U.S. manufacturing sector has been witnessing resurgence under the Trump administration since 2017, shrugging off its lengthy spell of weak productivity and sluggish growth. The manufacturing sector has continued to gain traction in January 2019, after a successful 2018.

Manufacturers have increased capital spending and hiring driven by massive tax overhaul, deregulatory measures and strong domestic economy. Notably, manufacturing sector constitutes nearly 12% of the U.S. GDP. Consequently, investment in manufacturing stocks with a favorable Zacks Rank and strong growth potential will be a prudent decision.

U.S. Manufacturing Remains Strong

On Feb 1, the Institute for Supply Management (“ISM”) reported that the U.S. manufacturing expanded in January for the 117th consecutive month. The January index came in at 56.6 compared with 54.3 in December 2018 and also surpassed the consensus estimate of 54.3. Out of a total of 18 manufacturing industries, 14 reported growth in January.

New orders index came in at 58.2, significantly higher than 51.3 registered in December. This marks the index’s expansion for the 37th successive month. Notably, any reading above 50 indicates expansion of the manufacturing sector and a reading above 55 highlights robust manufacturing growth.

Solid Hiring in Manufacturing Sector

According to the Department of Labor, the manufacturing sector generated 284,000 jobs in 2018, highest since 1997. This sector generated 207,000 jobs in 2017. On Feb 1, the Department of Labor reported that the manufacturing sector continued to gain traction with 13,000 new jobs in January.

Consequently, job creations by this sector in the past one year (January 2018 to January 2019) stood at 261,000, of which durable goods industries, producing industrial intermediaries, generated more than 80% of job additions.

In its latest outlook survey in October 2018, the National Association of Manufacturers reported that about 500,000 manufacturing jobs are available in the United States. On November 2018, a study by the Manufacturing Institute and Deloitte had projected that by the end of 2028, the U.S. manufacturing sector will witness shortages of around 2.4 million skilled workers.

Positive Developments on Trade War Front

On Jan 31, President Donald Trump told reporters that he is hopeful of forging a deal with China before the March deadline. Notably, the two countries are currently observing a trade truce which will come to end on Mar 1. Moreover, CNBC reported that officials of the two countries are trying for a meeting between President Trump and his Chinese counterpart Xi Jinping in late February.

This will be the second meeting between the two leaders in less than three months. Any positive development on the United States – China trade war front will be highly beneficial for this sector.

Our Picks

At this stage, investing in manufacturing stocks with strong growth potential will be lucrative. However, picking winning stocks may be difficult.

This is where our VGM Score comes in handy. Here V stands for Value, G for Growth and M for Momentum and the score is a weighted combination of these three scores. Such a score allows you to eliminate the negative aspects of stocks and select winners. However, it is important to keep in mind that each Style Score will carry a different weight while arriving at a VGM Score.

We have narrowed our search on five such stocks each carrying a Zacks Rank #2 (Buy) and VGM Score of either A or B. You can see the complete list of today’s Zacks #1 Rank (strong Buy) stocks here.

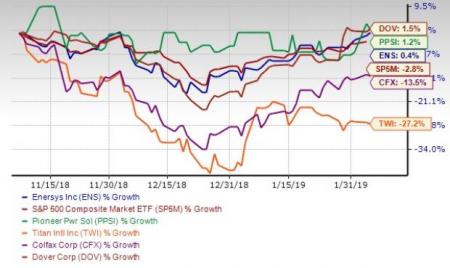

The chart below shows price performance of our five picks in the last three months.

Pioneer Power Solutions Inc. (NASDAQ:PPSI) is a specialty manufacturer of electrical transmission and distribution equipment. It has a VGM Score of A. The company has expected earnings growth of 54.3% for current year.

Titan International Inc. (NYSE:TWI) is a leading global manufacturer of off-highway wheels, tires, assemblies, and undercarriage products. It has a VGM Score of B. The company has expected earnings growth of 130% for current year.

Colfax Corp. (NYSE:CFX) is a global provider of fluid handling products, including pumps, fluid handling systems and specialty valves. It has a VGM Score of B. The company has expected earnings growth of 14.9% for current year.

Dover Corp. (NYSE:DOV) provides equipment and components, specialty systems, consumable supplies, software and digital solutions, and support services worldwide. It has a VGM Score of B. The company has expected earnings growth of 15.7% for current year.

EnerSys (NYSE:ENS) is the global leader in stored energy solutions for industrial applications. It has a VGM Score of B. The company has expected earnings growth of 26.5% for current year.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Pioneer Power Solutions, Inc. (PPSI): Free Stock Analysis Report

Titan International, Inc. (TWI): Free Stock Analysis Report

Dover Corporation (DOV): Free Stock Analysis Report

Colfax Corporation (CFX): Get Free Report

Enersys (ENS): Get Free Report

Original post

Zacks Investment Research