- Nerves kick in as debt ceiling talks drag on, uncertainty builds ahead of US CPI

- Dollar pares some gains, euro bounces off lows but lacks momentum

- Wall Street slides as bank stocks remain under pressure, default risks rise

Caution sets in before inflation data

Markets continued to struggle for direction on Wednesday amid some anxiety ahead of the April inflation report out of the United States later in the day and an ongoing stalemate in Congress over raising the debt ceiling. With the Fed clearly signalling that it remains in data-dependent mode, a pause in June hangs in the balance and today’s CPI figures could be what tips the odds in either direction.

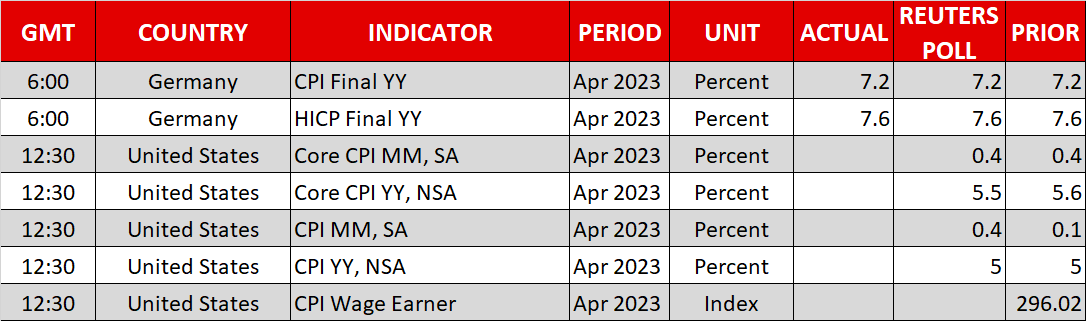

The consumer price index is expected to have risen by 5.0% over the year to April, which would signal a stall in the progress to bring inflation down following an uninterrupted decline from the peak of 9.1% in June 2022. However, there may be some good news from the core CPI front, as it is projected to have dipped slightly to 5.5%.

If the latest PMI surveys and the Cleveland Fed’s Nowcast inflation tracker are to be believed, the risks are tilted towards an upside surprise.

After Friday’s robust NFP numbers, a hot CPI reading would cast further doubt on market bets that the Fed will begin cutting rates in the second half of the year. It is those bets that have been propping up shares on Wall Street during what has been an uninspiring earnings season, while the US dollar has been hammered against currencies like the euro and pound due to the divergence in the monetary policies.

Debt ceiling drama rumbles on

Another source of concern lately is the growing risk of a US debt default as Democrats and Republicans remain far apart on reaching a deal to raise the debt ceiling. The White House is trying to up the pressure by warning that the government could run out of cash as early as June 1, but Republicans are not giving any ground in the negotiations.

House speaker and Republican majority leader Kevin McCarthy told reporters he “didn’t see any new movement” after his meeting with President Biden yesterday. But Congressional leaders are due to meet again on Friday and this is providing some relief for traders.

Disney earnings eyed amid banking gloom

US stock futures started Wednesday in the red, extending yesterday’s losses. Bank stocks staged a modest but unconvincing rebound on Tuesday after coming under renewed pressure on Monday. The Fed’s latest loan officer survey did not point to anything too alarming in credit conditions in the aftermath of the banking turmoil and profitability in the sector hit an all-time high in the first quarter.

Nevertheless, confidence in smaller regional banks remains very low amid worries that there are more failures to come.

Disappointing earnings forecasts from PayPal (NASDAQ:PYPL) and Skyworks (NASDAQ:SWKS) also weighed on the broader market on Tuesday, while Disney will come under the spotlight today when it announces its results.

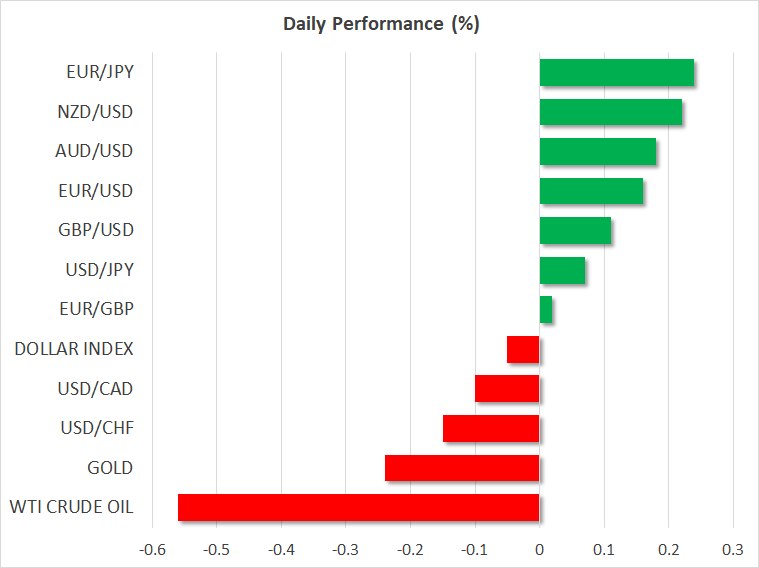

Dollar flat as euro lags and sterling climbs ahead of BoE

In currencies, the US dollar was more or less flat against a basket of currencies, with the euro slipping marginally and the pound crawling higher.

The euro has been underperforming over the past week following a batch of poor data out of the Eurozone’s powerhouse, Germany. The sudden deterioration of the German economy has prompted investors to scale back their rate hike expectations for the European Central Bank even though policymakers have not toned down their hawkish rhetoric.

The pound, meanwhile, has been benefiting from better-than-expected economic indicators as well as bets that the Bank of England will raise rates several more times this year, of which the next is anticipated to be announced tomorrow.