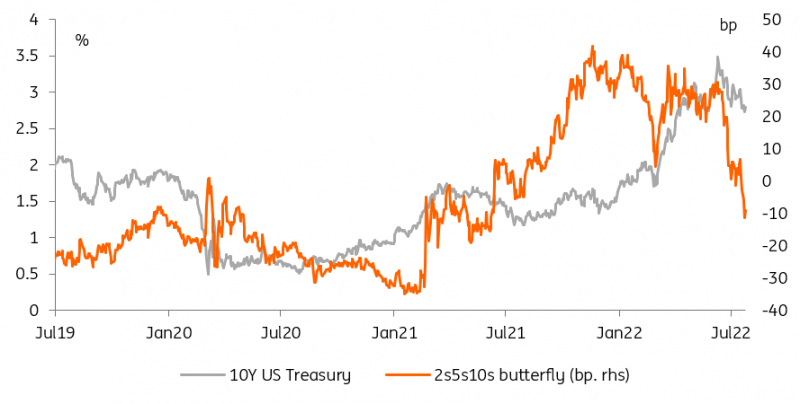

Minimal market reaction to the 75bps hike. If anything inflation breakevens were a tad higher, but not much in it. Nominal rates are seeing little change in terms of impact effect. But the lead up to this has seen market rates fall, calming inflation expectations, pushing towards delivering on what was expected and no more. Meanwhile, the 5-year continues to richen to the curve, strengthening the turning point story for market rates, having set that peak at 3.5% for the 10-year a little over a month ago.

The influential 5yr area is now signalling a turn in the cycle

We think market rates have peaked. Specifically, the 3.5% area reached by the 10-year Treasury yield in mid-June was most likely it. We argue that it’s not about the level per se. It’s about the cycle, and the fact that the influential 5-year area is now signalling a turn in the cycle. Specifically, the 5-year yield is no longer sitting above an interpolation between the 2-year and 10-year (and trading cheap), but is now trading rich.

5-year coming in on the curve confirms that rates are looking to the end of this cycle

Source: Refinitiv, ING

This second 75bps hike from the Federal Reserve solidifies this, as it will further tame inflation expectations, which have really come down markedly in the past month or so. The recent 9.1% inflation print is noteworthy, but not pivotal. Inflation expectations matter more. The 2-year inflation breakeven (which incorporates the latest inflation) is now down to the 3% area, having been at 4.5% in mid-June (and 5% in March).

"Inflation expectations have really come down markedly"

In addition, post this FOMC the Fed has completed two-thirds of what we think it will deliver in total. Typically from there, the turning point is upon us. The US yield curve is under flattening pressure now as the Fed continues to hike. As the hikes begin to slow (which we see by the autumn), the next big move will be a steepening from the front end, as the curve begins to get ready for potential cuts at some point in 2023.

German inflation to spur ECB hawks

Inflation takes centre stage once again in European markets with Germany kicking off the July CPI releases followed by other member states, and the eurozone-wide measure. The ECB has barely started its hiking cycle and has just done away with years of negative interest rates policy (NIRP). We suspect the inflation peak in this cycle is ahead, rather than behind us, which in turn piles pressure on the ECB to keep up its hawkish rhetoric.

"Central banks have lost control of the back end of the curve"

Whether markets listen is another question altogether. It is possible that another upside inflation surprise lights a fire under the front-end, or at least prevents if from pricing out further hikes after the already sizeable drop these past two months. However, we are increasingly of the view that central banks have lost control of the back end of the curve, as recession fears boil over. This means that a more hawkish tone at the ECB could well be greeted by lower yields, as the ECB is seen as hiking into a recession.

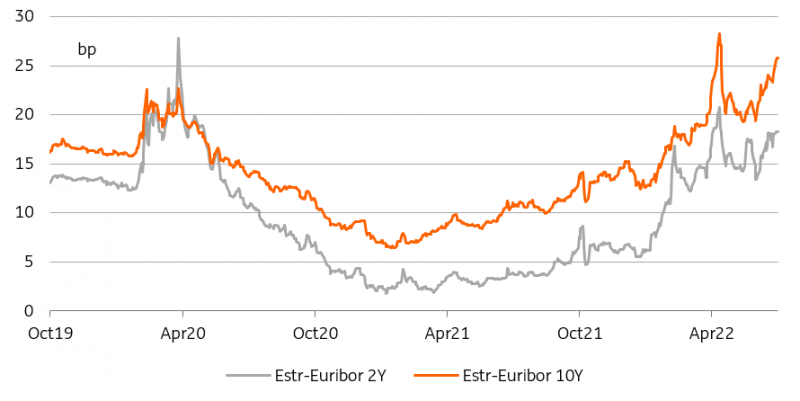

The recession is already tightening financial conditions for the ECB

Source: Refinitiv, ING

Some of the tightening of financial conditions the ECB is trying to deliver with its hikes is also happening with markets bracing for a recession. There are many indicators that illustrate this point. The widening of credit CDS indices is one, another is the widening of the Euribor-Estr basis. In both cases, they show that tighter financing conditions are feeding through to various corners of the economy and of markets, thus reducing pressure on the ECB to hike aggressively.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more