The U.S. second revised GDP estimates showed that the economy advanced 3.5% in the third quarter of the year. This marked an unchanged print from the first estimates.

New sales report disappointed as with most other housing market data. New home sales rose 544k during the month missing estimates of a 583k increase. Revisions to previous month’s data showed new home sales being revised higher to 597k.

The Fed Chair, Jerome Powell gave his much anticipated speech yesterday. Powell said that the Fed funds rates were nearing the neutral level. This sent the U.S. stock markets higher.

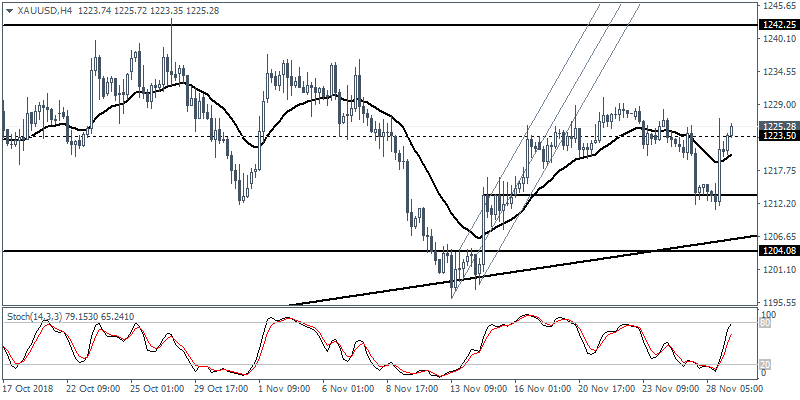

Commodities also gained as gold prices jumped on his comments. The U.S. dollar index closed 0.55% lower on the day.

Powell’s comments come after earlier in the day, President Trump expressed his displeasure at the Fed’s rate hike plans once again.

The Bank of England Governor Mark Carney also gave his views on Brexit, which was overshadowed by Fed Powell's comments. Carney cautioned that in the event of a disorderly Brexit, inflationary pressures will need to be contained. The BoE would therefore act by hiking interest rates.

Carney's comments come as the UK leaders will decide in early December on the draft Brexit deal that was approved by the EU leaders last week. The GBP rallied somewhat, largely due to a weaker greenback.

A somewhat busy day today, Switzerland will be releasing its quarterly GDP numbers. Economists forecast that GDP advanced 0.4% in the third quarter, a somewhat slower pace of increase compared to the 0.7% increase previously.

This is followed by the German preliminary inflation report for November. Consumer prices likely advanced by 0.2% on the month, marking the same pace of increase as the month before.

The ECB President Mario Draghi is due to speak later in the day followed by the ECB releasing the financial stability report.

The NY trading session will see the core PCE data coming out. Core PCE price index is expected to rise by 0.2% on the month. This follows personal spending and income which are expected to rise 0.4% respectively.

Pending home sales data will be another data point this week on the housing markets. Pending home sales are forecast to rise by 0.8% on the month accelerating from a 0.5% increase previously.

The evening is capped off with the release of the Fed's monetary policy meeting minutes.

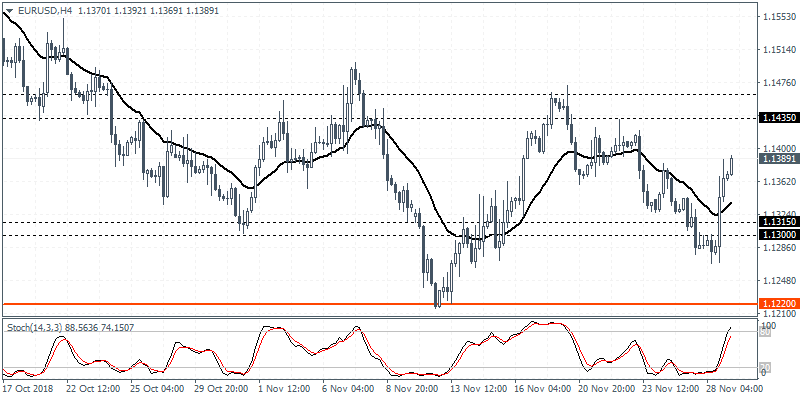

EUR/USD intraday analysis

EUR/USD (1.1389): The EUR/USD currency pair posted a strong bullish engulfing candlestick pattern yesterday. Price action is likely to test the 1.1400 level in the near term. A breakout above this level is required for the EUR/USD to post further gains. This comes as the currency pair is seen posting a near inverse head and shoulders pattern. If the neckline resistance at 1.1462 - 1.1435 is breached, then the minimum upside target is seen at 1.1620.

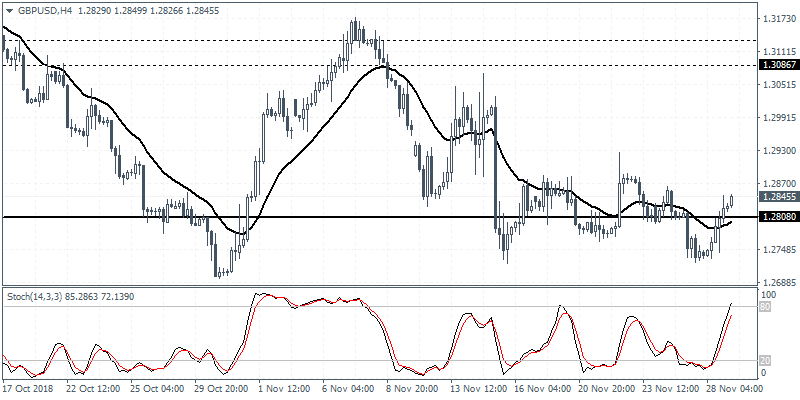

GBP/USD intraday analysis

GBP/USD (1.2845): The British pound was seen briefly slipped below the 1.2808 level but price action reversed the losses. GBP/USD was seen clearing the 1.2808 level and is likely to see some upside momentum in the near term. The consolidation however is expected to be maintained. We expect another modest decline back to the 1.2808 - 1.2806 level where support could once again be established. Following a reversal at this level, the GBP/USD will be seen aiming for 1.2940 followed by a likely retest of the resistance level at 1.3086.

XAU/USD intraday analysis

XAU/USD (1225.28): Gold prices posted a strong rebound off the 1213.50 level of support. The strong rally initially met the resistance level at 1223.50 only to post a dip before breaking past this resistance level. In the near term, gold prices could maintain the momentum targeting 1242.25. To the downside, the bias is likely to change if gold posts a reversal and eases back to the 1223.50 level and then back to the 1213.50 support.