S&P 500 turns positive for 2018

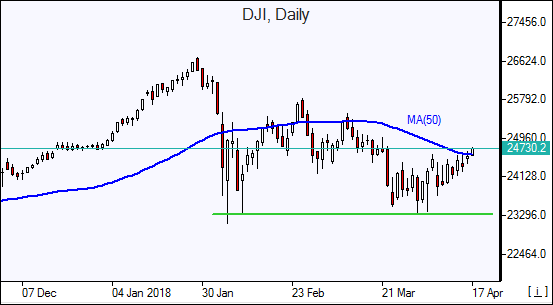

US equities ended higher Monday as positive earnings reports buoyed market sentiment. The S&P 500 gained 1% to 2682, turning positive for the year. The Dow Jones industrial rose 1% to 24603. The NASDAQ Composite index added 0.8% to 7166. The dollar weakening accelerated: live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.4% to 89.40. Stock indices futures point to higher openings today.

Earnings reports are in focus with global markets on edge after US and allies airstrike in Syria over weekend. Improved quarterly performance is anticipated with earnings for companies in the S&P 500 expected to grow 17.3% in the first quarter as sales grow 10%, according to FactSet. In US-China trade front the US blocked Chinese telecommunications-gear maker ZTE Corp. from exporting sensitive technology from America and is examining ways to retaliate against Beijing’s restrictions on US providers of cloud computing and other high-tech services. Economic news were mixed: retail sales rose 0.6% in March to end a streak of three straight declines, and the Empire State manufacturing index slipped to a reading of 15.8 in April from 22.5 in March.

FTSE 100 leads European indices retreat

European stocks pulled back Monday. The euro and British Pound accelerated gains against the dollar. The Stoxx Europe 600 index fell 0.4%. The DAX 30 lost 0.4%, France’s CAC 40 slipped less than 0.1% and UK’s FTSE 100 dropped 0.9% to 7189.20. Indices opened 0.1% - 0.4% higher today.

Geopolitical tensions and expectations of additional US sanctions against Russia weighed on market sentiment.

China GDP in line with expectations

Asian stock indices are mixed today after report China’s economy grew 6.8% in the first quarter of 2018 from a year earlier, unchanged from the previous quarter. Nikkei rose 0.1% to 21851 despite continued yen rise against the dollar. Chinese stocks are lower as data showed March industrial output missed expectations and first quarter fixed asset investment growth slowed: the Shanghai Composite Index is down 1.1% and Hong Kong’s Hang Seng Index is 0.4% lower. Australia’s ASX All Ordinaries is little changed with Australian dollar steady against the US dollar.

Brent rising

Brent futures prices are higher today on concerns geopolitical tensions may result in supply disruptions from Middle East. Prices fell yesterday as the Energy Information Administration reported Monday crude oil production from seven major US shale plays is expected to climb by 125,000 barrels a day in May to 6.996 million barrels a day. June Brent crude settled 1.6% lower at $71.42 a barrel on Monday.